I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON DATA FROM DECEMBER 18, 2024

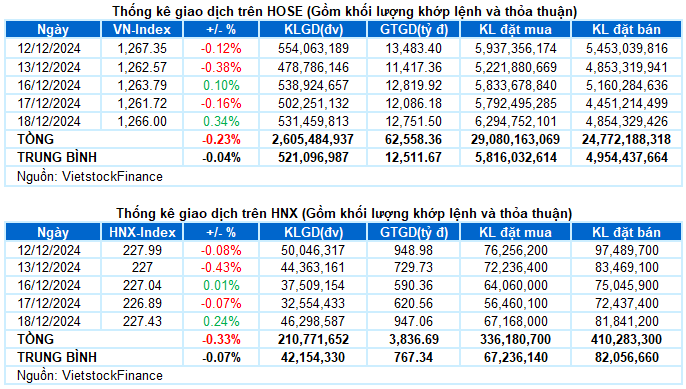

– The main indices recovered during the trading session on December 18. The VN-Index closed 0.34% higher at 1,266 points, while the HNX-Index increased by 0.24% from the previous session to reach 227.43 points.

– The matching volume on the HOSE reached nearly 392 million units, a 9.4% increase compared to the previous session. On the HNX, the matching volume rose by 37.5% to more than 39 million units.

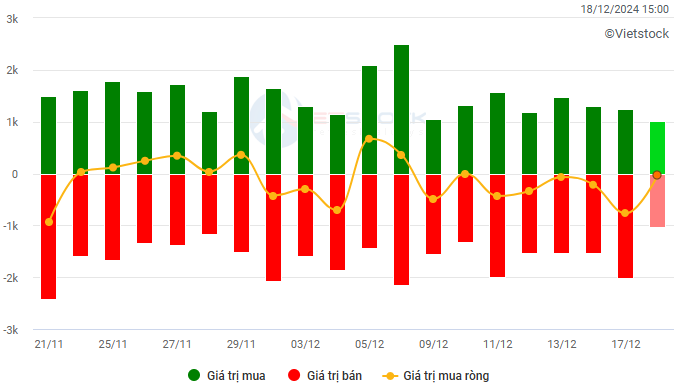

– Foreign investors net sold slightly on the HOSE with a value of over VND 42 billion and net sold nearly VND 44 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

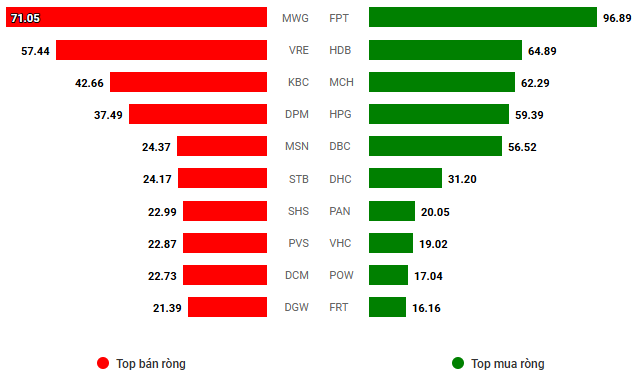

Net trading value by stock code. Unit: VND billion

– Investors maintained a cautious trading sentiment ahead of important events at the end of the week. The morning session of December 18 witnessed a familiar scenario, as the early gains were not enough to attract buying pressure, pushing the VN-Index back towards the reference level before the lunch break. However, buyers stepped in during the afternoon session, not only preserving the gains but also staging a strong recovery towards the end, which helped reclaim the intraday peak. The VN-Index closed at 1,266 points, a 0.34% increase from the previous session.

– In terms of impact, HPG, BID, and GAS were the main contributors to today’s recovery, helping the VN-Index gain more than 1 point. On the other hand, the 10 stocks with the most negative influence did not take away even 1 point from the overall index, with VHM alone responsible for a 0.4-point loss.

– The VN30-Index ended 0.17% higher at 1,329.83 points. Buyers regained the upper hand, with 18 stocks advancing, 7 declining, and 5 remaining unchanged. Among them, POW, HPG, and PLX led the gains with increases of 2%, 1.3%, and 1%, respectively. Conversely, VHM continued to face selling pressure and ended up as the worst performer, falling by 1%. The remaining stocks fluctuated within a 1% range.

Green dominated across all industry groups, with the energy sector leading the way, surging by 2.45%. The leading stocks in this sector all recorded strong gains, including BSR (+2.29%), PVS (+3.02%), PVD (+2.99%), PVC (+6.8%), POS (+4.57%), and PVB, which hit the daily limit-up.

Some other notable performers across different sectors include HPG (+1.3%), HSG (+2.99%), BMP (+1.64%), DHG (+4%), VEA (+2.61%), PVT (+2.03%), POW (+2.02%), REE (+1.95%), OIL (+2.56%), VHC (+1.65%), DBC (+5.33%), BAF (+5.11%), and YEG (+6.73%), among others.

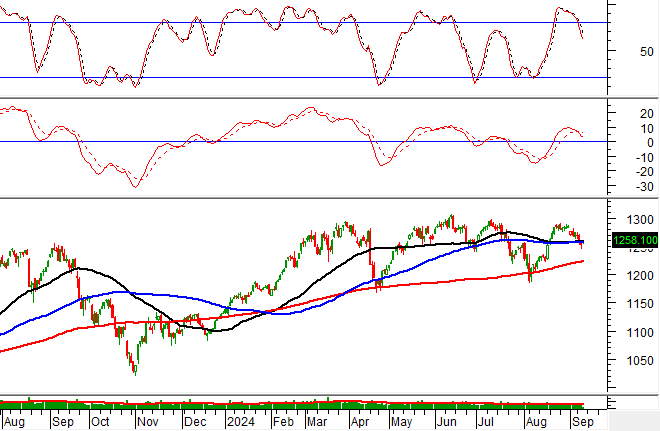

The VN-Index returned to positive territory while remaining above the SMA 200-day moving average. However, to reinforce the uptrend, the trading volume needs to surpass the 20-day average. At present, the Stochastic Oscillator indicator has signaled a sell-off within the overbought zone. Additionally, the MACD indicator is narrowing its gap with the Signal Line.

II. TREND AND PRICE MOVEMENT ANALYSIS

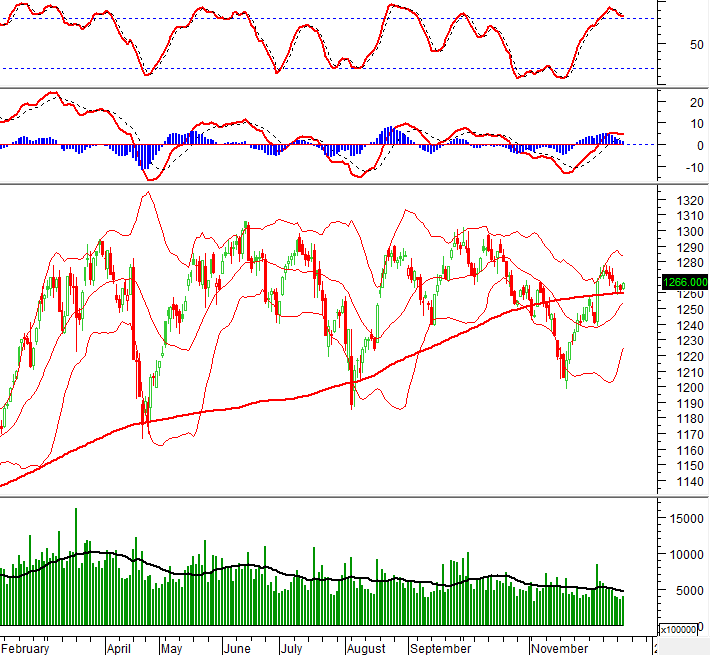

VN-Index – Maintained Above the SMA 200-Day Moving Average

The VN-Index returned to positive territory while remaining above the SMA 200-day moving average. However, to reinforce the uptrend, the trading volume needs to surpass the 20-day average. The Stochastic Oscillator indicator has signaled a sell-off within the overbought zone.

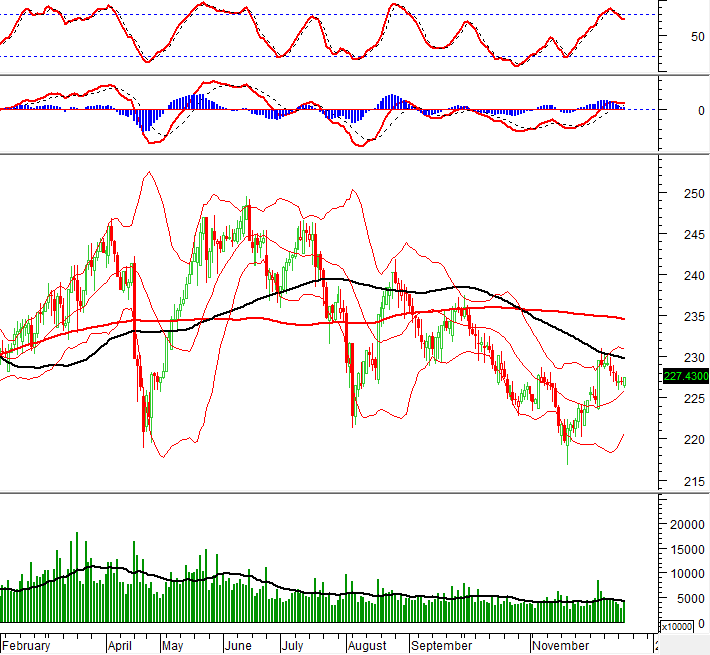

HNX-Index – Stochastic Oscillator Indicator Continues Downward Trend After Sell Signal

The HNX-Index performed well, staying above the SMA 50-day moving average and the Middle Bollinger Band. If the trading volume in the coming sessions surpasses the 20-day average, it will support the upward trend. The Stochastic Oscillator indicator continues its downward trajectory after giving a sell signal and has exited the overbought zone, indicating that the index’s outlook remains uncertain.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index indicator for the VN-Index dropped below the EMA 20-day moving average. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign Capital Flow: Foreign investors continued net selling on December 18, 2024. If this trend continues in the coming sessions, the market sentiment may turn less optimistic.

III. MARKET STATISTICS FOR DECEMBER 18, 2024

Analysis and Strategy Department, Vietstock Consulting

Technical Analysis for the Session on December 19th: Unexpectedly Gloomy Sentiment

The VN-Index and HNX-Index both witnessed declines, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.

Stock Market Blog: Sell Less, Balance the Price Easy

Today’s trading value on the two exchanges dropped below 10 trillion VND, the lowest in 13 sessions. The continued low liquidity indicates weak selling pressure, with both buyers and sellers temporarily reducing their trading intensity to observe. Price volatility in this situation can change rapidly…