Interest Rates on the Rise: Identifying the Best Term for Depositors

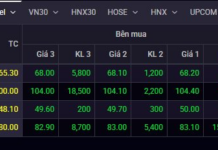

In early December 2024, the savings market witnessed notable changes in deposit interest rates offered by banks. Institutions such as IVB, TPBank, Vietcombank, and BIDV adjusted their rates, presenting attractive investment opportunities for depositors. Notably, smaller banks like OceanBank, NCB, Bac A Bank, and Vietbank are offering top-tier market rates.

Specifically, OceanBank, the Ocean Bank, introduced two attractive deposit schemes in November and December 2024. Their current “Chào Xuân” promotion, running from December 2, 2024, to February 28, 2025, offers an interest rate of 4.3%/year for a 1-month term; 3-month terms earn 4.6%/year; 6-month terms earn 5.5%/year, and 12-month terms stand at 5.8%/year.

For similar term lengths, Eximbank offers an interest rate of 4.3% for 3 months, while 6 and 12-month terms are set at 5.2%. BaovietBank’s rates are 4.35% for 3 months, 5.2% for 6 months, and 5.8% for 12 months. IVB has also increased its rates for 3, 6, and 12-month terms to 4.35%, 5.35%, and 5.95%, respectively, from 4.1%, 5.1%, and 5.8% at the end of November.

ABBank has increased its interest rate for 3-month terms; however, the 5-month term has been adjusted down by 0.1%/year to 4.2%/year. For longer terms of 18 months and above, the “ceiling” rates range from 6.1% to 6.3%, but according to a retail branch vice director in Hoan Kiem District, only a few customers opt for these terms.

Consequently, there is a significant variation in interest rates for 1, 3, 6, and 12-month terms across various banks. Notably, the most popular terms among depositors, 3, 6, and 12 months, exhibit a clear differentiation in rates offered by different institutions. These adjustments not only reflect changing trends in the savings market but also indicate the operational developments and capital mobilization strategies of individual banks.

Attractive Gifts and Promotions for Customers

In addition to advertised rates, banks are offering extra incentives to customers in various forms. For instance, Techcombank is offering an additional 0.5%/year to first-time depositors or those with increased balances. VPBank provides VIP customers with an extra 0.5%-0.7%/year for large deposits with terms of 6 months or longer. BVBank offers an additional 0.6%/year for customers using their Digimi digital banking channel, applicable to terms ranging from 1 to 6 months with a minimum deposit of only VND 10 million.

Recently, banks have intensified competition to attract deposits through various promotional programs. Some banks offer grand prizes like SH Mode scooters, MacBooks, and iPhone 16s to savings account holders. Even OceanBank, a new member of the MBGroup ecosystem, has launched impressive promotions. In addition to their top-tier interest rates, they are offering cash prizes and the chance to win a Vinfast VF7 car worth nearly VND 1 billion, iPhone 16 Pro Max phones, and Airpods 4 headphones through their “Chào xuân rộn ràng, tưng bừng lãi suất” program. OceanBank is the first bank to launch a spring promotion, even as northern Vietnam awaits winter.

Accelerating Loan Disbursements in the Final Month of the Year

The State Bank of Vietnam’s announcement of increased credit growth targets for some banks at the end of November has eased the pressure on many businesses and individuals seeking capital. Typically, towards the year-end, numerous customers seek short-term loans or funds to complete pending projects and stock up for the Tet holiday. Moreover, large loans with extensive paperwork may take a month or more to process, requiring both the bank and the customer to maintain a swift pace.

According to our observations, banks are accelerating loan disbursements to businesses, households, and individuals in the last month of the year. Mr. Kim Tuan Anh, a member of OceanBank’s Management Board, shared that the bank continues to promote a VND 2,000 billion package to support SMEs with interest rates starting at 6.5%/year. They also offer medium and long-term credit packages for corporate customers at 6% for 24 months. VietBank is implementing a preferential short-term loan package with interest rates starting at 6.3%/year.

Consumer lending is also on the rise in the last month of the year due to concentrated and substantial spending. Banks like VPBank, VIB, Vietcombank, and OceanBank are offering consumer loan packages to individual customers. For loans under VND 100 million, borrowers are not required to present a feasible capital usage plan but only need to provide minimal information about their repayment capacity and loan purpose.

Mr. Vu Trong Hung, Director of a processed food import-export company in Hai Duong, shared that his company is focusing its cash flow on year-end and Tet holiday inventory. Timely bank disbursements enable his company to negotiate with suppliers and autonomously place and pay for orders. Ms. Nguyen Ngoc Thuy, owner of a construction and interior design company in Hanoi, shared that it is challenging to retain skilled laborers in the construction and interior design industries during the year-end and Tet holiday. Many businesses, including Ms. Thuy’s, have to advance or escrow wages and bonuses to retain employees. Therefore, active bank disbursements in the last month of the year have helped her company secure resources and accept new projects.

With only about seven weeks left until the Tet holiday, the savings market will, as usual, witness a symphony of colorful promotional programs. While other investment channels remain subdued or unpredictable, savings deposits continue to attract new capital. Moreover, stable year-end credit conditions facilitate business operations and improve people’s lives.

“Cash in Hand, a Bountiful Spring” with FE CREDIT’s Mega Livestream

“Capitalizing on the booming trend of livestreaming, FE CREDIT is excited to announce the launch of not one, but two, thrilling livestream series from now until December 2024. Get ready for an exhilarating ride with “Drive into the New Year with a New Set of Wheels” and “Fill Your Wallets for a Prosperous Spring”. With prizes including Urbox gift vouchers and Urbox e-shopping codes worth up to VND 1,000,000, it’s an opportunity not to be missed! Join us live and be a part of this exhilarating journey as we ring in the new year and spring season with a bang.”

Low-Interest Rates to Support Production and Holiday Shopping

With the Lunar New Year fast approaching, businesses are bustling with production and inventory preparations to meet the surge in year-end shopping demands. The current low-interest rates offered by lending institutions are expected to further stimulate consumer spending during this peak shopping season.

Prime Minister Requests SBV to Implement Stronger Measures to Reduce Lending Rates

Prime Minister Pham Minh Chinh has issued Official Dispatch No. 135/CD-TTg on December 16, 2022, emphasizing the continued strengthening of measures to regulate interest rates and credit.

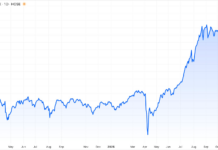

“Standard Chartered: Robust USD and Vietnam’s Economic Growth Trajectory Towards 6.7% in 2025”

In its latest economic update on Vietnam, released on December 12, 2024, Standard Chartered Bank forecasts a strong USD in 2025, with a weakening bias in the early part of the year. The bank predicts a 6.7% GDP growth for Vietnam in 2025, with a 7.5% year-on-year expansion in the first half and a 6.1% growth in the latter half.