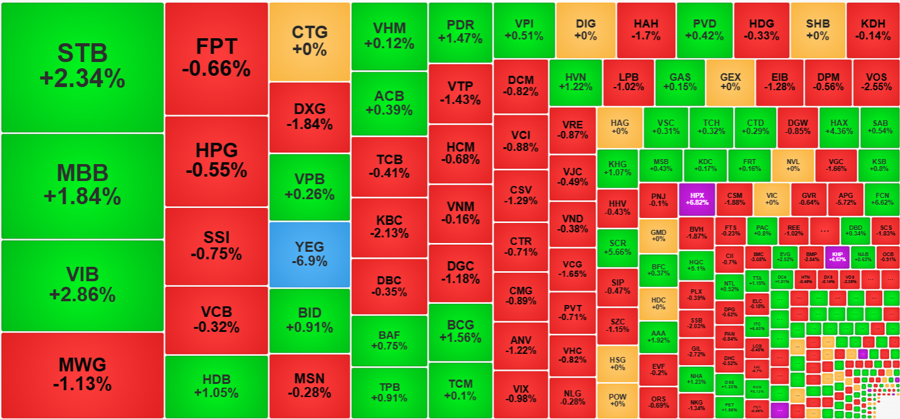

The market witnessed significant volatility during the afternoon session, but the VN-Index closed with a minor loss of 1.17 points. The VN30-Index managed to stay in positive territory, despite a modest gain. The large-cap banking stocks within the VN30 basket performed better than the overall market, with seven out of the top ten stocks by gain percentage coming from this sector.

MBB led the banking sector with a 1.84% increase, followed by BID (0.91%), VIB (2.86%), and STB (2.34%). Additionally, HDB, ACB, and TPB contributed to the top performers with more modest gains of 1.05%, 0.39%, and 0.91%, respectively.

While the gains in this sector were not remarkable, maintaining a positive performance amid a generally weak large-cap market is commendable. The VN30 basket witnessed a 34% decline in trading volume compared to the previous day, and the banking sector within it saw a 35% drop in trading activity. The VN30-Index closed with a meager 0.02% gain, comprising 11 gainers and 15 losers.

Small and mid-cap stocks, which had been performing well in recent sessions, faced notable profit-taking pressure today. During the morning session, only 52 stocks declined by more than 1%, but this number increased to 75 in the afternoon. Large transactions were observed in several stocks, including YEG, MWG (down 1.13% with a turnover of 402.2 billion), DXG (down 1.84% with 165.7 billion), KBC (down 2.13% with 132.4 billion), VTP (down 1.43% with 11.4 billion), DGC (down 1.18% with 108.4 billion), and HAH (down 1.7% with 96.3 billion).

The combined trading volume of these 75 stocks accounted for 20.2% of the total volume on the HoSE, indicating a notable shift in trading behavior over the last five sessions. Only three stocks in the VN30 basket declined by more than 1%—SSB, BVH, and MWG—while the rest were either large-cap or small-cap stocks. The high number of stocks and their substantial trading volumes suggest a change in investor behavior, as they actively book profits in hot stocks following a short-term bullish period.

However, this trend has not yet spread widely, and the market remains supported by capital inflows, leading to stock differentiation and even outperformance in some cases. All 11 stocks that hit the daily limit-up in the VN-Index were small-cap stocks, notably PGV, BMC, HPX, and KHP. Several stocks with trading volumes ranging from 10 to 30 billion also performed well, including FCN (up 6.62%), SCR (up 5.66%), ITC (up 5.53%), HQC (up 5.1%), and HAX (up 4.36%). While these stocks could not maintain their intra-day highs, the decline from their peak prices was modest, and their gains over the reference price remained impressive, thanks to the support of speculative capital.

Foreign investors turned net buyers in the afternoon session, with a net buy value of 818.6 billion VND, a significant increase of 70% from the morning session. Their net selling value decreased slightly by 2% to 827.5 billion VND, resulting in a negligible net sell of 8.9 billion VND. In the morning session, they had net sold 355.8 billion VND. The stocks that witnessed the highest net selling were VCB (175.4 billion), FPT (67.7 billion), VNM (49.2 billion), STB (41.4 billion), NLG (32.5 billion), MSN (28.3 billion), and HPG (22.5 billion). On the buying side, SSI (+43.4 billion), CTG (-41.7 billion), KDH (+28.4 billion), PDR (+24.3 billion), and VHM (+20.2 billion) saw the highest net buying.

Today’s pause in the upward momentum is not unusual, as the market needs to consolidate after a significant gain in the previous session. Investors are showing more discipline and are not making impulsive decisions. Additionally, the “hot” status of many stocks has led to reduced speculative activity. While profit-taking in speculative stocks is not yet widespread, several stocks still exhibit upward momentum. Meanwhile, the overall market liquidity has contracted, and the trading volume in the large-cap basket has not changed significantly, indicating limited capital rotation.

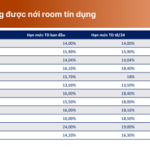

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.

The VIB and Bui Cong Khanh Offer Exclusive Deposit Promotion: “A Hundred Rivers Flow into the Great Ocean”.

VIB, a leading international bank, has unveiled an enticing promotional program for its depositors this Lunar New Year 2025. The highlight of this promotion is the exclusive, limited-edition artwork series titled “A Hundred Rivers Flow into the Sea.” This exquisite gift offering is sure to captivate the attention of VIB’s valued customers and art enthusiasts alike.

The VIB and Bui Cong Khanh Offer Exclusive Deposit Promotion: “A Hundred Rivers Flow into the Great Ocean”.

VIB, a leading international bank, has unveiled an enticing promotional program for its depositors this Lunar New Year 2025. The highlight of this promotion is the exclusive, limited-edition artwork series titled “A Hundred Rivers Flow into the Great Ocean.” This exquisite gift offering is sure to captivate the attention of VIB’s valued customers and art enthusiasts alike.