The market continued its lackluster performance, with trading volume hitting a 30-session low. Investor participation waned further, with total trading value across the three exchanges falling below 14 trillion VND. Despite the cautious sentiment, the VN-Index managed to stay afloat, closing at 1,261.72, a marginal decline of 2.07 points.

While breadth was negative, with 147 gainers and 232 losers, the extent of losses was limited. Blue-chip stocks underperformed, with FPT and MWG, the most actively traded stocks, falling 1.27% and 1.15%, respectively, and accounting for 30.4% of the basket’s total turnover. The remaining constituents posted modest declines, except for a few small-cap stocks that attracted attention.

From a liquidity perspective, small-caps were the only group to witness an increase in trading volume, rising 20% from the previous session, while VN30 and mid-caps declined by 8% and 12%, respectively. Notable performers in terms of liquidity included GEE, KDH, VTP, and DBC, with gains ranging from 1.02% to 2.54%.

Furthermore, several stocks, including STG, ABS, PAC, FIR, SGT, GSP, HVH, and YEG, hit the upper circuit breaker, indicating the presence of speculative money flows despite the overall cautious market sentiment.

Foreign investors unexpectedly turned net sellers, offloading FPT shares worth nearly 312 billion VND. This marked the largest net selling activity by foreign investors on the HoSE in the last nine sessions. With ETF rebalancing scheduled for the week, ending on December 20, some retail-led transactions may have already surfaced.

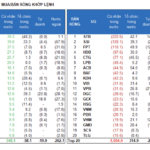

Foreign investors sold a net amount of 768.5 billion VND, with a net selling value of 672.4 billion VND in the matched orders segment. Their net buying activities in the matched orders segment were concentrated in the Healthcare and Media sectors, with SIP, VHM, HDB, DXG, VIX, DGC, KDH, CTG, VTP, and HAH being the top purchased stocks.

On the other hand, their net selling activities in the matched orders segment were focused on the Information Technology sector, with FPT, MWG, NLG, HPG, VRE, VCB, VGC, CMG, and SSI being the top sold stocks.

Domestic individual investors were net buyers to the tune of 801.1 billion VND, with a net purchase value of 675.7 billion VND in the matched orders segment. In the matched orders segment, they were net buyers in 14 out of 18 sectors, primarily in the Information Technology sector. Their top purchases included FPT, HPG, MWG, VRE, NLG, VPB, PVD, VCB, SSI, and VGC.

On the selling side, they offloaded stocks in 4 out of 18 sectors in the matched orders segment, mainly in the Healthcare and Media sectors. Their top sold stocks included VHM, DXG, SIP, VIX, VTP, CTG, HDB, KBC, and CTD.

Proprietary traders were net sellers, offloading a net value of 86.2 billion VND in the overall market and 31.0 billion VND in the matched orders segment. In the matched orders segment, they were net buyers in 5 out of 18 sectors, with the highest net purchases in the Industrial Goods & Services and Real Estate sectors. Their top buys included GEE, NLG, CTD, PNJ, FTS, DXG, VCG, GMD, FUEVFVND, and E1VFVN30. Conversely, they offloaded stocks in the Banking sector, with FPT, VPB, KDH, ACB, VCB, STB, MSN, HDB, SHB, and HPG being the top sold stocks.

Local institutional investors were net sellers, offloading a net value of 46.0 billion VND in the overall market and net buying a value of 27.7 billion VND in the matched orders segment. In the matched orders segment, they were net sellers in 7 out of 18 sectors, with the highest net selling value in the Industrial Goods & Services sector. Their top sold stocks included GEE, HAH, NLG, ORS, TCB, HDB, TCH, TCM, HPG, and EVF. Conversely, they were net buyers in the Information Technology sector, with FPT, VTP, VIB, VJC, MWG, VCB, KBC, STB, CTG, and CTD being their top purchases.

Block trades today amounted to 4,130.6 billion VND, an increase of 11.5% from the previous session, contributing 29.8% to the total trading value. Notably, there was a significant block trade in EIB, with over 11 million shares worth 215.1 billion VND changing hands between domestic institutions.

Additionally, domestic individual investors continued to be active in the Banking sector (EIB, TCB, STB, VPB, HDB, LPB) and large-cap stocks (FPT, VHM, HPG, MSN). For EIB, today marked the second consecutive session of substantial block trades executed by domestic individual investors.

In terms of sector allocation, there was an increase in the flow of funds into Chemicals, Aquaculture, Oil Equipment & Services, Software, Construction Materials & Interior, and Textiles, while a decrease was observed in Real Estate, Banking, Securities, Steel, Food & Beverage, Retail, Oil & Gas Production, and Plastics & Rubber.

Specifically, in the matched orders segment, there was an increase in the allocation of funds towards small-cap stocks (VNSML) and a decrease in large-cap (VN30) and mid-cap (VNMID) stocks.

Stock Market Outlook for Week of December 9-13, 2024: Short-Term Correction Pressure

The VN-Index had a lackluster performance last week, declining in 4 out of the last 5 trading sessions. Moreover, the trading volume remained below the 20-day average, indicating a shift towards cautious sentiment among investors. Adding to this, the return of net selling by foreign investors suggests that the short-term outlook for the market remains risky.

The Stock Market Sell-Off: A Whopping 1,756.1 Billion VND Net Selling by Individual Investors

The market is buzzing with liquidity as banks take the lead. Today’s trading volume across all three exchanges reached an impressive 19,000 billion VND, with foreign investors making a remarkable turnaround. They net bought an outstanding 738.1 billion VND, and their matched orders alone accounted for 588.2 billion VND in net purchases. It’s a clear sign of confidence in the market, and we can expect some exciting movements in the coming days.

The Psychology of Rest Dominates, Liquidity Plunges

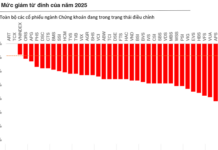

Investor sentiment was muted in the final days of the 2024 financial year. This morning’s trading activity by foreign investors hit a record low, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.

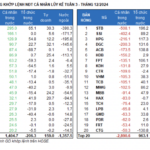

The Pre-Festive Season Sell-Off: Individual Investors Dump Stocks, Net-Selling 2.6 Trillion VND Last Week

Individual investors sold a net 2,594.7 billion VND, of which they sold a net 2,194.5 billion VND in stocks.