Illustrative image

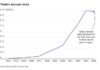

The United States is set to maintain its position as the world’s largest exporter of liquefied natural gas (LNG), surpassing Qatar and Australia in 2024.

According to data from Kpler, cited by Reuters, US LNG exports will reach a new record, expected to hit 86.9 million tons, up 0.8% from 2023, retaining its top spot in the list of the world’s largest LNG exporters.

Last year, the United States exported more LNG than any other country. According to data from the US Energy Information Administration (EIA), the average US LNG exports reached 11.9 billion cubic feet per day, a 12% increase from 2022. Despite the continued growth in domestic LNG exports, Kpler estimates that the export rate this year will be much slower than in 2023.

The EIA forecasts US LNG exports to remain near 12 billion cubic feet per day, almost unchanged from 2023, according to the latest Short-Term Energy Outlook (STEO). However, the EIA states in its December 2nd STEO report that US LNG exports are expected to increase by 15% to reach nearly 14 billion cubic feet per day in 2025, due to expanded export capacity from the Plaquemines LNG and Corpus Christi LNG Stage 3 plants.

The Plaquemines LNG facility has just produced its first LNG batch, according to Venture Global, the developer of the plant in Port Sulphur, Louisiana. The testing phase is expected to last around 18 months.

Despite the lack of significant growth in average LNG exports this year, lower regional LNG prices have impacted the profits of the largest US exporters. Additionally, the EIA believes that spot LNG prices will remain lower than in 2022 and 2023.

In the US, natural gas futures for December delivery rose 5.10% to $3.356, mainly due to forecasts of colder temperatures, especially in the western US in early December, following an unusually warm autumn. This drop in temperature, combined with a cold snap in the Midwest, is expected to increase the demand for heating gas.

According to Eli Rubin, an analyst at EBW Analytics Group, this weather shift has pushed gas prices above important technical thresholds. Many investors who had previously bet on a prolonged downward trend have adjusted their positions, contributing to the price increase.

However, Rubin cautions that this upward trend may only be temporary, as US gas inventories remain at historical highs. Additionally, increased gas production due to more attractive prices could put downward pressure on prices in the coming months.

Unlike the oil market, the gas market remains highly regional, with prices varying across different areas. This characteristic makes long-term trend predictions complex, especially in the current context.

Reference: Oilprice

“LNG Power Producer Seeks Direct Access to Consumers, Bypassing EVN”

The LNG-to-power plants aim to sell electricity directly to large industrial consumers, such as factories and industrial parks. With their efficient and reliable power generation capabilities, these plants offer a competitive advantage to energy-intensive industries, ensuring a stable and consistent supply of electricity. By bypassing the traditional utility providers, these plants can offer competitive pricing and tailored energy solutions to their industrial customers, revolutionizing the way energy is consumed and empowering businesses with greater control over their energy costs and sustainability practices.

The Golden Grain Belt: A $2 Billion LNG Plant Investment to Boost Local Economy and Rival the VinFast Factory in Revenue

The Thai Binh LNG Thermal Power Plant project boasts a staggering investment of approximately $2 billion, with an electrical output surpassing that of Vietnam’s largest hydroelectric plant by 1.6 times. Upon completion, the plant is expected to contribute an impressive $4,000 billion VND annually to the state budget.