2024 marks a golden milestone in the history of Vietnam’s electric car manufacturer, VinFast, as it becomes the top automotive brand in Vietnam. As a result, the market share of electric vehicles compared to total industry sales also skyrocketed, propelling Vietnam into the group of countries with high electric vehicle adoption rates compared to many international markets.

A Brilliant Year for Electric Vehicles

Specifically, in 2024, VinFast’s sales exceeded 87,000 units, making it the leading brand in terms of car consumption in the entire market. This sales figure is 2.5 times higher than in 2023 (34,855 vehicles), equivalent to a 150% increase.

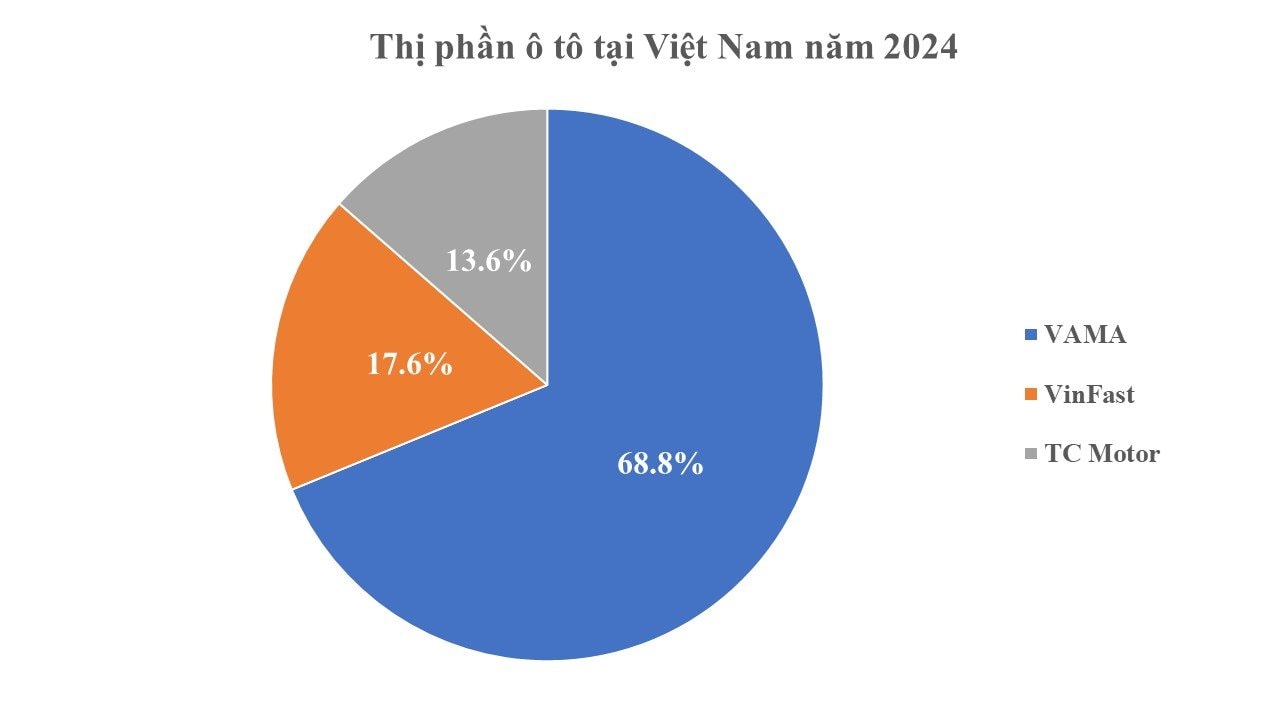

Combining the sales of the members of the Vietnam Automobile Manufacturers’ Association (VAMA) of 340,142 units, TC Group – the manufacturer and distributor of Hyundai vehicles with 67,168 units, the total sales of the Vietnamese automobile market reached more than 494,000 units, almost equal to the record level of 2022 – excluding some manufacturers that did not announce sales figures.

Based on the published data, the group of pure electric vehicles in the Vietnamese market currently accounts for up to 17.6% of the total market. However, this is only a relative figure because, apart from VinFast, other electric car manufacturers such as Wuling, BYD, and Gelly do not disclose their sales figures, as well as some gasoline car manufacturers such as Nissan, Volkswagen, Chinese manufacturers, and some luxury car manufacturers.

If we consider this relative figure, the market share of electric vehicles in the Vietnamese automobile market has doubled compared to 2023 (only about 8.6%).

Another factor that demonstrates the strong development of Vietnam’s electric vehicle market is the launch of 14 electric vehicle models during the year, out of a total of 60 new models introduced, accounting for 1/4 of the total number of vehicles launched in the year. Among these 14 vehicles, there are products ranging from urban cars to mid-size electric sedans and SUVs, from luxury to affordable vehicles.

Vietnam’s Electric Vehicle Market Share is Impressive

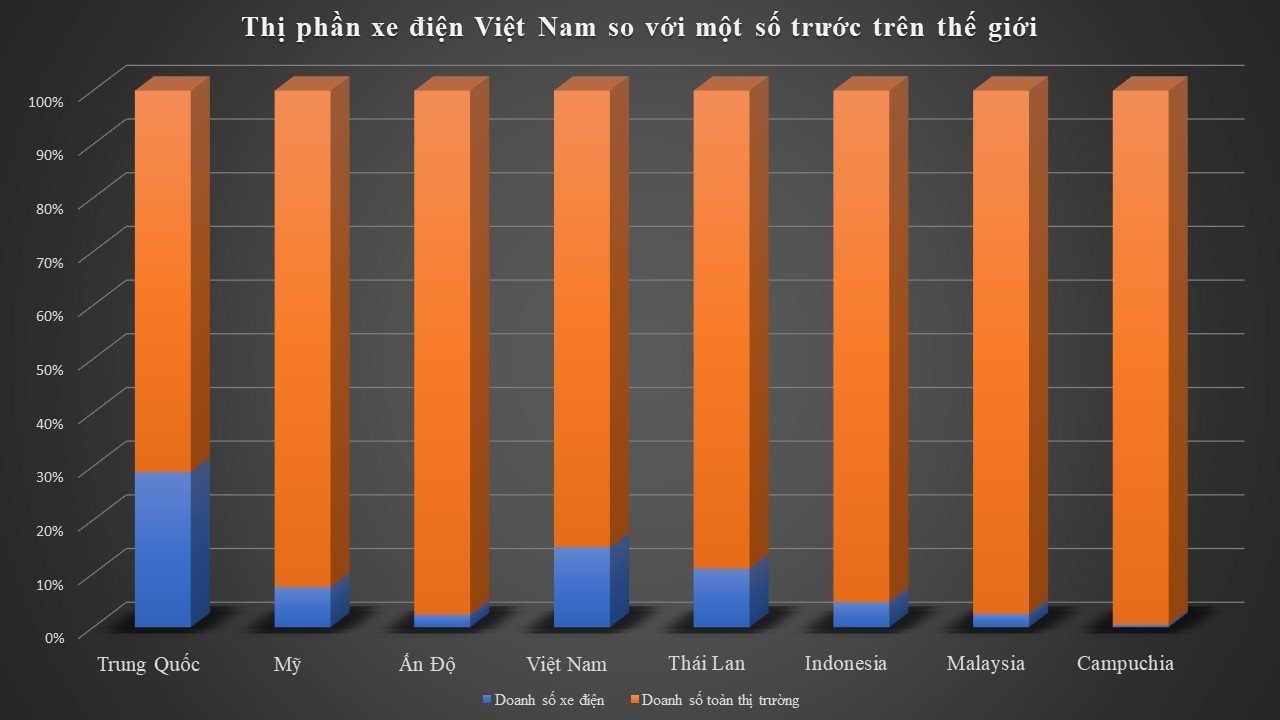

Data from the China Association of Automobile Manufacturers (CAAM) shows that China’s automobile sales (including exports) in 2024 exceeded 31.4 million units, up 4.5% from the previous year. Specifically, annual sales in the electric vehicle segment surpassed 12.8 million units, accounting for more than 40% of total sales.

Meanwhile, in the US, new car sales reached 15.9 million units, up 2.2% from 2023 and the highest since 2019, according to Wards Intelligence. Of that, annual electric vehicle sales reached 1.3 million, or 8.1%.

Similarly, India’s electric vehicle sales in 2024 reached nearly 100,000 units, up 20% from 82,688 units. However, electric vehicle sales accounted for only about 2.4% of the total of 4.07 million vehicles sold, up from 2.1% in 2023.

In Southeast Asia, Thailand’s automobile market in 2024 ended with about 570,000 units sold, down 26% from the previous year. Electric vehicle sales in 2024 in this market decreased by 8.1% from the previous year to 70,137 units (accounting for 12.3%).

In the two large markets of Indonesia and Malaysia, electric vehicle sales in 2024 were 42,889 units (accounting for nearly 5% of the total automobile market) and 21,789 units (about 2.5%), respectively.

At the same time, new car sales in Cambodia increased to 467,252 units in 2024, equivalent to 8.7%. Notably, electric vehicle sales in Cambodia reached 2,253 units (0.4%), up a strong 620% from 313 units in 2023.

Based on the published data, it can be seen that Vietnam’s electric vehicle market share in 2024 ranked second only to China, the world’s largest electric vehicle consumer. Meanwhile, in the second and third largest automobile markets in the world, the US and India, Vietnam’s electric vehicle market share is slightly higher.

At the same time, compared to other countries in the Southeast Asian region, Vietnam’s electric vehicle market share in 2024 is leading the region, followed by Thailand, Indonesia, Malaysia, and Cambodia.

The year 2025 is crucial for ensuring sustainable growth. Market research by Mordorintelligence indicates that the scale of Vietnam’s electric vehicle market is estimated to reach 2.93 billion USD in 2025 and is expected to reach 6.69 billion USD in 2030, with a compound annual growth rate (CAGR) of 18% in the period 2025-2030.

According to experts, the Vietnamese electric vehicle market in 2025 will continue to grow, and VinFast is expected to maintain its leading position thanks to its local advantage, while imported car brands will bring breakthrough technology choices.

At the same time, the Vietnamese electric car manufacturer promises to continue to conquer many new historical milestones, including the goal of 84% localization rate by 2026.