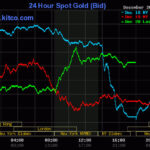

SJC Saigon Jewelry Company listed SJC gold price at 84.9-86.9 million VND/tael bought and sold.

Phu Quy Jewelry Group listed SJC gold bar price at 84.7 – 86.9 million VND/tael bought and sold, down 400,000 VND/tael compared to yesterday morning.

Baominhchau JSC listed SJC gold bar price at 84.9 – 86.85 million VND/tael, down 400,000 VND/tael.

Mi Hong’s gold price today is at 85.2 – 86.2 million VND/tael bought and sold.

The buy-sell gold price difference is at the level of 2 million VND.

Currently, the listed buy-sell gold price difference is around the threshold of 2 million VND/tael. Experts said that this difference is very high, causing investors to face the risk of loss when investing in the short term.

Similarly, the prices of gold rings of the brands were also adjusted down.

DOJI in Hanoi and Ho Chi Minh City markets decreased the buying price by 600,000 VND and the selling price by 500,000 VND, to 84.6 million VND/tael and 86.2 million VND/tael, respectively.

PNJ listed at 85 million VND/tael and 86.9 million VND/tael, down 200,000 VND for buying and 100,000 VND for selling.

Mi Hong listed the gold ring price at 85.1 – 86.1 million VND/tael.

Bao Tin Minh Chau listed the buying price of plain rings at 84.9 million VND/tael and the selling price at 86.85 million VND/tael, down 650,000 VND for buying and 400,000 VND for selling.

Phu Quy SJC is buying gold rings at 84.5 million VND/tael and selling at 86.2 million VND/tael, down 700,000 VND and 500,000 VND, respectively.

This goes against the usual trend, as gold prices typically rise during the Lunar New Year period.

Expert forecasts for gold prices in 2025

This morning, the world gold price was listed at 2,703 USD/ounce. The world gold price is equivalent to 83.4 million VND/tael. Domestic gold prices are currently about 4 million VND/tael higher than world prices.

The market is awaiting the inauguration of US President-elect Donald Trump on January 20. His trade tariffs are expected to boost inflation and cause trade conflicts, potentially increasing the appeal of gold as a safe haven.

Gold prices have risen 29% this year, reaching 2,667 USD/ounce, leading experts at J.P. Morgan to believe that gold will continue to grow as the new US administration takes office in 2025.

Ross Norman, CEO of Metals Daily, forecasts that the gold price will reach 3,200 USD/ounce this year. In the recently released 2025 Precious Metals Price Outlook report.

Norman predicted that the average spot gold price in 2025 would be 2,888 USD/ounce, with a high of 3,175 USD/ounce and a low of 2,630 USD/ounce.

In addition, strong purchases by central banks, especially India, have provided a major boost to gold prices. In October, the Reserve Bank of India added 27 tons of gold, bringing the total purchases for the year to 77 tons. This indicates that gold remains important in national reserves.

Gold to Maintain its Bullish Streak in 2025, Defying Global Commodity Turbulence

2024 is set to be a challenging year for key global commodities, particularly Brent crude oil and copper. However, in a contrasting development, gold is forecasted to continue its upward trajectory, remaining resilient amidst economic and geopolitical uncertainties, and is expected to soar in price over the coming year.

Gold Prices Surge Amid Heightened Risk Aversion

In 2025, the gold price is expected to enter a highly volatile phase, with experts predicting a rollercoaster ride for investors.