As of December 31, 2024, OCB’s total assets reached VND 280,712 billion, a 17% increase from 2023. Notably, the bank recorded a market credit growth rate of nearly 20%, higher than the industry average of 15.08%. This growth was driven by a continued focus on two strategic customer groups: individuals and small and medium-sized enterprises. Market funds mobilized amounted to VND 192,413 billion, a 15% increase from the beginning of the year.

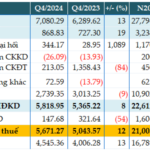

OCB’s fourth-quarter net revenue showed significant growth, reaching VND 3,218 billion, a 60% increase compared to the same period in 2023. The bank’s core business activities performed well, with net interest income increasing by VND 1,323 billion, equivalent to a 99% year-over-year increase. This impressive performance was mainly attributed to nearly 20% credit growth and an improved NIM of 3.5% by the end of 2024.

OCB’s fourth-quarter non-interest income reached VND 563 billion, a remarkable 148% increase from the previous quarter. Notably, service income increased by VND 126 billion, or 37%, compared to the same period last year, driven by effective digital transformation and growth in fee-based services.

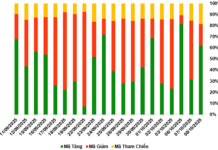

The bank’s digital transaction rate stands at 96%, which is quite high compared to other banks in the system. For instance, just seven months after the launch of the new OCB OMNI digital banking platform, transaction volume on this channel increased by 74%, CASA by 21%, and online savings deposits by 32% compared to the same period in 2023. Liobank also recorded impressive growth, attracting 300,000 new customers and facilitating VND 11,000 billion worth of transactions, with 8 million transactions performed, a 4.2-fold increase from 2023. Its ranking on app stores is 4.7+, placing it among the top financial applications. Notably, in 2024, as part of its “leading bank” journey, OCB adopted the Open Banking model and surpassed the milestone of 150 Open APIs. By the end of 2024, the number of customers connected to OPEN API at the bank increased by 150% compared to 2023, with a robust processing efficiency of over 6 million transactions per month.

Strong growth in digital transactions at OCB in 2024

|

However, net income from foreign exchange and securities trading, particularly government bonds, decreased due to unfavorable market conditions and the impact of the Fed’s interest rate cuts and the “strength” of the US dollar. These factors directly affected the investment and business activities of banks across the system.

OCB’s cumulative pre-tax profit for 2024 was VND 4,006 billion, a 3% decrease compared to the previous year. However, the fourth quarter showed remarkable growth compared to the previous quarters. Specifically, profit reached VND 1,453 billion, a 230% increase from the third quarter.

Commenting on this, Mr. Pham Hong Hai, CEO of OCB, said: “2024 was a year of significant strategic changes for OCB in terms of business and operations. Faced with a global and Vietnamese economic landscape filled with unpredictable variables, we chose to adapt our strategy to be more flexible and quickly responsive to market changes, with a focus on sustainable business and operating goals. As a result, OCB restructured its business portfolio to diversify revenue streams, enhance asset quality, and actively improve debt management, collection, and handling. This approach yielded impressive results in the fourth quarter, as evidenced by the significant increase in pre-tax profits compared to the previous quarter. The bank also maintained a healthy balance sheet, with non-performing loan ratios compliant with SBV regulations and improved from the previous year. While our business results did not meet our expectations, I am confident that with our clear direction and the foundation built in the fourth quarter of 2024, OCB will surely return to the growth track in 2025 with a new mindset and even more remarkable achievements.”

In reality, OCB has been making significant strides towards sustainable development in 2024. Specifically, there has been a shift in the bank’s customer portfolio, with a stronger focus on strategic individual and small and medium-sized enterprise customers. Credit growth for individual customers increased by 11.4%, while SME lending grew by 51.7% year-over-year.

Notably, the bank is also promoting green finance, providing capital for projects that support sustainable development, such as renewable energy, green buildings, water supply plants, and smart agriculture, including sustainable farming, drip irrigation, and water storage and conservation. According to statistics as of December 31, 2024, green credit at OCB increased by 30% compared to 2023.

The bank has actively expanded its network nationwide, establishing 5 new branches and 12 transaction offices. Technology and digital transformation projects continue to be a priority for investment. Additionally, employee welfare, training, and internal programs have been given focused attention. These factors have contributed to a 12% increase in operating expenses compared to the previous year. However, investing in expanding the bank’s scale, building a strong core team, and enhancing capabilities will create a solid foundation for accelerated growth in the coming periods.

“In 2025, we will focus more on sectors such as energy, FMCG, logistics, and green lending, targeting sectors that are less energy-intensive and environmentally friendly, in addition to lending to SMEs and businesses managed by women. We will also continue to expand our FDI customer base, a key segment that OCB is strongly promoting in the new year. These sectors are the main drivers of economic growth, offering high growth rates and expansion potential,” added Mr. Pham Hong Hai.

“Furthermore, OCB is actively developing financial services, including working capital loans and cash flow management for start-ups with stable cash flow. We aim to contribute to the development of start-ups and support them in becoming future unicorns,” he further shared.

Minh Tai

– 15:45 24/01/2025

KienlongBank Reports Impressive Business Results for 2024

In Q4 of 2024, Kienlong Commercial Joint Stock Bank (KienlongBank; UPCoM: KLB) reported positive financial results. According to the consolidated financial statements, KienlongBank achieved impressive business growth, with pre-tax profits surpassing VND 1,100 billion for the first time.

Unlocking Sacombank’s Record-Breaking Success: A Dive into the Bank’s Impressive Q4 Performance and Annual Profits Surpassing 12,000 Billion VND

The bank’s estimated pre-tax profit for Q4 2024 stood at over VND 4,600 billion, a remarkable 68% increase compared to the same period last year. For the full year of 2024, the bank’s pre-tax profit is estimated to exceed VND 12,700 billion, the highest in its history and surpassing the target set by the Annual General Meeting of Shareholders.