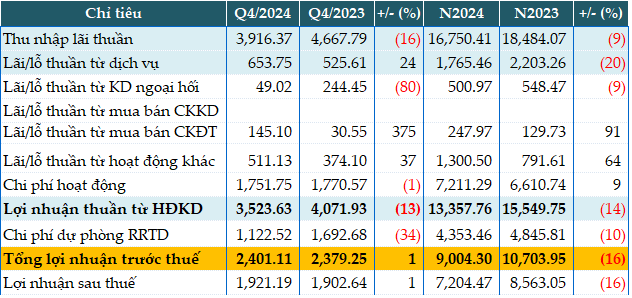

In 2024, VIB’s net interest income reached over VND 16,750 billion, a 9% decrease from the previous year. VIB attributed this to their focus on high-quality customers with strong collateral and the introduction of competitive retail lending packages, which led to a reduction in net interest margin (NIM) to 3.8%.

Non-interest income maintained a 6% growth rate year-on-year, contributing 19% to the bank’s total revenue. Fee income stood at VND 2,100 billion, driven by two main products: credit cards and insurance. VIB issued over 865,000 credit cards, with card spending reaching USD 5 billion, or an average of VND 10,000 billion per month, a more than 20% increase from the previous year.

Profit from foreign exchange trading decreased by 9% to over VND 500 billion due to increased spending on currency-related financial derivatives.

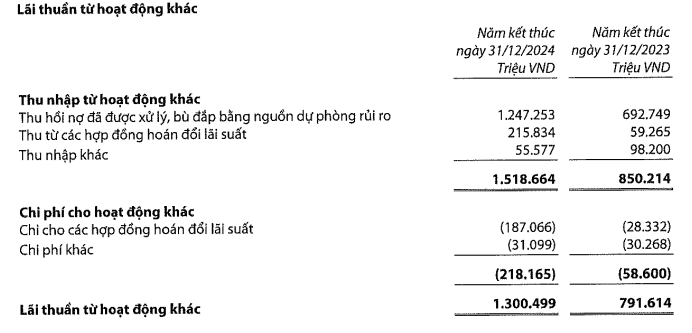

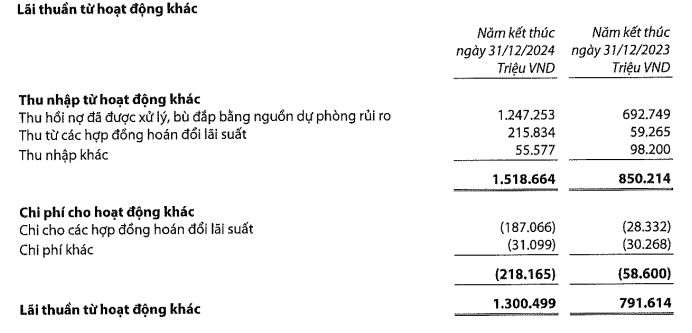

Investment securities trading profit surged by 91% to VND 248 billion. Notably, profit from other activities increased by 64% to VND 1,300 billion due to the recovery of previously written-off debts, offset by risk provisions of VND 1,247 billion, an 80% increase.

The bank’s operating expenses increased by 9% to VND 7,211 billion in 2024, mainly due to investments in people, technology, digital banking, marketing, and branch expansion. The cost-to-income ratio (CIR) stood at 35%.

During the year, VIB set aside more than VND 4,353 billion in credit risk provisions, resulting in a pre-tax profit of over VND 9,004 billion, a 16% decrease from the previous year. A VIB representative stated: “This is a substantial profit, truly reflecting the business results and market conditions.” The return on equity (ROE) reached approximately 18%.

Compared to the full-year target of VND 12,045 billion in pre-tax profit, VIB achieved 75% of its annual plan.

|

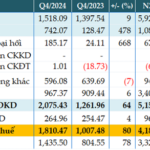

VIB’s Q4 and 2024 business results. Unit: VND billion

Source: VietstockFinance

|

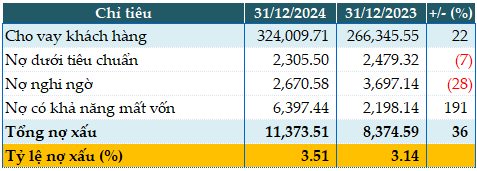

As of the end of 2024, the bank’s total assets grew by 20% year-on-year to VND 493,158 billion. VIB’s total loans reached VND 324,010 billion, a 22% increase, driven by growth in all four key segments: retail, corporate, SME, and financial institutions. Retail loans accounted for nearly VND 260,000 billion, maintaining a retail ratio of 80%, with over 90% of retail loans having collateral, mainly residential and land with full legal documentation and liquidity. The balance of corporate bond investments represented only 0.2% of total credit balance, and all bonds were in the production, trading, and consumer sectors.

Customer deposits increased by 17% year-on-year to VND 276,308 billion. Individual customer deposits reached nearly VND 200,000 billion, a 14% increase. The CASA and foreign currency ratio rose by over 35%, leading to a 14% reduction in interest expense for 2024.

|

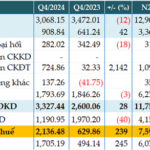

Loan quality of banks as of December 31, 2024. Unit: VND billion

Source: VietstockFinance

|

VIB’s total non-performing loans (NPLs) as of December 31, 2024, amounted to VND 11,374 billion, a 36% increase from the beginning of the year. The NPL ratio was 3.51%, while the bank reported a bad debt ratio of 2.4%.

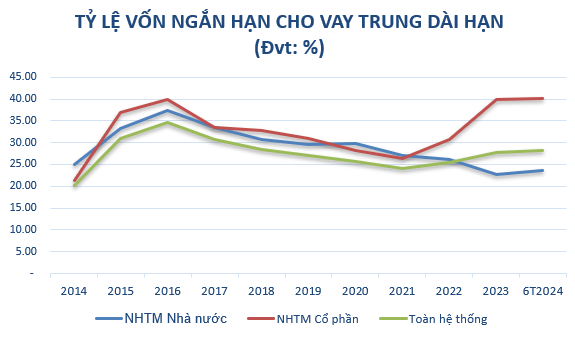

Safety ratios remained compliant with regulations: the Basel II capital adequacy ratio (CAR) was 11.9%, the loan-to-deposit ratio (LDR) stood at 72%, the short-term capital for medium and long-term loans ratio was 22%, and the net stable funding ratio (NSFR) under Basel III was 117%.

Han Dong

– 09:28, January 24, 2025

The Art of Refinement: Banking Asset Quality Under Control

Experts believe that even with the expiration of Circular 02, the asset quality of banks can be kept in check throughout 2025.

Borrowing Over VND 2,000 Billion from the State Bank, Eximbank Targets a 54% Surge in Pre-Tax Profit by 2024

“Eximbank’s consolidated financial statements reveal a remarkable performance in 2024, with a profit before tax of over VND 4,188 billion, reflecting a significant 54% year-on-year increase. This impressive growth was achieved despite a substantial rise in provisions for potential risks.”

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.