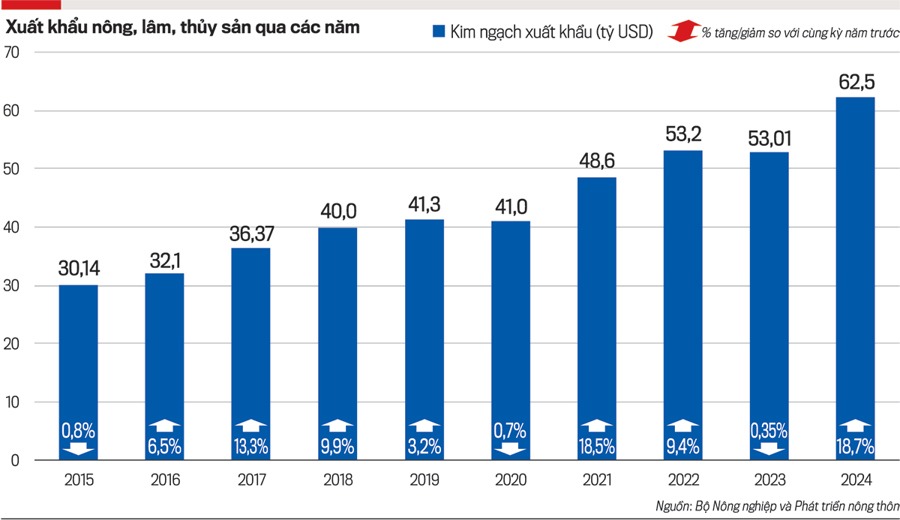

In 2023, Vietnam’s agricultural, forestry, and aquatic product exports reached 53 billion USD. The government set a target of 55-57 billion USD for 2024, but the sector surpassed expectations, achieving a remarkable 62.5 billion USD. This outstanding performance showcases a significant shift in Vietnam’s agricultural export strategy, marked by product diversification, market expansion, and the integration of science and technology in production.

MULTIPLE INDUSTRIES SURPASS 5 BILLION USD

According to the Ministry of Agriculture and Rural Development, in 2024, agricultural product exports reached 32.8 billion USD, a 22.4% increase from 2023. Livestock product exports amounted to 533.6 million USD, a 6.5% increase, while aquatic product exports totaled 10.07 billion USD, a 12.2% rise. Additionally, forestry product exports reached 17.28 billion USD, an impressive 19.4% increase.

Although exports of input products for agricultural production, such as fertilizers and pesticides, decreased by 5.7%, this did not dampen the overall robust growth of Vietnam’s agricultural exports.

Asia remained the largest market for Vietnam’s agricultural, forestry, and aquatic products, accounting for a 48.2% market share. The Americas and Europe followed closely with 23.7% and 11.3% shares, respectively. Notably, exports to the Americas and Europe witnessed significant growth. For instance, agricultural exports to the Americas increased by 23.6%, while those to Europe rose by 30.4% compared to 2023. Although Africa and Oceania had smaller market shares of 1.8% and 1.4%, respectively, they still recorded growth rates of 4.4% and 13.9%.

When considering individual countries, the United States and China remained Vietnam’s top two markets, with market shares of 21.7% and 21.6%, respectively. These markets experienced substantial growth, especially exports to the United States, which surged by 24.6%, while exports to China increased by 11%. Japan, with a 6.6% market share, was the third-largest market for Vietnam’s agricultural products.

In 2024, wood and wood product exports reached 16.2 billion USD, a 20.3% increase compared to 2023. The United States was the largest consumer of Vietnam’s wood and wood products, accounting for a 55.5% market share. China and Japan were the next largest markets, with shares of 13% and 10.8%, respectively. Compared to the previous year, exports to the United States increased by 25.2%, to China by 22.3%, and to Japan by 2.5%.

Aquatic product exports in 2024 amounted to 10.07 billion USD, a 12.2% increase from 2023. The United States, China, and Japan were the top three consumers of Vietnam’s aquatic products, with market shares of 18.5%, 17.1%, and 15.3%, respectively. Compared to 2023, exports to the United States increased by 16.4%, to China by 23.2%, and to Japan by 1.3%.

In 2024, five product categories achieved export turnovers of over 5 billion USD each: wood and wood products, aquatic products, vegetables and fruits, rice, and coffee. These products not only grew in value but also solidified Vietnam’s position on the global agricultural export map.

Vegetables and fruits also set a new record in 2024, reaching 7.12 billion USD, a 27.1% increase from the previous year. China remained the top market for Vietnam’s vegetables and fruits, with a 66.5% market share and an export value of 4.1 billion USD, a 28.7% increase from 2023. The United States and South Korea were the next largest markets, with market shares of 4.7% and 4.3%, respectively.

Rice exports witnessed impressive growth in 2024, with 9.18 million tons exported, earning 5.75 billion USD, the highest ever. This represented a 23% increase in volume and a 22.4% increase in value compared to 2023. The Philippines was the largest market for Vietnamese rice, with a 46.1% market share. Indonesia and Malaysia were the next largest markets, with shares of 13.5% and 8.2%, respectively. Compared to 2023, exports to the Philippines increased by 59.1%, to Indonesia by 20.2%, and to Malaysia by 2.2 times.

Coffee exports in 2024 reached 1.32 million tons, with a record turnover of 5.48 billion USD. Although the export volume decreased by 18.8%, the export value increased by 29.18%. The average export price of coffee in 2024 was 4,037 USD/ton, a 56.9% increase from 2023. Notably, coffee exports grew in all 15 of the largest markets, with the most significant increases in Malaysia (2.2 times) and the Philippines (2.1 times). The largest market for Vietnamese coffee exports was the EU, with Germany, Italy, and Spain being the top three consuming countries.

A YEAR OF TRANSFORMATION FOR AGRICULTURE

Not only did the key export products perform well, but other products below the 5 billion USD mark also showed impressive growth. Cashew nuts, rubber, pepper, cassava, and cassava products all made significant strides in exports. Specifically, cashew nut exports reached 4.48 billion USD, a 20.2% increase from 2023. The United States and China remained the main consumers of Vietnamese cashew nuts.

Rubber exports amounted to 3.37 billion USD, with a volume decrease but a 17.1% value increase due to higher rubber prices. China remained the primary market for Vietnamese rubber. In the case of pepper, although export volume decreased by 4.4%, export value surged by 46.5%, reaching 1.33 billion USD. The United States, Germany, and the United Arab Emirates (UAE) all showed remarkable growth in pepper imports.

Cassava and cassava product exports experienced a decrease in both volume and value but still reached 1.13 billion USD, with China as the main consuming market.

According to the Ministry of Agriculture and Rural Development, five factors contributed to the robust growth of Vietnam’s agricultural exports in 2024.

First, favorable conditions in major markets and rising prices for many agricultural products created opportunities for Vietnam to expand its exports. For instance, with rice, India’s ban on regular rice exports left a gap that Vietnamese rice could fill. Vietnam’s average rice export price in 2024 was 626 USD/ton, a 10.6% increase from 2023. Notably, throughout 2024, Vietnam’s rice export prices consistently ranked highest compared to competitors’ products. Specifically, on July 20, 2024, the price of 5% broken rice from Vietnam was 568 USD/ton, while the same product from Thailand was 550-555 USD/ton, India 539-545 USD/ton, and Pakistan 510-515 USD/ton.

Second, the positive impact of protocols signed with China, allowing the official export of various fruits to this market, played a significant role. Notably, durian exports reached 3.3 billion USD, accounting for 46% of the total vegetable and fruit export turnover.

Third, the transformation of Vietnam’s agricultural sector through restructuring, the application of science and technology in production and processing, and the expansion of raw material areas were crucial. Emphasizing the export of value-added products, such as processed vegetables, fruits, and aquatic products, contributed to enhancing the overall export value.

Fourth, addressing saline intrusion, developing raw material areas in connection with processing, and expanding export markets provided a boost for sustainable industry development.

Fifth, the signing of numerous Free Trade Agreements (FTAs) laid a solid foundation and propelled bilateral trade turnover between the parties to remarkable levels.

The trade balance in the agricultural, forestry, and aquatic sectors in 2024 recorded a surplus of 17.9 billion USD, a 46.8% increase compared to 2023. Within this, the forestry group had a surplus of 13.05 billion USD, a rise of 18.7%; the aquatic group had a surplus of 6.88 billion USD, a 17.5% increase; and the agricultural group had a surplus of 4.72 billion USD, triple the figure from 2023. Meanwhile, the production input group had a deficit of 5.24 billion USD, an 8.6% increase; the livestock group had a deficit of 2.93 billion USD, a 6.6% rise; and the salt group had a deficit of 28.2 million USD, a decrease of 21.5%.

With the impressive export performance in 2024, Vietnam’s agricultural sector is on a strong and steady growth trajectory. Free Trade Agreements will continue to present new opportunities for the export of Vietnamese agricultural products, especially processed food, aquatic products, and animal products. Additionally, promising prospects are emerging for Vietnamese agricultural exports in new markets, particularly the Halal market in the Middle East…

The full content of this article was published in the Vietnamese Economic Magazine, Issue 4+5-2025, released on January 27, 2025. Dear readers, please refer to the link below for the full article: https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1194

The Evolution of Vietnam’s Mechanical Industry: Immense Potential Yet to Hatch a “Leading Crane”

The mechanical engineering industry has taken strides in enhancing domestic content, serving as a catalyst for the growth of other industries and the economy. This sector has directly and indirectly created employment opportunities for millions, setting a precedent for the development of various sectors.

The Top 10 Moments in Industry and Trade for 2024

Based on the votes from units under the Ministry of Industry and Trade and the industry’s press agencies, on December 23, 2024, the Ministry of Industry and Trade announced the top 10 standout events of the industry in 2024.

Vietnam Achieves $24.31 Billion Trade Surplus in the Last 11 Months

According to the General Statistics Office, the total import and export turnover of goods in November reached a preliminary figure of $66.4 billion, a 4.1% decrease from the previous month. For the eleven-month period ending November 2024, the total import and export turnover of goods reached a preliminary value of $715.55 billion, reflecting a 15.4% increase compared to the same period last year. This growth was driven by a 14.4% rise in exports and a 16.4% surge in imports. The trade balance recorded a surplus of $24.31 billion during this period.