Vietnam’s Coffee Industry Booms in 2024: Robust Growth and Global Market Leadership

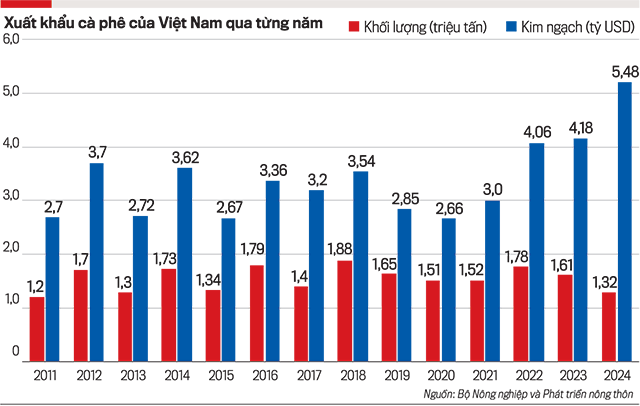

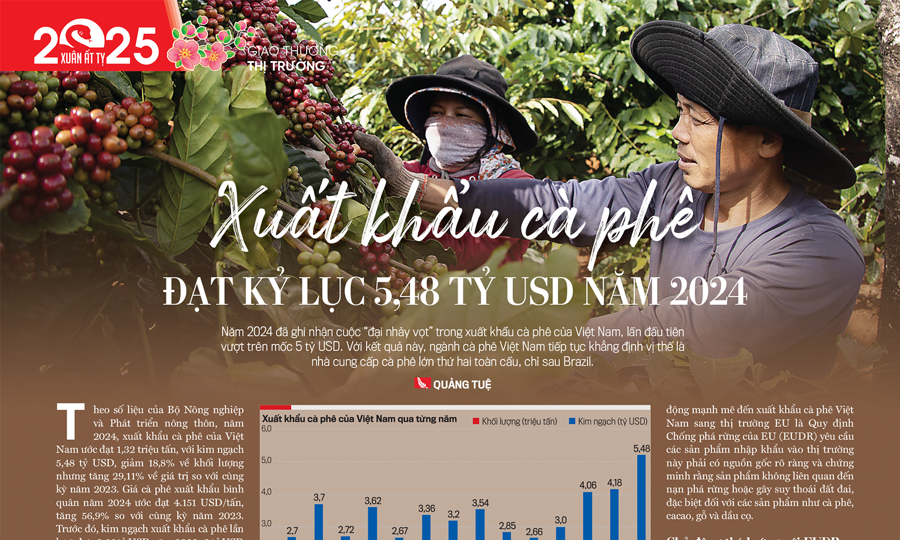

According to the Ministry of Agriculture and Rural Development, Vietnam’s coffee exports in 2024 are estimated to reach 1.32 million tons, with a turnover of 5.48 billion USD. This marks an 18.8% decrease in volume but a significant 29.11% increase in value compared to the same period in 2023. The average export price of coffee in 2024 is estimated at 4,151 USD/ton, a 56.9% increase compared to 2023.

ROBUSTA LEADS THE GLOBAL COFFEE MARKET

In 2024, coffee exports grew in all 15 of the largest export markets, with the most significant increases in Malaysia (2.2 times) and the Philippines (2.1 times). The EU remains the largest export market for Vietnamese coffee, with Germany, Italy, and Spain being the top three consuming countries, accounting for 11%, 8.1%, and 8% market share, respectively.

The Vietnam Coffee and Cocoa Association reported that in the 2023-2024 crop year (from October 2023 to September 2024), Vietnam exported approximately 1.46 million tons of coffee, worth 5.43 billion USD. This is the highest coffee export turnover in a crop year so far and the first time it has exceeded the 5 billion USD mark.

Historically, the global coffee market has been led by Arabica coffee, with prices typically twice or thrice that of Robusta. However, the market dynamics in 2024 were unusual. In the third quarter of 2024, Arabica coffee prices consistently remained above 4,000 USD/ton, while Arabica coffee futures on the New York commodity exchange traded above 4,444 USD/ton. The most notable event occurred in late October 2024, when Arabica coffee prices reached their highest level since 1977, while Robusta coffee prices peaked at a 27-year high.

According to Rabobank (a leading Dutch commercial bank with a global presence), from the beginning of the year until the end of September 2024, the global coffee market was mainly driven by Robusta, as producing countries, including Vietnam, faced challenges due to droughts and harsh weather conditions caused by the El Niño phenomenon.

Mr. Carlos Mera, Director of Agricultural Commodity Market Research at Rabobank, stated that Vietnam’s coffee production in the 2023-2024 crop year was not too disappointing, only about 5% lower than expected. However, this followed a period of reduced production in Brazil in previous years, leading to low inventory levels. Additionally, shipping delays due to rerouting by shipping companies amid concerns over the Red Sea crisis also contributed to the rise in coffee prices.

Meanwhile, coffee importers in Europe rushed to increase their stock before the EU’s Anti-Deforestation Regulation (EUDR) came into force. All these factors combined to drive up coffee prices. Some experts predict that the coffee market tension will ease in 2025, but prices are expected to remain on an upward trend in the long term due to climate change and other factors.

VIETNAM’S COFFEE INDUSTRY EMBRACES CHANGE FOR SUCCESS

In addition to favorable global market conditions, Vietnam’s coffee industry thrived in 2024 due to internal strengths and transformations. With stable production and a shift in production methods, Vietnamese coffee exports are opening up new opportunities, especially as the global market undergoes changes and new consumption trends emerge.

The Vietnam Coffee and Cocoa Association attributed the increase in coffee exports to high consumption in major markets such as the EU, the US, Japan, and ASEAN countries. Notably, potential markets like China and India have become bright spots in Vietnam’s export strategy. In 2024, Vietnam continued to promote the export of roasted and instant coffee, two products with high added value, thus increasing export value and enhancing the reputation of Vietnamese coffee.

“In 2024, improving coffee quality became a top priority for the Vietnamese coffee industry. Many farmers and businesses focused on adopting international quality standards such as Fair Trade, Organic, and UTZ to enhance the competitiveness of their products. Organic and high-quality coffee are gaining traction in demanding markets, particularly in Europe and North America.”

Vietnam Coffee and Cocoa Association.

Additionally, the industry is actively engaging in cooperation programs with international organizations to build and certify sustainable coffee-producing regions, reducing negative environmental impacts. These efforts aim to meet the market’s increasing demands for clean, sustainable coffee and protect the interests of coffee growers. One notable trend is the rapid growth of ready-to-drink coffee, especially instant and roasted coffee. Domestic enterprises have been increasing their processing capacity to meet the rising consumption needs of major markets.

To maintain the growth momentum of coffee exports in the coming years, the Vietnam Coffee and Cocoa Association emphasizes the need to continuously improve product quality, develop markets, and address challenges posed by climate change. Enhancing the supply chain, increasing processing capacity, and promoting sustainable coffee practices are key to solidifying Vietnam’s position as a leading coffee exporter in the international market.

One of the significant challenges currently impacting Vietnam’s coffee exports to the EU is the EU’s Anti-Deforestation Regulation (EUDR), which requires imported products to have a clear origin and proof that they are not associated with deforestation or land degradation, especially for products like coffee, cacao, timber, and palm oil.

PROACTIVELY ADAPTING TO EUDR TO SUSTAIN EXPORT GROWTH

“As one of the largest coffee exporters to the EU, Vietnam is directly impacted by the EUDR, especially regarding Robusta coffee, which accounts for a significant proportion of exports to markets such as Germany, France, Italy, and the Netherlands,” noted the Vietnam Coffee and Cocoa Association.

While the EUDR presents challenges, it also offers opportunities for Vietnam’s coffee industry to enhance the quality and value of its export products. One significant opportunity is the promotion of sustainable and organic coffee production, reducing environmental impacts. According to the Vietnam Coffee and Cocoa Association, the industry can leverage this trend to transition to more environmentally friendly production methods, thereby meeting the EU’s requirements for forest protection and sustainable development. Moreover, adapting to the EUDR can enable Vietnamese coffee enterprises to enhance their production capacity and supply chain management, from farming to processing and exporting.

To comply with the EUDR and seize the opportunities presented by the EU market, the Vietnam Coffee and Cocoa Association emphasizes several key strategies. These include investing in traceability technologies, utilizing blockchain, and implementing smart supply chain management systems to ensure transparency and compliance with EU requirements. Enterprises need to establish sustainable management systems that encompass production, processing, and exporting.

At the same time, the industry should continue to enhance product quality, adopt organic and sustainable agricultural production models, and prioritize environmental protection and deforestation reduction. Collaborating with international certification organizations will help elevate product value and build trust in the Vietnamese coffee brand. Additionally, providing support and training to farmers on international standards will enable them to better understand EU requirements and embrace sustainable production practices…

https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1194

The Great Rice Rush: From World ‘Kings’ to Unlocking the Floodgates

The golden rice fields are ready for harvest, yet the crops remain standing in the fields as traders refuse to buy. Rice mills and processing plants are overwhelmed with stock, forced to clear their warehouses at discounted prices. This is an alarming situation for Vietnam’s rice industry, once considered a stronghold for the country’s agriculture.

The Secretary-General’s Speech at the Conference on Breakthroughs in Science and Technology Development

General Secretary To Lam emphasized that science, technology, innovation, and digital transformation must be regarded as the “golden key” and vital factors in overcoming the middle-income trap and the risk of falling behind. These areas are also crucial in realizing our nation’s aspirations for strength and prosperity.

“Elevating Vietnam-Laos Cooperation: Aiming for a Transformative, Focused, and Impactful Partnership”

Within the framework of his visit to Laos and co-chairing the 47th meeting of the Vietnam-Laos Inter-governmental Committee, on the morning of January 10, in Vientiane, Prime Minister Pham Minh Chinh met with Thongloun Sisoulith, General Secretary of the Lao People’s Revolutionary Party Central Committee and President of Laos.

“T&T Group Ventures into its First Wind Energy Project in Laos”

The investment in the Savan 1 wind power project not only fulfills T&T Group’s commitment to expanding its clean energy portfolio but also marks a significant milestone as the Group’s first energy venture in Laos. This project underscores the Group’s dedication to ensuring energy security and fostering stronger collaboration between Vietnam and Laos.