The VN-Index officially closed for the 2024 Lunar New Year holiday, ushering in the 2025 Lunar New Year with a strong performance in the last two sessions. Today, it gained over 5 points, advancing towards the 1,265-point mark with a broad market breadth of 258 gainers and 195 losers. Despite this, liquidity slightly decreased compared to the previous session, reaching VND 11,078.4 billion.

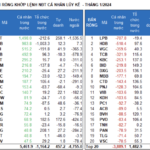

In terms of sectors, liquidity decreased notably in Banking, Securities, Steel, Construction, and Information Technology, while it increased in Food, Real Estate, Oil and Gas, and Agriculture. Regarding price movements, Steel, Information Technology, and Oil and Gas sectors declined, while the remaining sectors gained compared to the previous day.

Foreign investors recorded a net buy value of VND 614.6 billion, with a net buy value of VND 589.6 billion in matched orders.

The main sectors for foreign net buy in matched orders were Banking, Food and Beverage, and Consumer Staples. The top stocks in this category included LPB, MSN, GMD, HDB, SSI, PDR, DXG, VCB, VIX, and HPG.

On the selling side, foreign investors focused on the Information Technology sector, with the top stocks being FPT, FRT, VRE, CTR, BMP, OCB, FUEVFVND, HHV, and DIG.

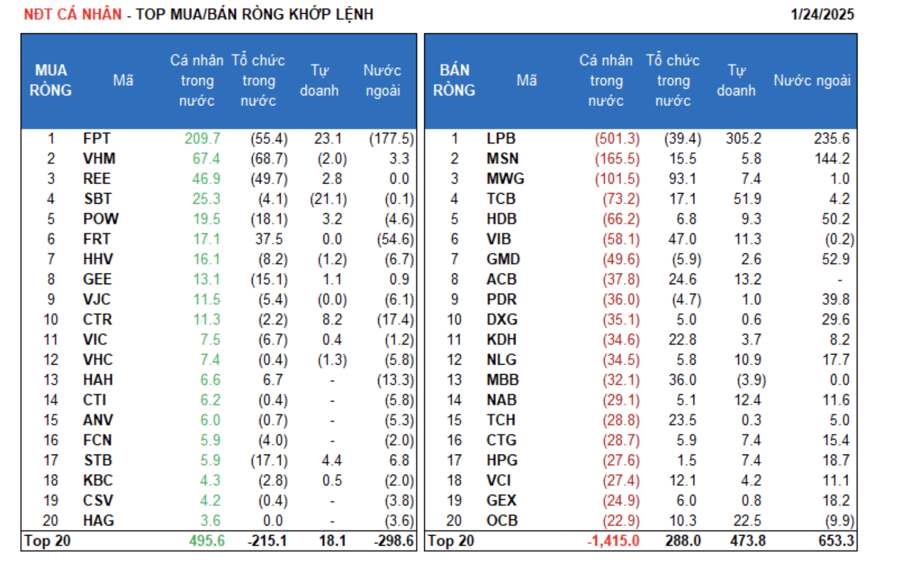

Retail investors recorded a net sell value of VND 1,421.6 billion, with a net sell value of VND 1,313.4 billion in matched orders.

In terms of matched orders, they net bought 5 out of 18 sectors, mainly in the Information Technology sector. The top stocks in their net buy list included FPT, VHM, REE, SBT, POW, FRT, HHV, GEE, VJC, and CTR.

On the net sell side, they sold 13 out of 18 sectors, mainly in the Banking, Food and Beverage, and Consumer Staples sectors. The top stocks in this category were LPB, MSN, MWG, TCB, HDB, VIB, ACB, PDR, and DXG.

Proprietary trading recorded a net buy value of VND 534.8 billion, with a net buy value of VND 538.4 billion in matched orders.

In terms of matched orders, proprietary trading net bought 11 out of 18 sectors, with the Banking and Information Technology sectors being the top performers. The top stocks in their net buy list included LPB, TCB, FPT, OCB, BSR, ACB, NAB, VIB, NLG, and HDB.

The top net sell sector was Food and Beverage. The top stocks in this category included SBT, SSI, E1VFVN30, VCB, MBB, VPB, VHM, SZC, VHC, and HHV.

Domestic institutional investors recorded a net buy value of VND 252.9 billion, with a net buy value of VND 185.4 billion in matched orders.

In terms of matched orders, domestic institutions net sold 6 out of 18 sectors, with the Information Technology sector recording the highest value. The top stocks in their net sell list included VHM, FPT, REE, LPB, POW, STB, SSI, GEE, HHV, and VCB.

The top net buy sector was Retail. The top stocks in this category included MWG, VIB, VRE, FRT, MBB, ACB, TCH, KDH, TCB, and GAS.

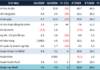

Today’s matched orders contributed 8.6% of the total trading value, a decrease of 14.9% compared to the previous session, reaching VND 1,166.9 billion.

Notably, there were matched orders between retail investors in MSN, FPT, EIB, and VIB, and between foreign investors in VPB, MWG, FRT, and NLG.

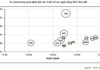

The money flow allocation increased in Real Estate, Food, Retail, Agriculture, and Electrical Equipment, while it decreased in Banking, Securities, Steel, Construction, Information Technology, and Chemicals.

In terms of matched orders, the money flow allocation increased in mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) stocks.

Unlocking Profits: YEG Stuck at Floor Price

The morning rally stalled as the breadth turned negative. While stocks that had surged in recent times faced selling pressure, most remained in the green. YEG stood out as the lone stock stuck at the floor price after a meteoric rise of 125% in December alone.

Stock Market Week of 12/16/2024 – 12/20/2024: A Prevailing Mood of Caution

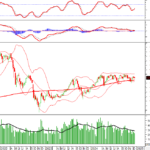

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.

Vietstock Weekly: Navigating Short-Term Risks

The VN-Index ended a rather pessimistic trading week as it continued to lose points and fell below the Middle Bollinger Band. The decline was accompanied by a drop in trading volume below the 20-week average, indicating limited participation of funds in the market. Currently, the MACD indicator is poised to give a sell signal as it narrows its gap with the Signal Line. Should this occur in the coming period, the index’s situation will turn even more negative.

The Bleak Fate of Saigon’s Renowned Textile Enterprise

Once a powerhouse in the garment industry, Garmex Saigon JSC boasted an impressive 5 factories and 70 production lines, working with renowned international brands. However, the company now finds itself in a dire situation, plagued by losses and facing the potential delisting of its stock.