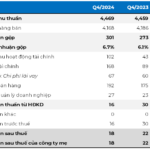

HQC’s consolidated Q4 2024 financial statements reported sales revenue and service provision of over VND 137 billion. Due to returned goods amounting to more than VND 82 billion, the net revenue stood at nearly VND 55 billion. After deducting the cost of goods sold, the company’s gross profit was almost VND 33 billion.

Additionally, financial revenue exceeded VND 29 billion, largely attributed to profit from joint ventures. Net profit reached nearly VND 6 billion after accounting for expenses. Combined with the nine-month performance, Hoàng Quân’s net profit for 2024 totaled approximately VND 33 billion, the highest since 2020, while net revenue surpassed VND 100 billion.

| HQC’s financial performance from 2015-2023 |

2024 marks the first year that HQC reports consolidated financial statements, following the acquisition of a majority stake in City Gold Investment JSC (HQC owns 98.04%) in the first quarter. The audited consolidated financial statements for 2023 showed that HQC generated nearly VND 293 billion in revenue and posted a net profit of over VND 5 billion.

Hoàng Quân has set ambitious goals for 2024, targeting VND 2,000 billion in revenue, a six-fold increase from 2023, and a net profit of VND 100 billion, a nineteen-fold surge. This represents the highest profit level in nine years, dating back to 2016. Thus far, the company has achieved 5% and 33% of these revenue and profit targets, respectively.

As of the end of Q4, HQC’s total assets amounted to nearly VND 10,137 billion, reflecting a 39% increase from the beginning of the year. Short-term receivables exceeded VND 4,600 billion, a 56% jump, with half attributed to short-term advances to suppliers and short-term receivables from customers totaling over VND 1,467 billion. Cash holdings also rose by 50% to surpass VND 42 billion.

Inventories stood at nearly VND 1,347 billion, more than double the amount at the start of the year, with notable ongoing production and business projects such as the Golden City social housing complex with a value of over VND 907 billion, Hoàng Quân Plaza condominium worth over VND 146 billion, and HQC Tân Hương valued at more than VND 59 billion, among others.

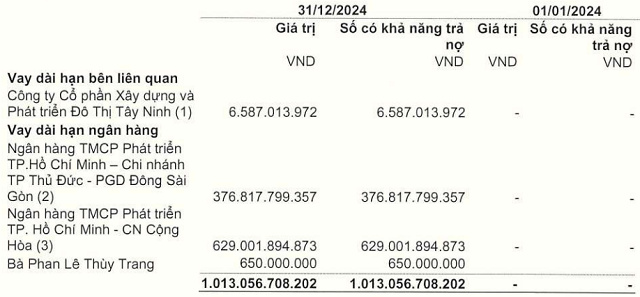

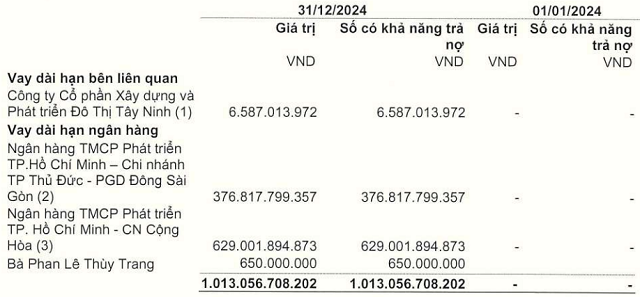

Total liabilities were close to VND 4,712 billion, a 60% increase from the beginning of the year, mainly due to a significant rise in the company’s financial borrowings, which increased from VND 61.5 billion to over VND 1,700 billion, accounting for 37% of total debt.

Long-term debt incurred by HQC in 2024. Source: HQC

|

|

The Golden City social housing project (commercially known as Golden City social housing) spans an area of 3.35 hectares in Tay Ninh province and is developed by City Gold Investment JSC. With a total investment of VND 1,777 billion, the project comprises seven 16-story apartment blocks offering 1,642 residential units.

|

– 12:37 31/01/2025

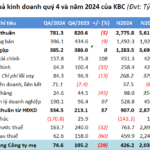

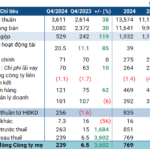

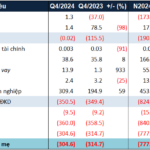

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.

The Poultry Baron: Dabaco’s Profitable Venture

Like the announced estimated profit results, the livestock giant Dabaco (HOSE: DBC) had its third-highest profitable year in its listed history, surging tens of times higher than the abysmal low of the previous year.

Record-Breaking Profits for Rubber Group Since 2012

The rubber price surge in Q4 has led to impressive revenue and profit figures for the Vietnam Rubber Group (HOSE: GVR), with results showing the highest figures in over a decade.