Gold prices witnessed a downward trend across jewelry and gold bar businesses this afternoon, July 9, 2025. Specifically, at Bao Tin Minh Chau, gold ring prices were listed at 115 – 118 million VND per tael, a decrease of 700,000 VND from this morning. PNJ adjusted its buying price down to 114.1 million VND per tael (down 600,000 VND) and selling price to 117 million VND per tael (down 300,000 VND). SJC also lowered its gold ring prices to 114 – 116.5 million VND per tael, a reduction of 400,000 VND. At DOJI, prices currently traded at the level of 107.9 – 112 million VND per tael, a decrease of 500,000 VND per tael.

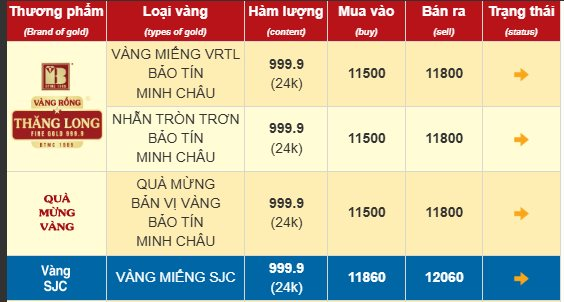

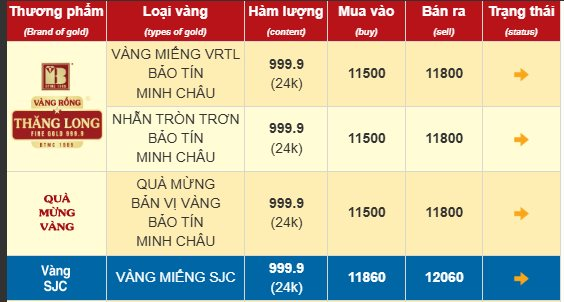

Gold ring and SJC gold prices listed at Bao Tin Minh Chau this afternoon, July 9, 2025.

Along with gold rings, gold bullion prices at these businesses were also adjusted downward and are currently trading at around 118.6 – 120.6 million VND per tael, equivalent to a decrease of 400,000 VND.

—

Opening the trading session this morning, gold bullion prices at Mi Hong Jewelry Company were adjusted upward by 500,000 VND per tael on the selling side, reaching 119.3 – 121 million VND per tael (buy-sell), while the buying side remained unchanged. Gold rings at Mi Hong also maintained their high levels, trading at 115.3 – 116.8 million VND per tael.

Some other businesses have not made any price adjustments yet. Bao Tin Minh Chau listed gold ring prices at 115.7 – 118.7 million VND per tael; SJC maintained its prices at 114.4 – 116.9 million VND per tael; PNJ traded at around 114.7 – 117.3 million VND per tael. Meanwhile, DOJI continued to keep gold ring prices at 108.4 – 112.5 million VND per tael. These gold companies unanimously listed gold bullion prices at 119 – 121 million VND per tael.

In the global market, gold traded at the level of 3,303 USD/ounce, a decrease of 28 USD compared to the same survey period yesterday, Vietnam time.

According to Kitco News, gold prices fell during the mid-day trading session on Tuesday (US time) as summer market liquidity weakened and short-term investor sell-offs intensified.

The market sentiment is “softening” after US President Donald Trump announced additional tariffs on Japan and South Korea, while also stating that he would impose tariffs ranging from 25% to 40% on many other countries.

This development pushed the US dollar up slightly, putting pressure on gold prices. However, analysts believe this is only a short-term technical adjustment. Many investors remain optimistic about gold in the long term.

In addition to short-term market factors, the central banks’ global gold-buying trend continues to be a pillar of support for gold prices.

According to the World Gold Council, in June, the People’s Bank of China continued to purchase 2 tons of gold, marking the eighth consecutive month of increasing reserves, bringing the total gold holdings to 2,299 tons.

Although the pace of buying has slowed compared to the end of 2024, experts believe that this trend will not stop soon, given the current reality of policy uncertainties, global coordination challenges, and long-term inflation.

“Central banks don’t buy gold to wait for a crisis; they are diversifying their portfolios to cope with the new reality. Gold is gradually regaining its role as a silent form of protection,” said Eugenia Mykuliak, CEO of B2PRIME Group.

Joy Yang, Director of Products at MarketVector Indexes, also emphasized that the prolonged trade war under President Trump is prompting many countries to reduce their dependence on the US dollar.

“There is no single currency that can completely replace the US dollar, but nations are still reducing their exposure to it. Gold is the only alternative left,” she said.

According to the Gold Focus report by Metals Focus, global central banks could buy up to 1,000 tons of gold in 2025, the fourth consecutive year of maintaining net purchases at this scale, accounting for about 21% of total global gold demand, compared to only 10% 15 years ago.

The All-Time High Global Gold Price Ahead of US Inflation Report

However, a pivotal U.S. inflation report on Friday could shape the trajectory of interest rates, which would impact the gold price.