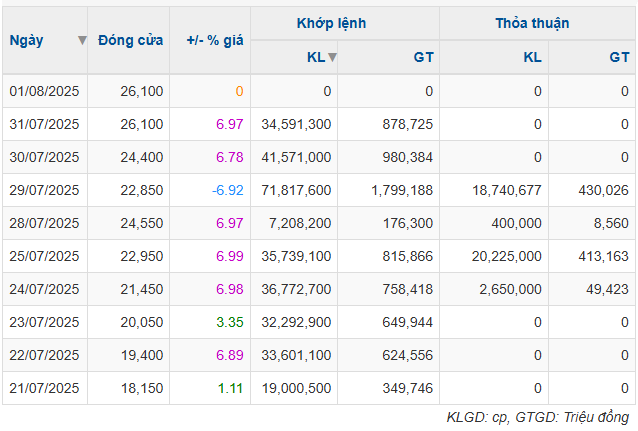

VSC’s Streak of 5/6 Consecutive Sessions Hitting the Ceiling Price – Source: VietstockFinance

|

Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) Capital One Member Limited Company sold over 10.1 million shares of Vietnam Container Shipping Joint Stock Company (Viconship, HOSE: VSC) on July 29, reducing its ownership from 13.52% to 10.82%, equivalent to more than 40.5 million shares.

The transaction took place on the same day VSC set a new record for liquidity, with nearly 90.6 million shares traded, including 71.8 million shares matched and 18.7 million shares negotiated, with a total value of over VND 430 billion. With an average price of around VND 22,946 per share, it is estimated that VietinBank Capital alone earned nearly VND 232 billion from the July 29 trade, most likely through a negotiated deal.

Previously, this organization sold 17.5 million shares on July 25, estimated to have earned about VND 357.5 billion. In total, within 5 trading days, VietinBank Capital has sold 27.6 million shares, reducing its ownership by more than 8% of VSC‘s capital, after raising its stake to 19% in February 2025.

VSC Share Price Hits New High Despite Profit-Taking Pressure

On July 29, VSC faced correction pressure as the market lost more than 64 points, causing the stock to fall to the floor price of VND 22,850 per share. However, immediately after that, VSC rebounded and continuously hit the ceiling price for 2 consecutive sessions on July 30 and 31, currently trading at VND 26,100 per share, the highest since its listing.

In just one week, the share price increased by nearly 22%, with explosive liquidity averaging more than 38 million shares per session, nearly 7 times higher than the average of the past year. Compared to the price a year ago, the share price has surged by 89%.

| VSC Share Price Movement since the beginning of 2025 |

Preparing to Adjust Profit Plan, 6-Month Profit Surges

Along with the movement of shareholders, VSC has also just announced the convening of an Extraordinary General Meeting of Shareholders in 2025, with the ex-right date falling on August 21. One of the important contents is to adjust the 2025 profit plan, based on positive business results after the first 6 months.

Specifically, in the second quarter of 2025, VSC reported a pre-tax profit of nearly VND 177 billion, up 57% over the same period, bringing the 6-month cumulative profit to VND 312 billion, up 54%, equivalent to 78% of the year plan. Six-month net profit reached nearly VND 197 billion, up 74%.

| VSC’s Semi-Annual Business Results over the Years |

The company explained that revenue in the second quarter increased by more than VND 89 billion, or 12% over the same period, thanks to the positive performance of member ports such as Vip Greenport, Xanh Greenport, and Nam Hai Dinh Vu. In addition, financial revenue increased sharply thanks to the recognition of investment profit from securities investment. At the same time, selling expenses and management expenses also increased due to the restructuring and digital transformation activities of the entire system.

As of June 30, 2025, VSC‘s consolidated total assets reached more than VND 8,775 billion, up 13% from the beginning of the year. The portfolio of trading securities (all stocks) alone reached a fair value of VND 1,423 billion, accounting for 16% of total assets. In addition, the Company also holds more than VND 319 billion in short-term bank deposits.

– 08:42 01/08/2025

The Foreigners’ Sudden Sell-Off: A Tale of Contrasting Strategies in the Market

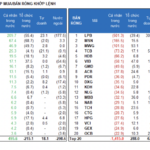

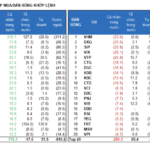

Foreign investors unexpectedly ramped up net selling today, offloading FPT shares worth nearly VND 312 billion. This marked the largest net sell-off by this group in nine sessions on the HoSE. In contrast, individual investors net bought VND 801.1 billion worth of shares.

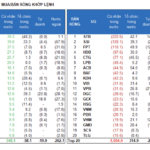

The Stock Market Sell-Off: A Whopping 1,756.1 Billion VND Net Selling by Individual Investors

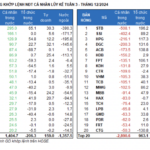

The market is buzzing with liquidity as banks take the lead. Today’s trading volume across all three exchanges reached an impressive 19,000 billion VND, with foreign investors making a remarkable turnaround. They net bought an outstanding 738.1 billion VND, and their matched orders alone accounted for 588.2 billion VND in net purchases. It’s a clear sign of confidence in the market, and we can expect some exciting movements in the coming days.