Anticipating the “Wave” of Upgrades

After years of effort, the Vietnamese stock market has come close to the milestone of being upgraded from a frontier to an emerging market, following the Ministry of Finance’s issuance of Circular 68/2024, officially allowing the non-pre-funding mechanism for foreign investors – one of the important criteria in FTSE Russell’s assessment standards.

The Vietnamese stock market continues to surge amidst the news of potential upgrades. Photo: Dat Thanh |

Riding on the expected wave of upgrades, foreign investors have consistently increased their net buying value in recent months. This trend is similar to what has been observed in other markets that have been upgraded, where foreign capital tends to flow in significantly before, during, and after the evaluation period.

Discussing this development at the workshop “Upgrading the Stock Market, Expanding Capital Mobilization Channels for the Economy,” Mr. Pham Luu Hung, Chief Economist at SSI Securities Corporation, stated that while the Vietnamese stock market has not yet been upgraded, many foreign investors believe that it will be. As a result, some investors are still buying their favorite stocks, with a value corresponding to about 5-10% of their total portfolio value.

Similarly, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), acknowledged that “never before has the Vietnamese market received so much attention from foreign investors,” as they continuously meet and work with international investment funds and financial institutions in recent weeks.

Moreover, the regulatory authorities are also making preparations to meet the demands of domestic and foreign investors, as well as market members.

Regarding the short-selling mechanism, Mr. Nguyen Son, Chairman of the Members’ Council of the Vietnam Securities Depository and Clearing Corporation (VSDC), said that the legal provisions related to this mechanism have been mentioned in Circular 120/2020 of the Ministry of Finance, while the technical operations are being integrated into the KRX system.

Notably, immediately after the new system is operational, the SSC, the Stock Exchange, and the VSDC have been preparing to gradually introduce new products when the underlying system runs stably.

For the intraday trading mechanism, the VSDC, the Stock Exchanges, and the SSC are working with the technology contractor to adjust the system parameters when the new technology platform operates stably.

“This will help reduce the pressure at the beginning of the day when the system has to cope with a large number of orders. This goes hand in hand with improving the system’s efficiency by upgrading and developing additional system capacity to make it smoother,” said Mr. Son.

Additionally, Ms. Pham Thi Thuy Linh, Head of the SSC’s Market Development Department, said that the regulatory authorities have made policy changes, such as requiring listed and public companies to disclose bilingual information to ensure equal access to information for domestic and foreign investors, as stipulated in Circular 68/2024. They also require listed companies to clearly disclose the foreign ownership ratio to help investors make informed investment plans.

Furthermore, the Ministry of Finance has issued Circular 18/2025 to address the criteria that FTSE Russell assessed as not yet met, including the settlement cycle (DvP) and the costs related to failed transactions.

“The new mechanisms have been operating effectively and stably. Among hundreds of thousands of NPF transactions (non-pre-funding for foreign investors), there were only four failed transactions, and they were all safely handled through the provisions of Circular 18 and Circular 68,” said Ms. Linh.

With these preparations in place, Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities, forecasts a 70% chance of an upgrade in September 2025 and a 30% chance of a delay until March 2026, as FTSE Russell needs more time to assess the stability of the system and its ability to handle transaction failures.

Upgrading Enterprises to ESG Standards

As the official upgrade of the Vietnamese stock market draws near, there is still much to be done for businesses and the economy to reap the benefits of this development.

Some securities companies are aiming to design personalized services and products for their clients. Illustration: N.A |

Looking at markets like Pakistan, the UAE, and Greece, which were upgraded but did not grow as expected and even saw a decline in foreign capital attraction, Ms. Pham Thi Thuy Linh suggested that listed companies need to proactively review and focus on their core business areas. For restricted business lines, they should adjust their business registration and industry codes to increase the foreign ownership ratio and, thus, improve corporate governance. This is also a way to enhance the quality of existing goods on the market.

“The SSC will coordinate with units within the Ministry of Finance and relevant ministries and sectors to review business lines, aiming to expand the foreign ownership ratio for industries that are not genuinely restricted,” said Ms. Linh.

From the perspective of enterprises, Ms. Ha Thu Thanh, Chairman of the VIOD, said that the quality of corporate governance in Vietnam has improved significantly, with assessment scores increasing according to the roadmap approved by the Prime Minister. The country is now aiming for the average governance score of ASEAN countries.

However, with the market expected to be upgraded, investment funds will ask questions like, “How long has the enterprise been listed?” as they must comply with transparency requirements and expectations regarding leadership positions and governance quality. Therefore, enterprises need to develop more specialized strategies, focusing on sustainability and non-financial factors.

“Listed companies should view corporate governance as a measure to enhance their asset value. Corporate governance is the new goal for all enterprises to advance in step with the market’s upgrade,” said Ms. Thanh.

Additionally, Mr. Nguyen Quang Huy, from Nguyen Trai University, stated that for listed companies, ESG (Environmental, Social, and Governance) is no longer a voluntary choice but a prerequisite for survival and attracting foreign investment. In this context, the investor relations (IR) department will play the role of a “responsible storyteller,” connecting the company’s ESG commitments with investors’ expectations.

“Instead of merely presenting financial indicators, IR must convey a transparent ESG data ecosystem, from emissions and renewable energy usage to human resource management and anti-corruption efforts. In a market where trust and non-financial transparency determine long-term capital flows, IR is the bridge that shapes the company’s reputation and sustainable valuation,” said Mr. Huy. He emphasized that IR should proactively convey the ESG philosophy from the company’s leadership to the market through standardized ESG data.

Van Phong – Dung Nguyen

– 07:00 01/08/2025

Who is the Richest Real Estate Tycoon on the Stock Exchange?

In the real estate arena, VinGroup Joint Stock Company (HOSE: VIC) Chairman, billionaire Pham Nhat Vuong, reigns as Vietnam’s wealthiest stock market player.

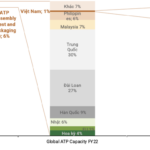

“Vietnam: Shining Star in the $95 Billion ATP Stage of the Global Semiconductor Supply Chain”

The May 2024 report by the Semiconductor Industry Association (SIA) and BCG projects a significant growth for Vietnam in the Assembly, Testing, and Packaging (ATP) of chips, with its global market share expected to rise from 1% in 2022 to an impressive 8% by 2032.

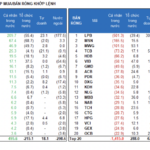

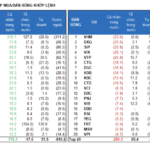

The Psychology of Rest Dominates, Liquidity Plunges

Investor sentiment was muted in the final days of the 2024 financial year. This morning’s trading activity by foreign investors hit a record low, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.