The scale of individual investors’ assets saw a significant decline in Q4 2024, dropping by 61 thousand billion VND, equivalent to a 3.8% decrease, according to data from FiinTrade.

AS INDIVIDUALS WITHDRAW CASH, FUNDS BULLISH ON STOCKS

Specifically, the total financial assets, including stocks, bonds, fund certificates, etc., managed by securities companies decreased by 43.7 thousand billion VND (-2.9%). Regarding deposit balances, data shows that individual investors’ deposits at securities companies declined for the third consecutive quarter, falling by 17.8 thousand billion VND to over 73.5 thousand billion VND, the lowest level in the past six quarters.

The evolution of individual investors’ asset scale in Q4 2024 and deposit balances indicates a shift in capital towards other asset classes, reflecting domestic investors’ cautious sentiment towards the stock market.

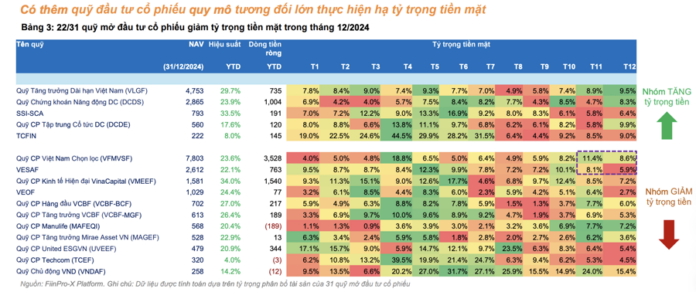

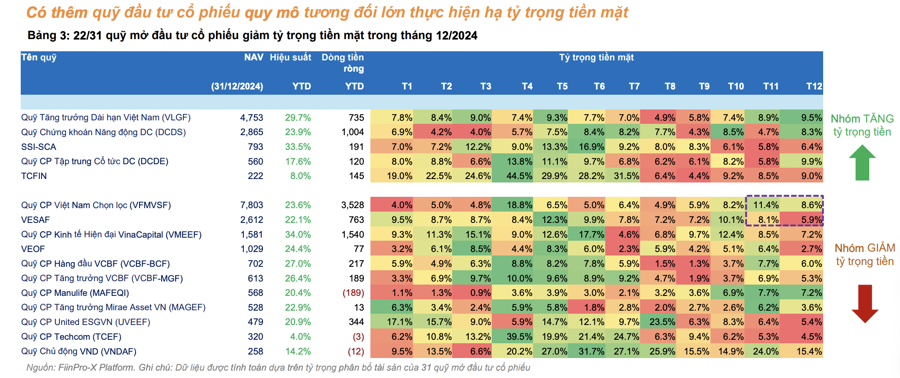

In a separate development, investment funds continued to accelerate their stock purchases. Out of 31 stock funds investing in Vietnam, 22 decreased their cash holdings in December 2024. Notably, the Vietnam Select Stock Fund (VFMVSF) significantly reduced its cash position to 8.6%, down from 11.4% in November. With a NAV of over 7.8 thousand billion VND as of the end of 2024, VFMVSF is the largest fund to reduce its cash holdings in the past six months.

Additionally, the VinaCapital Market Access Equity Fund (VESAF) and the VinaCapital Modern Economy Equity Fund (VMEEF), with a combined NAV of over 4 thousand billion VND, decreased their cash holdings for the second consecutive month. Most funds also reduced their cash positions and ramped up stock purchases throughout 2024.

This can be attributed to the strong performance of investment funds in the past year. Out of 66 stock funds, 41 recorded outstanding growth, outperforming the Vn-Index (+12.1%) in 2024, thanks to positive returns in the first half.

The VinaCapital Modern Economy Equity Fund (VMEEF), a newly established fund in 2023, led the way with a growth rate of +34%, attributed to its significant allocation to Banking and Technology stocks (FPT, FOX). Following closely was the Vietnam Long-Term Growth Fund (VFMVSF), with a growth rate of +29.7%, the highest performance since its inception (2021). Considering a five-year timeframe, this fund has achieved impressive results, with a compound annual growth rate (CAGR) of +15.3%.

The VinaCapital Market Access Equity Fund (VESAF) and the SSI Sustainable Competitive Advantage Fund (SSI-SCA) maintained stable CAGR in both the short and long term. Their growth rates for the past year were 22.1% and 33.5%, respectively. Several other funds doubled the VN-Index’s performance, including the Vietnam Long-Term Growth Fund (+29.7%), the VCBF Leading Stock Fund (+27%), the VCBF Growth Stock Fund (+26.4%), and the Bao Viet Prospect Stock Fund (+25.1%).

WILL THE WEIGHT OF INDIVIDUAL INVESTORS DECLINE?

Commenting on this phenomenon, Mr. Nguyen The Minh, Director of Research and Analysis for Yuanta Securities’ Retail Client Division, identified three main reasons for the decrease in individual investors’ cash holdings at securities companies.

First, the stock market’s lackluster performance in the past year, characterized by sideways movement and unexpected crashes, made trading challenging and resulted in consecutive losses for investors. Consequently, they opted to withdraw from the market. The majority of individual investors lack a long-term investment mindset, and 90% of them prefer short-term speculation, which often leads to low returns and motivates them to exit the market.

Second, the stock market faces competition from more attractive investment avenues, such as gold, bitcoin, and real estate. The rise in gold prices and the bitcoin wave, despite its recent downturn, present opportunities for small investors who favor short-term gains. While bitcoin has incurred losses, its profit potential still surpasses that of the stock market. Even the real estate sector has lured away some investors, as it is customary for individuals to seek tangible assets at the beginning of the year.

Regarding investment funds, 2024 witnessed robust growth in their performance, which also explains the decline in individual investors’ cash deposits at securities companies. Individual investors, realizing that their self-directed investment strategies were less effective than purchasing fund certificates, shifted a significant amount of capital to mutual funds, resulting in a substantial decrease in their cash balances.

“2024 proved that buying and holding for the entire year could be more successful than short-term speculation. This trend is likely to persist in 2025, with the market driven by fundamental factors, and investment funds anticipating an improvement in the underlying conditions,” emphasized Mr. Minh.

Mr. Minh further explained that individual investors opting to invest in mutual funds instead of making their own investment decisions could lead to better profitability. Typically, the collective decision-making process of a fund, which often involves a team of experts, outperforms the choices made by a single individual. Moreover, funds usually allocate a small portion of their portfolio to short-term speculation, focusing primarily on long-term investments.

“From a market perspective, a decrease in the proportion of individual investors and a corresponding increase in institutional investors would reduce market volatility. It would also mitigate the FOMO (fear of missing out) mentality and extreme sell-offs witnessed in 2024 and 2022. In Southeast Asia, Vietnam stands out with over 90% of its market comprising individual small investors, which, given the market’s significant size, results in excessive speculation and market risk,” said the Director of Research and Analysis for Yuanta Securities’ Retail Client Division.

The Price of Gold Plummets as Investors Rush to Cover Stock Market Losses

The US dollar index and Treasury yields fell during the session, but failed to buoy the precious metals market.

The Cryptocurrency Comeback: Will Bitcoin Bounce Back in January 2025?

As investors look ahead to 2025, historical market data suggests that January could be a bullish month for Bitcoin and the broader digital asset market.