MARKET OUTLOOK FOR THE WEEK OF JULY 28 – AUGUST 01, 2025

During the week of July 28 – August 01, 2025, the VN-Index paused its upward trend, with trading volume reaching an all-time high, indicating strong profit-taking pressure. Currently, the index is retesting the old peak from April 2022 (equivalent to 1,480-1,530 points) while the Stochastic Oscillator indicator has signaled a sell-off in the overbought region. Investors should be cautious of potential adjustments as the indicator may exit this zone in the coming period.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator has fallen out of overbought territory

On August 01, 2025, the VN-Index witnessed a slight decline, forming a small-bodied candle alongside declining trading volume in recent sessions, reflecting investors’ cautious sentiment.

At present, the index is retesting the mid-term upward trendline, coinciding with the Fibonacci Projection 200% level (approximately 1,475-1,500 points). This zone offers substantial support for the VN-Index in the near term.

Moreover, the Stochastic Oscillator indicator has descended from the overbought region after issuing a sell signal. Should the index breach this support zone, the short-term outlook would turn increasingly pessimistic.

HNX-Index – Tracking the upper band of the Bollinger Bands

On August 01, 2025, the HNX-Index witnessed a decline, accompanied by trading volume surpassing the 20-session average, indicating investors’ subdued optimism.

Presently, the Stochastic Oscillator is weakening within the overbought territory after signaling a sell-off. Should the indicator exit this zone in the upcoming sessions, the risk of a short-term correction heightens.

However, the index remains close to the upper band of the Bollinger Bands, while the MACD indicator continues its upward trajectory, having issued a buy signal. This suggests that positive prospects remain intact.

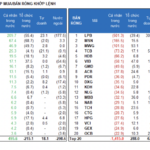

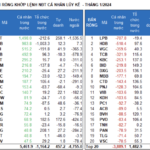

Capital Flow Analysis

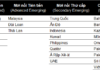

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index is positioned above the 20-day EMA. If this status persists in the upcoming session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors continued net selling on August 01, 2025. If this trend persists in the coming sessions, the situation will turn gloomier.

Technical Analysis Department, Vietstock Consulting

– 16:58 03/08/2025

The Great Capital Shift: Will Frontier and Emerging Markets Trump the US by 2025?

The global investment landscape may be shifting its gaze away from the traditional allure of the US stock market in 2025. There is a potential shift towards frontier and emerging markets, with Vietnam being a key player in this narrative.

Unlocking Profits: YEG Stuck at Floor Price

The morning rally stalled as the breadth turned negative. While stocks that had surged in recent times faced selling pressure, most remained in the green. YEG stood out as the lone stock stuck at the floor price after a meteoric rise of 125% in December alone.