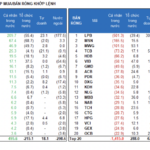

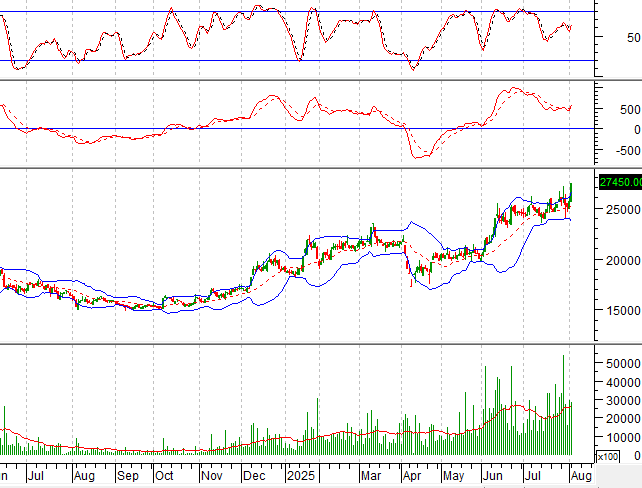

Technical Signals for VN-Index

In the trading session on the morning of August 4, 2025, the VN-Index rebounded with a slight decline in trading volume, indicating investors’ cautious sentiment.

Additionally, the index is retesting the Middle line of the Bollinger Band while the MACD line continues to weaken after a sell signal. This suggests that the short-term outlook remains pessimistic.

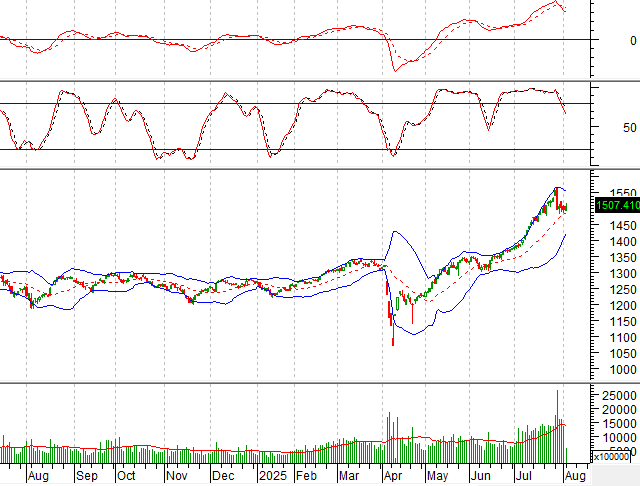

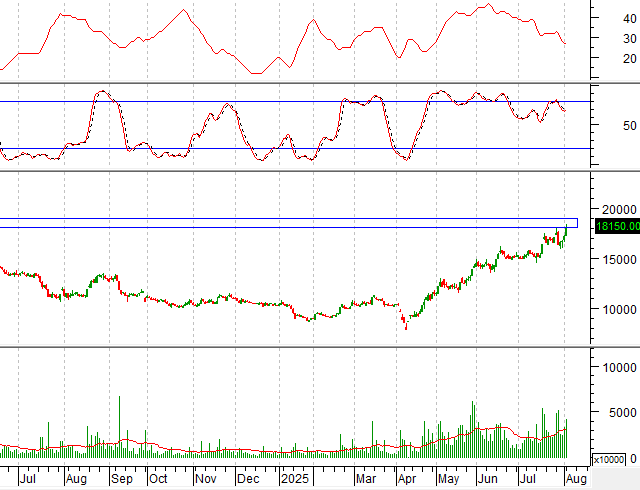

Technical Signals for HNX-Index

In the morning session of August 4, 2025, the HNX-Index opened slightly higher, accompanied by a drop in volume, indicating investors’ cautious sentiment.

Furthermore, the Stochastic Oscillator indicator continues to weaken and is about to fall out of the overbought region after a sell signal, adding to the pessimism.

If this indicator maintains its negative signal, the poor outlook may return. The Fibonacci Retracement 100% threshold (equivalent to the 248-250 point region) will serve as a good support in the coming time if a correction occurs.

CTI – CTI Joint Stock Company

In the morning session of August 4, 2025, CTI’s stock price opened with a strong increase, forming a White Marubozu candlestick pattern, and trading volume exceeded the 20-session average, indicating investors’ optimistic sentiment.

Additionally, the price has risen above the upper band of the Bollinger Band, and the MACD line has crossed above the signal line, giving a buy signal. This further supports the long-term upward trend.

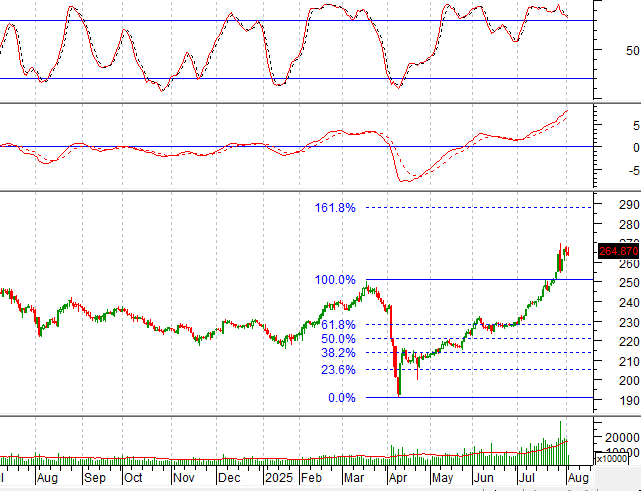

NVL – No Va Real Estate Investment Group Joint Stock Company

In the trading session on the morning of August 4, 2025, NVL’s stock price rose sharply, accompanied by a trading volume exceeding the 20-session average, reflecting investors’ optimism.

Additionally, the Stochastic Oscillator indicator gave a buy signal again, while the ADX line remained in the strong trend region (ADX>25).

Currently, the price is about to retest the old peak of April 2024 (equivalent to the 18,000-19,000 region). If the price surpasses this peak, the stock’s upward momentum will be more sustainable.

Technical Analysis Department, Vietstock Consulting Department

– 12:00 04/08/2025

Vietstock Weekly 04-08/08/2025: Profits Taking Pressure Intensifies

The VN-Index stalled in its upward trajectory last week as trading volumes hit an all-time high, indicating significant profit-taking pressure. The index is currently retesting the old peak from April 2022 (1,480-1,530 points) while the Stochastic Oscillator has signaled a sell-off within the overbought territory. Investors should be cautious of the potential for further corrections if the indicator exits this zone in the coming period.

“Front-Running the Upgrade ‘Wave’: Foreign Investors Buy Over 8 Trillion VND in July”

The VN-Index witnessed a remarkable journey in July, reaching an unprecedented closing high of 1,557.42 points. This achievement can be largely attributed to the significant net foreign buying of over VND 8.1 trillion, with 14 net buying sessions during the month. As a result, the net selling scale from the beginning of the year was narrowed to nearly VND 29.4 trillion.

Technical Analysis for August 1st: Pessimism Persists

The VN-Index and HNX-Index both witnessed a decline, alongside a dip in trading volume, indicating a cautious sentiment among investors.