The international landscape is ever-changing, and we are entering a new era of tariffs.

In an interview, Mr. Truong Hien Phuong, Senior Director of KIS Vietnam Securities, shared that on the international front, the US is in its final round of negotiations with China to finalize tariff agreements. As both countries are Vietnam’s largest import and export partners, any changes in tariffs between these two nations will significantly impact Vietnam’s economy and, consequently, its domestic stock market.

Geopolitical tensions, including conflicts between Israel and Iran and Russia and Ukraine, are also expected to influence market sentiment. A de-escalation of tensions would boost market absorption and investor confidence. Conversely, an escalation, especially if the US intervenes, would negatively affect global investor sentiment.

Additionally, the actions of the US Federal Reserve (Fed) regarding interest rate adjustments are crucial to monitor, as they have a strong impact on global stock markets.

Mr. Truong Hien Phuong, Senior Director, KIS Vietnam Securities

|

Ms. Nguyen Hoang Anh, Investment Advisory Director at LPBank Securities (LPBS), highlighted another critical aspect of global trade: the countervailing duties that came into effect on August 1, 2025. Apart from a few countries with agreements with the US, most nations must accept the countervailing duty rates imposed by Mr. Trump. For Vietnam, while the 20% tax rate has been known since early July, the key question revolves around the definition of “goods in transit” and the percentage of Vietnamese goods subject to the 40% tax rate, as well as specific tax rates for different industries.

Domestic Positives

Mr. Truong Hien Phuong offered a positive outlook for the domestic landscape, not just for August but also for the following months. First, there are expectations for an upgrade to the Emerging Markets status by FTSE Russell in September. If this happens, it would be incredibly positive news, potentially attracting significant capital inflows from large global funds that reference Emerging Markets indices. These inflows could reach several billion USD. Typically, foreign investors anticipate such upgrades, so August is viewed as a favorable month.

Second, the second-quarter financial results revealed many bright spots, with improved profit margins for numerous enterprises, indicating a recovery in financial health.

Third, supportive policies from the government, notably Resolution 68 on private economic development—a significant contributor to GDP and employment—are in place. Additionally, increased public investment and prudent monetary policy management have helped keep inflation below 4%, stabilize exchange rates, and maintain low-interest rates. These factors collectively create a conducive environment for businesses and the stock market.

Considering these factors, the Senior Director of KIS Vietnam foresees the Vietnamese stock market continuing to accumulate and potentially breaking out in August, despite possible volatile sessions.

Ms. Nguyen Hoang Anh added that the draft of the new personal income tax (PIT) law has also drawn attention from both stock and real estate investors due to its proposed new taxation methods. However, as it is still in the consultation and refinement phase, any related information regarding the management’s perspective on these tax rates in the future will impact the prospects of various asset markets.

Ms. Nguyen Hoang Anh, Investment Advisory Director, LPBS

|

Commenting on the proposed PIT collection, Mr. Truong Hien Phuong stated that if realized, the impact on investment capital flows in the stock market would be negligible. Taxing actual profits would be more reasonable than the current practice of levying 0.1% on the total sales value, which means paying taxes even when incurring losses. However, determining actual profits in the stock market is complex and can give rise to various scenarios. Additionally, the 20% tax rate might be considered slightly high, given the high-risk nature of the stock market, and compensatory policies for investors should be considered.

Navigating the Market After a Strong Rally

According to Ms. Nguyen Hoang Anh, considering the factors of money flow and consecutive liquidity records, the market is undoubtedly vibrant. However, the accumulation of favorable factors has prevented the market from experiencing sufficiently deep corrections. Investor perspectives are divided between believing the market is in an “uptrend” and thinking it has become overheated. This distinction will only become clear after the VN-Index peaks and establishes a more stable price range.

In terms of valuation, the P/E ratio of the VN-Index remains at 15 times, significantly lower than the peak levels of 18–19 times in 2021 and even farther from the 2018 levels. So, while the market may experience short-term overheating, it is not yet in a bubble state like the previous two major waves.

However, the LPBS Investment Advisory Director believes the market needs breathing room. Intense sessions of gains and losses may become more frequent in the coming period. Depending on variables such as exchange rates, interbank interest rates, and the potential upgrade, the market could consolidate sideways, forming a new price baseline if positive news emerges, or it could correct downward to establish a lower price baseline before rallying towards the year-end.

The market is in a phase where timing and position sizing are more critical than stock selection. Investors can maintain a satisfactory growth rate in their portfolios during an uptrend by sticking to familiar stocks instead of constantly buying and selling. After a strong rally, most investors have made profits, so new investments require careful consideration.

For those who have “missed the boat,” joining at this stage and giving in to FOMO (fear of missing out) could increase the risk of losses. The probability of winning or losing with new investments has significantly decreased compared to a few weeks ago.

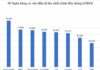

Predicting the market for August, Mr. Truong Hien Phuong anticipated volatile sessions but an early accumulation and continued rise, expecting the market to fluctuate within the range of 1,500 – 1,650 points.

In this context, potential sectors include securities, banking, residential real estate, steel, industrial real estate, and public investment. Additionally, the energy and fertilizer sectors will attract attention due to their profit potential. Mr. Truong Hien Phuong emphasized that stocks with strong brands, good profit margins, feasible projects, and long-term development potential will attract capital flows.

Regarding portfolio allocation, it is advisable to increase stock positions during market corrections. From now until the potential upgrade in September, the market will likely remain in an uptrend, so it is essential to take advantage of this period. Investors can take profits when the market rises sharply but should consider repurchasing when it corrects to reasonable price levels.

– 10:00 04/08/2025

Gold Slides After Powell Says No Rush to Cut Rates

The Fed’s meeting spurred a rise in Treasury yields and the dollar, exerting downward pressure on precious metals.

Do Bonuses for the Vietnamese National Football Team Have to Pay Personal Income Tax?

At a press conference held by the Ministry of Finance on January 7, Deputy Director of the General Department of Taxation, Mai Son, announced that the monetary bonuses and commemorative medals awarded to the Vietnamese football players following their victory in the 2024 ASEAN Cup will be exempt from personal income tax.

China’s Trade Dependence on the US Plunges to a New Low

“This development comes as Beijing braces for the possibility of tariffs being imposed by U.S. President-elect Donald Trump when he assumes office on January 20th. With Trump’s return to the White House, there is anticipation and concern over potential new trade policies that could significantly impact China’s economy.”

What Do We Learn from the Record State Budget Collection?

This year, for the first time, the budget revenue reached an impressive figure of over 1.7 quadrillion VND, surpassing the 2023 figure by 13.7%. Despite this remarkable achievement, there are still underlying issues with the budget revenue, including an outdated personal income tax policy that poses the risk of tax losses.

Trump’s Tough Talk Leaves EU in a Bind: “Buy More American Energy or Face Higher Tariffs”

Former US President Donald Trump has threatened to impose tariffs on the European Union if its member states do not increase their purchases of American oil and natural gas. In a characteristic display of his aggressive trade policy approach, Trump is demanding that the EU boost its imports of US energy resources or face economic consequences. This bold ultimatum underscores Trump’s unwavering commitment to protecting and promoting American economic interests on the global stage.