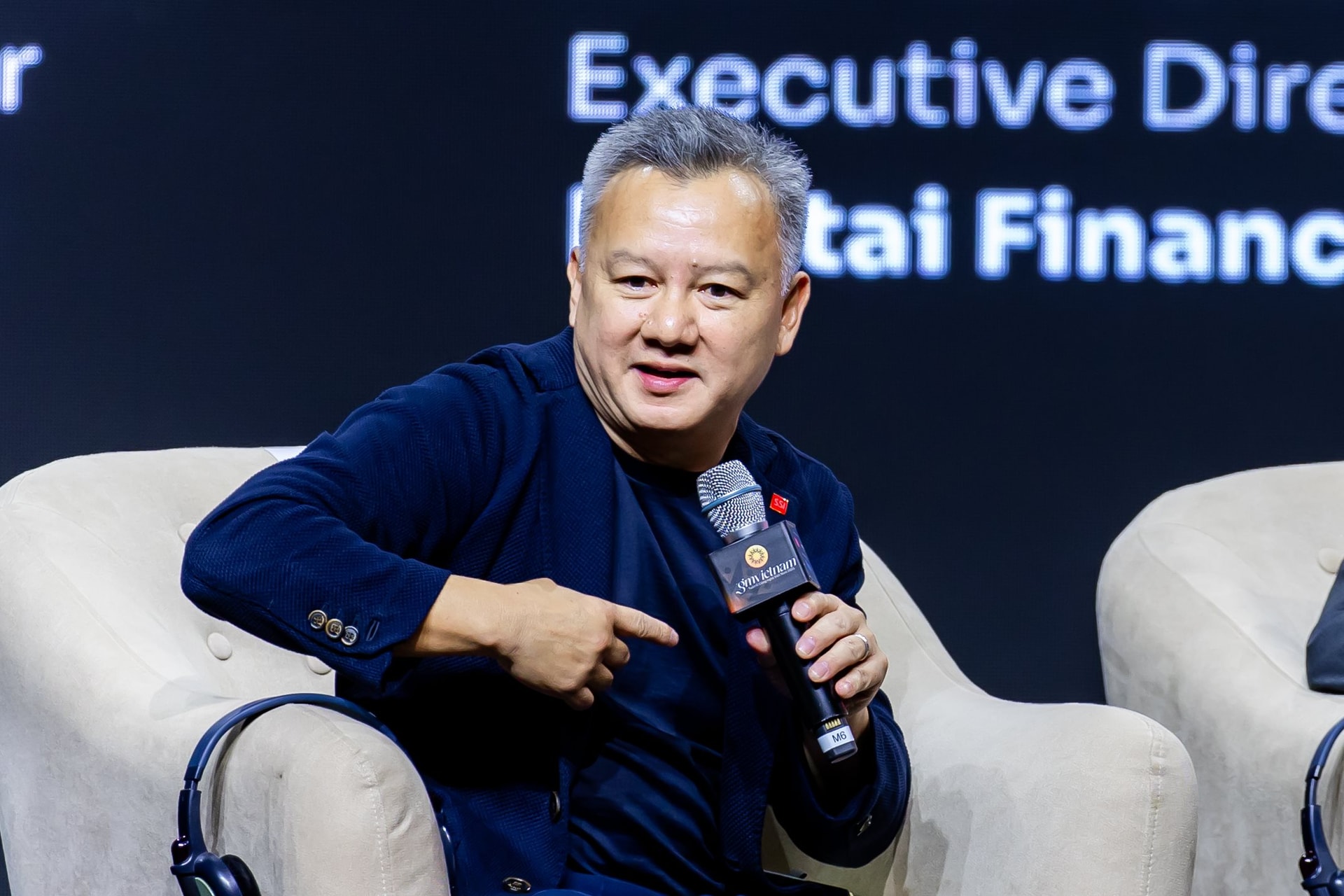

Mr. Thomas Nguyen, Director of Foreign Markets at SSI Securities Corporation

“ Digital assets have become a favored investment avenue for many Vietnamese ”

On the sidelines of the Vietnam GM 2025, Mr. Thomas Nguyen, Director of Foreign Markets at SSI Securities Corporation, shared his insights on the blockchain ecosystem in Vietnam, the prospects of the digital asset market, and the evolving legal framework for crypto assets.

Evaluating the blockchain ecosystem in Vietnam, Mr. Nguyen believes that everything is still in a transitional phase. Vietnam has rapidly embraced blockchain technology, attracting the attention of numerous investors and organizations. However, most of the current influential participants are from foreign countries. Therefore, Mr. Nguyen emphasizes the need for Vietnam to develop its own indigenous infrastructure.

The biggest challenge lies in venture capital investment. With his experience in the US and other markets, Mr. Nguyen states: “It can be said that Vietnam has not even started building its own blockchain infrastructure. Even our traditional stock market is relatively new. This is not a criticism but simply an observation: we are a young country, and blockchain is also a young industry.”

Additionally, a crucial factor is the legal framework. It is challenging to develop an ecosystem without a clear understanding of what is permitted and what is not. “I believe the Vietnamese government is taking an important first step by establishing a transparent legal framework. With this framework in place, capital flows, human resources, and innovative ideas can emerge and thrive,” says the SSI director.

Recently, the National Assembly passed the Law on Digital Industry, which includes provisions for digital assets and technology-related laws to support this field. Answering the question of how many years it will take for digital assets to become the most favored investment channel for Vietnamese people, Mr. Nguyen affirms that, in a sense, this has already become a reality.

“Digital assets have already become a favored investment choice for many Vietnamese. A large portion of the population has proactively chosen crypto as their preferred investment avenue. The question now is whether the government will seize this opportunity to recognize and accompany the market. I make this assertion because the scale of crypto transactions in Vietnam is currently estimated to be three to four times that of the traditional stock market. This indicates that digital assets are already favored over stocks. Hence, instead of asking ‘how many years,’ my answer is: this trend is already here, right now,” says Mr. Nguyen.

With the implementation of the legal framework and the participation of large financial institutions, the market will become more regulated

According to Mr. Nguyen, who hails from the traditional finance industry, crypto has several advantages in Vietnam. The country has made a leapfrog advancement in this field.

GM Vietnam 2025, the largest blockchain event in Asia, organized by SSI Digital and Kyros Ventures, attracted 20,000 attendees over two days, August 1-2.

“This does not diminish the role of the traditional financial market. I still work within and support the development of this market. But I believe that if properly directed, the crypto market is not only the number one choice but will also continue to maintain this position. The growth trajectory of this field is currently very strong,” emphasizes the SSI expert.

Unlike the stock market, which operates five days a week from 9 am to 3 pm, the digital asset market trades 24/7. Some concerns revolve around the risk of a market crash or significant fluctuations even while we “sleep.” This raises the issue of risk management and portfolio allocation.

Mr. Nguyen, with his decades of experience in traditional finance, believes that as any market develops and matures, it will gradually exhibit similar characteristics. Therefore, the notion that the crypto market will remain perpetually “chaotic” is inaccurate.

“As soon as the legal framework is implemented and large financial institutions become involved, the market will become more regulated, and excessive volatility will diminish. My prediction is that risk management in the future will be more tightly controlled due to two factors: first, legal regulations, and second, the participation of large organizations.

If we look at the crypto market in Vietnam today, almost 100% of the transactions are from individual investors, and large organizations like Dragon Capital, VinaCapital, or SSI are not yet actively involved in asset management. When this changes, the market will become more mature and better controlled.

In other words, while I don’t have a specific risk management model for a 24/7 market, based on my experience from other markets, I believe that once regulatory bodies and financial institutions become involved, the market will experience less volatility, and risks will be managed more systematically and effectively,” states Mr. Nguyen.

Mr. Nguyen shared his approach to allocating assets to crypto, revealing that he personally holds 0.65% of his assets in Bitcoin, not through direct electronic wallet transactions but via a Bitcoin ETF managed by BlackRock. This is a testament to the gradual integration of digital assets into the traditional financial system.

The SSI director is excited about Vietnam’s efforts to establish a legal framework for crypto. “Consider this: the regulators could have chosen to ‘shut down’ the market, like China, but Vietnam decided to recognize and accompany the market, fostering the development of crypto. I don’t believe there will be two separate systems operating independently. Over time, they will converge, even if this process takes longer than expected. Today, I can invest in a traditional ETF from BlackRock and indirectly own a portion of the crypto market, which is considered a ‘hot’ field. This is a glimpse of the future integration of the two financial worlds,” says Mr. Nguyen.

According to statistics, the market capitalization of digital assets has reached $4 trillion, and Mr. Nguyen believes that this figure is still lower than the capitalization of corporations like NVIDIA or Apple.

“In my view, this market is still a ‘child.’ Yes, it’s bigger than it was yesterday, but it’s still in its infancy,” says Mr. Nguyen, adding that most of his assets are in real estate, a large portion in stocks, some in bonds, a bit in gold, and only about 0.65% in crypto.

“I share this not only to surprise the audience but also to emphasize that this allocation is quite normal. If you look at the data, crypto currently accounts for less than 1% of global assets. This indicates that despite its rapid growth and media attention, the digital asset market is still in its early stages and needs more time to mature and solidify its position alongside traditional investment channels,” concludes Mr. Nguyen.

“Front-Running the Upgrade ‘Wave’: Foreign Investors Buy Over 8 Trillion VND in July”

The VN-Index witnessed a remarkable journey in July, reaching an unprecedented closing high of 1,557.42 points. This achievement can be largely attributed to the significant net foreign buying of over VND 8.1 trillion, with 14 net buying sessions during the month. As a result, the net selling scale from the beginning of the year was narrowed to nearly VND 29.4 trillion.

The Green Industrial Revolution: Businesses Can’t Go It Alone.

The green transition in industrial production requires an accompanying ecosystem of aligned policies, green financing, suitable technology, and collaboration between stakeholders.

The Two $3 Billion Coastal Metropolis Projects: What Makes Them So Special?

Introducing our two visionary projects: the Tu Bong New Coastal City and the Dam Mon New Coastal City. With a sprawling 620-hectare and 82-hectare reclamation respectively, these transformative developments are set to redefine the urban landscape and unlock the vast potential of Vietnam’s stunning coastline.