Vietnam National Gas Corporation (PV GAS), stock code: GAS, will finalize its list of shareholders on August 29, 2025, for the purpose of paying dividends for the year 2024 and issuing bonus shares from the capital increase using retained earnings. The ex-dividend date is August 28, and the expected dividend payment date is November 25, 2025.

PV GAS has announced a cash dividend payout of 21%, meaning that shareholders will receive VND 2,100 per share. With over 2.34 billion shares in circulation, the company will distribute nearly VND 4,920 billion in dividends.

In addition to the dividend payout, PV GAS will issue bonus shares at a ratio of 3%, meaning that for every 100 shares owned, shareholders will receive 3 new shares. The issuance is expected to comprise nearly 70.3 million shares, funded by the company’s investment development fund as of the end of 2024. Following this issuance, PV GAS’ charter capital is expected to increase to nearly VND 24,130 billion.

PV GAS is known for its consistent cash dividend policy since 2011, with high payout ratios reaching up to several percent each year. In 2023, the company paid a record-high dividend of 60%. Due to its unique shareholder structure, with the Vietnam National Oil and Gas Group (PVN) holding 95.76% of its capital, the majority of the dividend payout will go to the state budget.

Notably, this is the third consecutive year that PV GAS has issued bonus shares to its shareholders. In the previous years, the bonus share ratios were 20% (in 2022) and 2% (in 2023).

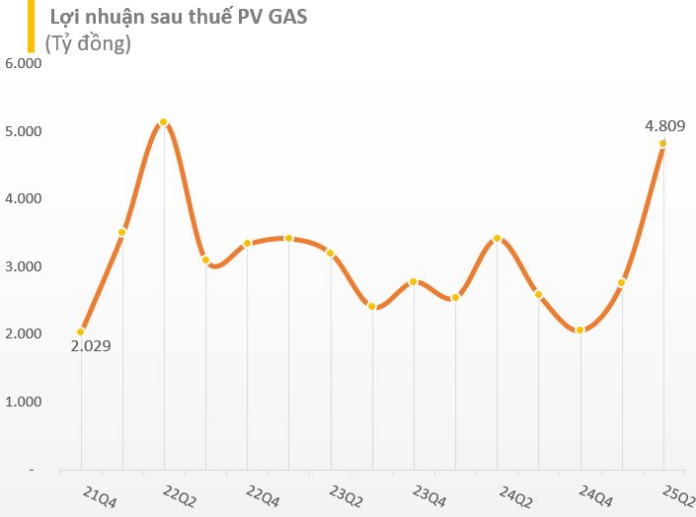

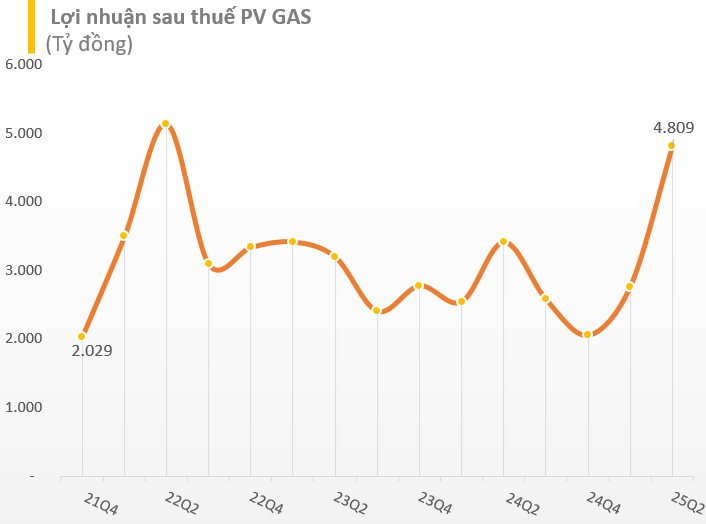

Regarding the company’s performance in Q2 2025, PV GAS reported consolidated net revenue of VND 30,080 billion, almost unchanged from the same period in 2024. A 3.3% increase in cost of goods sold led to a 13.7% decrease in gross profit, which stood at nearly VND 4,954 billion compared to VND 5,736 billion in the previous year. Consequently, the gross profit margin decreased from 19.09% to 16.47%.

After deducting expenses, PV GAS’ net profit reached VND 4,809 billion, a nearly 41% increase compared to the same period last year, and the highest in the last 12 quarters. The net profit attributable to the parent company was VND 4,748 billion, a significant 43% increase year-on-year.

According to the company’s explanation, the main reason for the profit increase in Q2 was the reversal of allowance for doubtful accounts of VND 1,814 billion, while other activities remained stable.

For the first half of 2025, GAS recorded consolidated net revenue of VND 55,756 billion, a 4% increase compared to the same period in 2024, completing 75.4% of the year’s plan of VND 74,000 billion. Consolidated net profit reached VND 7,571 billion, a 27% increase, thereby completing 142.9% of the year’s plan of VND 5,300 billion.

As of June 30, 2025, PV GAS’ consolidated total assets reached VND 88,634 billion, an 8.3% increase from the beginning of the year. In terms of asset structure, cash and cash equivalents, and bank deposits accounted for VND 41,108 billion, or 46.5% of total assets.

Additionally, the company’s construction in progress increased by 25.4% compared to the beginning of the period, amounting to VND 2,155 billion. The largest contributor to this was the B-O Mon pipeline project, which accounted for VND 1,656 billion, a 60% increase from the beginning of the year.

On the liabilities side, as of June 30, 2025, the company’s consolidated total liabilities were VND 19,861 billion, a 2.1% decrease from the beginning of the year. Short-term debt stood at VND 14,440 billion, while long-term debt was VND 5,421 billion. Shareholders’ equity reached VND 68,773 billion, an 11.6% increase from the beginning of the period. Retained earnings as of the end of Q2 2025 amounted to VND 13,612 billion.

Two Garment Companies Share “Dividend” Gifts at the Beginning of the Year

In the beginning of 2025, Textile Companies 7 and 29/3 allocated over 15 billion VND and nearly 8 billion VND respectively, to pay dividends to their shareholders.