**QCG Reports Strong Financial Results in Q2 2025, Signaling a Turnaround**

The recently released Q2 2025 financial report of Quoc Cuong Gia Lai Joint Stock Company (QCG) revealed impressive figures, with a 395% year-on-year surge in revenue to VND 131 billion.

This remarkable growth was primarily driven by a 47-fold increase in revenue from real estate sales, which jumped from just over VND 2 billion in Q2 2024 to VND 97 billion in Q2 2025. After deducting expenses, QCG’s net profit stood at VND 2.5 billion, a significant improvement compared to the loss of over VND 17 billion in the same period last year.

For the first half of 2025, QCG’s cumulative revenue reached over VND 242.5 billion, nearly 3.7 times higher than the previous year. The company also recorded a profit after tax of more than VND 10.7 billion, a remarkable turnaround from the loss of over VND 16.6 billion in the first half of 2024.

Since mid-2024, Mr. Nguyen Quoc Cuong has taken over as CEO from his mother, Ms. Nguyen Thi Nhu Loan, despite also managing his own corporation, C-Holdings.

QCG’s project in Danang

At the recent shareholder meeting, Mr. Cuong addressed the company’s debt of VND 2,882 billion to Sunny Island Investment Joint Stock Company, which is linked to the case of Ms. Truong My Lan and Van Thinh Phat Group. He assured that QCG will start repaying the debt in Q2 2025 as per the court’s decision and complete it within two years.

As of the end of June, QCG’s total assets amounted to nearly VND 9,500 billion, with inventory valued at VND 1,200 billion. For the Bac Phuoc Kien project, the company recorded production and business costs of VND 5,420 billion.

Mr. Cuong highlighted the company’s diverse portfolio of residential projects, including one in Danang and another on National Highway 13 in Ho Chi Minh City. With its substantial assets, vast land bank, and improving legal framework, QCG is well-positioned to secure bank loans, issue bonds, or attract additional investment. Mr. Cuong expressed confidence that the company’s performance will significantly improve by the end of 2025.

Additionally, QCG plans to change its name later this year.

“Repayments Begin: The Saga of Quốc Cường Gia Lai and Sunny Island”

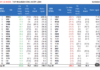

In Q2 2025, Quoc Cuong Gia Lai began refunding Sunny Island to reclaim the Phuoc Kien project. Conversely, QCG borrowed an additional VND 240 billion from two major corporations.

The Billionaire’s Stock Surprise: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Shares Surge to Historic Highs at Year-End

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.