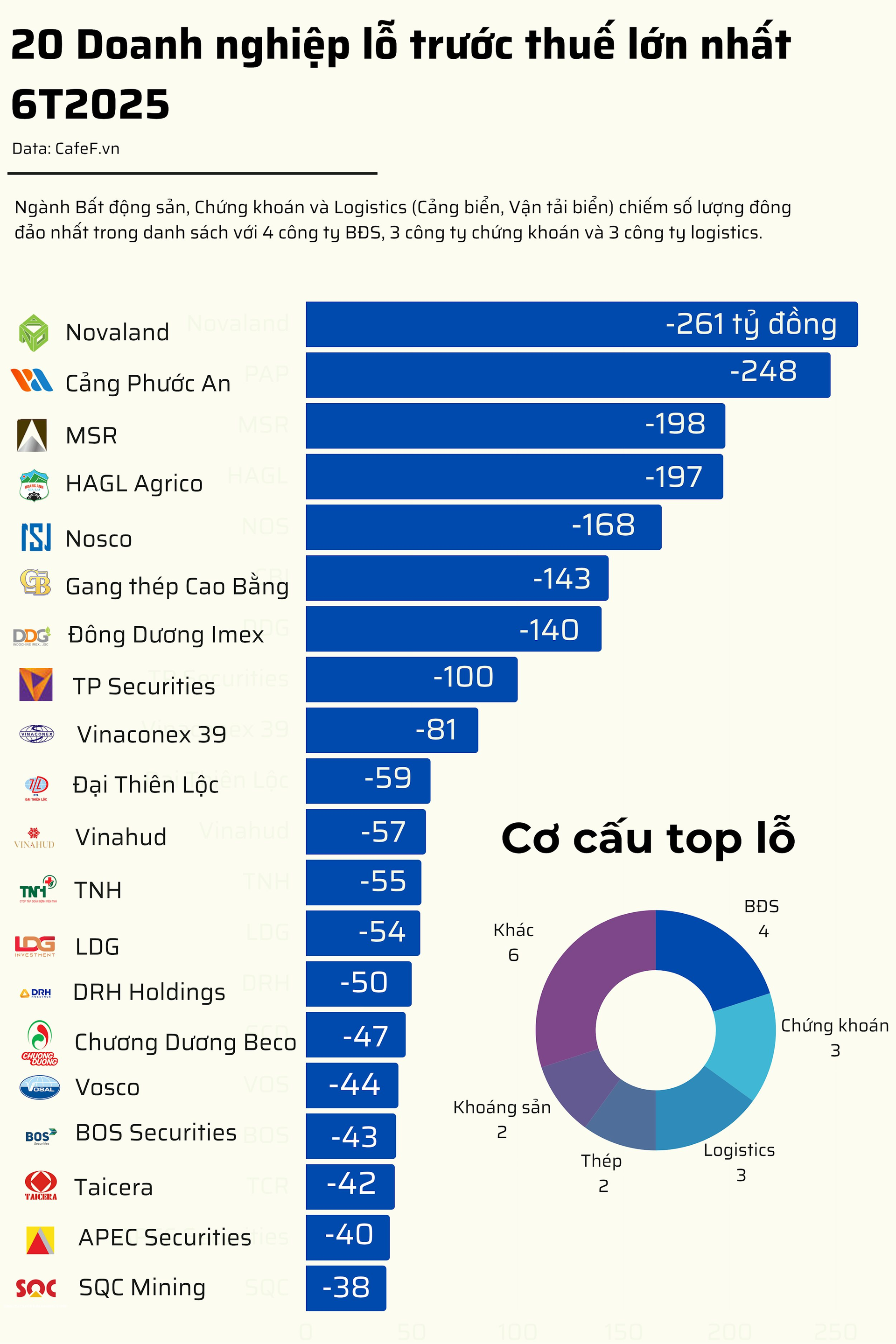

While the business landscape for the first half of 2025 was painted with vibrant hues of profit and growth, many enterprises also faced significant challenges, as evident from their substantial losses.

The ranking of the top 20 companies with the highest losses in the first half of 2025 not only included familiar names but also surprised with some businesses transitioning from profits to losses.

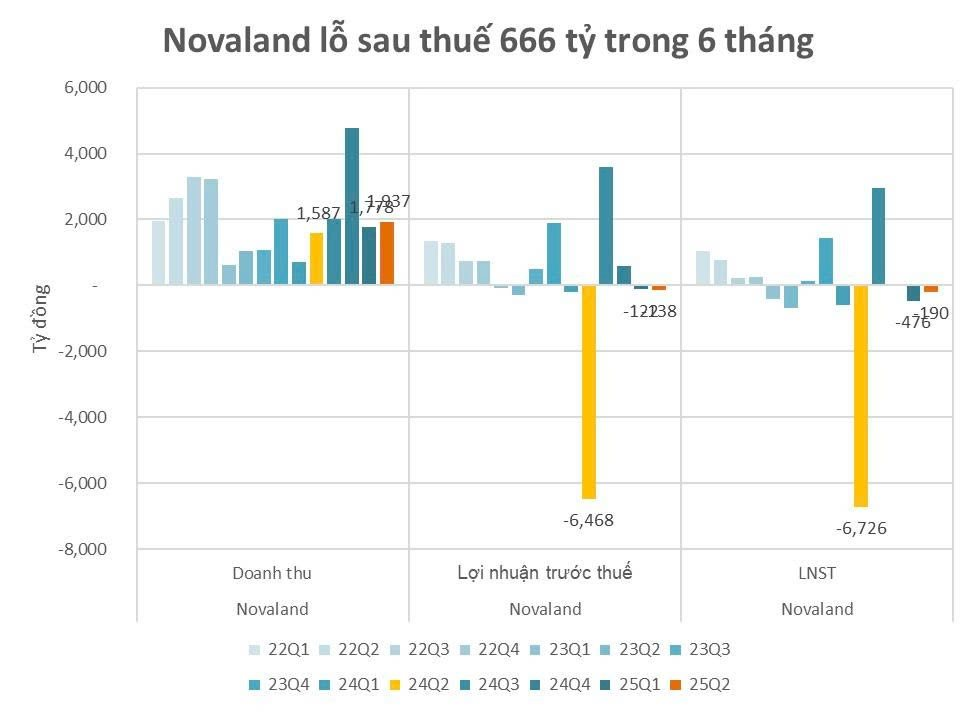

Leading the list was Novaland Group, with a pre-tax loss of 261 billion VND. However, compared to the same period last year, the loss showed significant improvement, as it stood at 6,682 billion VND in the first half of 2024.

The consolidated after-tax profit revealed a loss of 666 billion VND, mainly due to foreign exchange rate differences and other operating losses. Still, it showed improvement compared to the loss of 7,327 billion VND in the previous year.

Novaland wasn’t alone in this journey, as three other real estate enterprises in the top 20 loss-making companies showed improvements compared to the previous year. Specifically, Vinahud’s loss decreased from 107 billion VND to 57 billion VND, LDG’s loss improved from 401 billion VND to 54 billion VND, and DRH Holdings reduced its loss from 90 billion VND to 50 billion VND.

Following closely in second place was Phuoc An Port, with a loss of 248 billion VND. In late 2024, the state management agency granted a certificate of eligibility for the port operation of Wharf No. 5 and 6 at Phuoc An Port. The company officially put Phase 1 of the project into operation.

While this expansion opened up revenue-generating opportunities for Phuoc An Port, it also led to the accounting of two fixed expenses: interest expenses on loans for Phase 1 funding and depreciation expenses for the now-operational Phase 1.

Other businesses with losses exceeding 100 billion VND in the first half of 2025 included Masan High-Tech Materials (MSR) with a loss of 198 billion VND, HAGL Agrico (HNG) at 197 billion VND, Nosco (NOS) at 168 billion VND, Cao Bang Steel (CBI) at 143 billion VND, Dong Duong Imex (DDG) at 140 billion VND, and Tien Phong Securities (ORS) at 100 billion VND.

While some companies improved their financial standing compared to the previous year, others experienced a reversal of fortune. Dong Duong Imex (DDG), for instance, swung from a profit of 7 billion VND in the first half of 2024 to a loss of 140 billion VND in the same period in 2025. Similarly, Thep Dai Thien Loc (DTL) transitioned from a profit of 10 billion VND to a loss of 59 billion VND, and TP Securities moved from a profit of 219 billion VND to a loss of 100 billion VND. Thai Nguyen Hospital, Vosco, and APEC Securities also followed a similar trajectory.

Analyzing the industry breakdown, the real estate sector contributed the most representatives to the top loss-making list with four companies. The logistics sector (including marine transport and ports) had three entries: Phuoc An Port (PAP), Nosco (NOS), and Vosco (VOS). The securities industry also had a strong showing with three representatives: TP Securities, BOS Securities, and APEC Securities.

The steel industry and the mineral industry each had two enterprises in the top 20, while other industries contributed one company each.