In mid-July, Mr. Vo Van Minh, Vice Secretary of the City Party Committee and Chairman of the Ho Chi Minh City People’s Council, worked with the leaders of SCG Group (Thailand) and Long Son Petrochemical Co., Ltd. (LSP) – the investor of the Long Son Petrochemical Complex project in Long Son commune.

At the meeting, Mr. Kulachet Dharachandra, SCG’s Country Director in Vietnam and General Director of LSP, announced that the LSP complex is expected to restart in August.

Closely following this development, SCG of Thailand provided an update on the LSP complex in its report on operations in the first half of this year. SCG stated that the LSP complex is likely to restart in late August or early September, with personnel ready to operate the complex.

SCG also mentioned that one advantage of “reviving” the LSP complex at this time is to benefit from the new import tax rates for polypropylene (PP) and polyethylene (PE) into Vietnam.

Specifically, according to Decree 199/2025, which took effect on July 8, the import tax rate for HDPE and LLDPE, the main output products of the LSP complex, will be adjusted to 2%. This is an increase from the previous rate of 0%, but it is still lower than the 10% rate previously proposed by SCG. These products are fundamental to various industries, including packaging, agriculture, electrical equipment, automotive parts, and more.

According to SCG, the tax increase aims to protect Vietnam’s nascent petrochemical industry and ensure long-term sustainability by reducing reliance on foreign suppliers.

How significant is SCG’s business in the Vietnamese market?

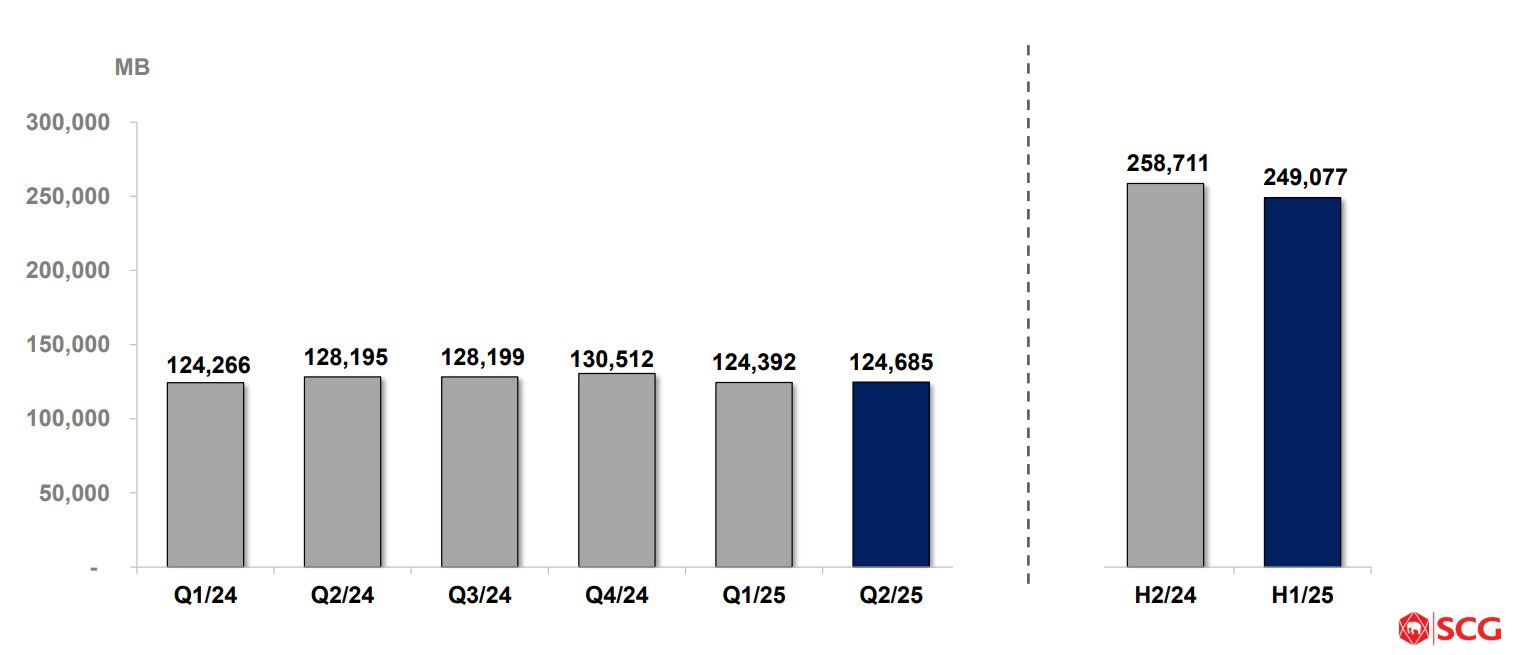

In its half-year report, SCG reported a revenue of 249.1 billion baht, a % increase compared to the same period last year. This figure includes 124.7 billion baht in Q2/2025, a 3% decrease.

SCG’s global revenue (in million baht)

Thailand, SCG’s home market, contributed the most to its revenue, with 136.7 billion baht, accounting for 55% of the total. Vietnam ranked second with a 9% contribution, equivalent to approximately 22.4 billion baht (over 18 trillion VND). Other significant markets include Indonesia with 7%, China with 4%, and Cambodia with 3%.

The Long Son Petrochemical Complex has a designed capacity of 1.4 million tons of plastic pellets annually, along with various other plastic products. At maximum capacity, the complex is expected to generate $1.5 billion in revenue per year and contribute approximately $150 million to the state budget. However, the complex, which commenced operations on September 30, 2024, had to halt operations after just 15 days. LSP stated that they would resume the refinery project when profit margins improve.

Facing challenges and determined to turn things around, SCG announced in February 2025 that they would invest an additional $500 million to retrofit the plant to use ethane as a new feedstock, either simultaneously or as a replacement for naphtha and propane. The project is expected to be completed in 2.5 years, by the end of 2027.

The Ultimate Road Revolution: Achieving 3,000 km of Highways by 2025

Prime Minister Pham Minh Chinh has urged ministries, sectors, and localities to accelerate, break through, and be more daring in their efforts to complete the construction of 3,000 kilometers of expressways by the end of this year.

Dot Property Awards 2025: Celebrating Vietnam’s Real Estate Trailblazers

On July 31st, the Dot Property Vietnam Awards 2025 announcement ceremony took place at the prestigious The Reverie Saigon hotel. The event attracted over 200 guests, including prominent figures from the real estate industry, sector experts, award council advisors, and representatives from various media outlets.

Capital Square: Inspired by the Iconic Bridge that Transformed Danang

“Capital Square, a prestigious riverside development on the iconic Han River, is an inspiring vision for the future. Drawing its essence from the vibrant, thriving metropolis of Danang, widely regarded as one of Vietnam’s most desirable cities, this exclusive complex offers a sophisticated lifestyle and a truly elevated standard of living.”

“Van Phu Reports 56% Profit Growth in First Half of 2025”

With a boost from positive macroeconomic factors, the real estate market’s recovery has significantly impacted Van Phu – Invest Development Joint Stock Company (HOSE: VPI). The company has reported impressive financial results for the first half of 2025, with a 56% year-over-year increase in after-tax profit, totaling VND 148.8 billion.

The Ultimate Escape: Discover the Exclusive Resort Community in Danang by DatVietVAC, Now Offering 18 Luxury Villas for Sale

The luxury real estate project, The Nam Khang Resort Residences, from media and entertainment mogul DatVietVAC Dinh Ba Thanh, has taken a significant step forward with the recent announcement from the Da Nang City Construction Department. Eighteen villas within the resort have been deemed eligible for sale and lease-purchase as future constructions.