With the strong determination for innovation from the leaders of the Party and State, along with the close attention and direction of the Government, the Ministry of Finance, and the support of ministries, sectors, and localities in 2025, the macro-economy and the business investment and operating environment will have many conditions to break through. Positive factors of the macro-economy will create momentum for the Vietnamese stock market to continue to maintain stability and good liquidity in 2025.

On the occasion of the New Year, Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, had an interview with the press about the orientations and solutions for developing the Vietnamese stock market in 2025.

Ma’am, in 2025, many assessments suggest that the world and Vietnamese economies will continue their positive recovery trend. However, challenges remain unpredictable. According to the State Securities Commission’s assessment, what factors may affect the Vietnamese stock market’s performance this year?

Despite many fluctuations due to various impacts from the global economic, trade, and geopolitical situation, the Vietnamese stock market in 2024 remained basically stable, safe, and developing. It continued to affirm its role as an important medium and long-term capital channel for the economy and businesses. The market maintained stability and good liquidity, with strengthened discipline and increased transparency and sustainability.

Along with the market, under the close direction of the Ministry of Finance, 2024 also marked many impressive achievements in managing, operating, and supervising the stock market. Notably, the legal framework was improved with the issuance of the amended Securities Law. Previously, Circular 68/2024/TT-BTC removed a critical bottleneck for the market upgrade process…

However, these positive results were not only due to the efforts of the securities sector but also the fruit of the entire industry’s accumulation over the years, along with the participation of the entire political system, which created an important foundation for the development of the stock market in recent years. It is expected that these achievements will continue to motivate the Vietnamese stock market to develop more robustly, qualitatively, and sustainably in the New Year of 2025 and the following years.

We must agree that the stock market always depends on many factors, both subjective and objective. The stock market’s performance reflects the sum of macro factors at home and abroad, the health of businesses, and investors’ faith and expectations. Therefore, the stock market performance this year and in the future will largely depend on macroeconomic policies and domestic and global economic prospects.

In its World Economic Outlook report for 2025, the International Monetary Fund (IMF) forecasts global economic growth to reach 3.2%, equivalent to the 2024 level. Meanwhile, the Organization for Economic Cooperation and Development (OECD) predicts that the global economy will remain resilient in 2025 and 2026, with the same GDP growth rate of 3.3%. However, the IMF also warns of many unstable and unpredictable factors for the global economy, including potential trade conflicts, geopolitical tensions, an overly strong US dollar, and the weakening of some economies.

The State Securities Commission also assesses that the world’s favorable conditions and challenges will continue to have multifaceted impacts on Vietnam’s macro-economy and stock market.

Domestically, with the Government’s solutions and the strong participation of ministries, sectors, and localities, Vietnam has many opportunities to achieve the GDP growth target set by the Government. Along with that, with the Government’s reform and innovation solutions, the investment, production, and business environment will continue to improve, positively supporting businesses’ development in the coming year. In addition, some internal factors related to investors’ psychological expectations, such as more positive foreign capital flows and prospects for market upgrades, can also be mentioned.

Therefore, looking at the overall picture, the domestic stock market in 2025 is expected to be brighter, thanks to the expectations of breakthroughs from Vietnam’s internal strengths.

With the close attention and direction of the Government, the Ministry of Finance, and the support of ministries, sectors, and localities, the positive factors mentioned above are expected to continue to create a foundation for the Vietnamese stock market to maintain stability, good liquidity, and growth in both scale and quality.

As you shared, the market upgrade is a highlight of the past year, and there will be more positive signals in 2025. What is your assessment of the solutions to upgrade the stock market that the management agency has implemented?

Upgrading the stock market from a frontier to an emerging market is a significant and correct policy of the Government, which has received the close attention and direction of the Prime Minister in the past time. 2025 is the target year for the Vietnamese stock market to be upgraded from a frontier to an emerging market according to the Strategy for Developing the Securities Market by 2030, approved by the Prime Minister.

Upgrading the stock market from a frontier to an emerging market will not only bring many opportunities for the Vietnamese stock market and market participants but also contribute to enhancing the country’s investment environment and promoting economic development. International financial institutions, experts, and market members believe that when upgraded, the Vietnamese stock market will attract a substantial amount of capital, boosting market scale and liquidity growth. Therefore, this is a significant determination and a task that the State Securities Commission has been actively implementing under the close direction of the Ministry of Finance’s leaders.

As we know, Circular 68/2024/TT-BTC has been officially issued, marking an important step forward and removing legal obstacles to meet the FTSE Russell’s market upgrade criteria. Through practical records, the implementation of the non-prefunding transaction business for foreign institutional investors has been smooth, meeting investors’ trading needs and ensuring safety and smoothness from market members and related parties. In addition, the amended Securities Law has been promulgated, including supplementary provisions to meet the standards for upgrading the stock market.

Besides, the Ministry of Finance and the State Securities Commission continue to work with related ministries and sectors, such as the State Bank and the Ministry of Planning and Investment, to coordinate and propose solutions to meet the market upgrade criteria. Ministries and sectors are also actively implementing solutions to create more favorable conditions for foreign investors’ activities in the Vietnamese market, such as amending legal regulations related to indirect investment capital account opening procedures to reduce procedures and shorten the time for opening accounts, updating and publishing the State’s maximum ownership ratio in conditional business lines, and restricting access for foreign investors.

In addition, the State Securities Commission has been actively working regularly with international rating organizations, large international investors, and propagating the Government’s directions and determination in upgrading the market. We also coordinate with foreign institutional investors to answer their questions and address their difficulties when investing in Vietnam and garner their support for Vietnam’s stock market upgrade goal.

Upgrading the stock market depends on the objective assessment of international rating organizations through the practical experience of foreign investors. However, through records from international and domestic organizations, Vietnam has many opportunities for FTSE Russell to upgrade as planned. The management agency is still making its best efforts to implement the next tasks to remove bottlenecks, such as deploying the central counterparty (CCP) mechanism, coordinating to propose easing restrictions on foreign ownership, and implementing information disclosure in English to meet MSCI’s upgrade criteria.

In the context of many drastic policies to bring the country into a new era, what solutions will the securities sector have to develop the stock market more robustly in both “quality” and “quantity,” Madam Chairwoman?

2025 is a significant year with many important milestones, marking the end of the 2021-2025 social-economic development plan, the 80th anniversary of the establishment of the country, the 50th anniversary of the reunification of the country, and important events for the finance sector and the financial market, including the 80th anniversary of the finance sector and the 25th anniversary of the operation of the stock market.

Assigning tasks to the securities sector, Minister of Finance Nguyen Van Thang emphasized that the securities sector must continuously strive, including all market members, from reforming the infrastructure and improving service quality to attracting international investors and medium and long-term capital for the state budget, businesses, and the economy. At the same time, it is necessary to create a transparent, safe, and attractive investment environment so that the Vietnamese stock market becomes a reliable destination for domestic and foreign investors.

To meet the Minister’s expectations, the securities sector will continue to synchronously implement solutions to ensure the sustainable development of the Vietnamese stock market, affirming its role as an important medium and long-term capital channel for the economy and contributing effectively to the country’s economic growth. The focus will be on the following groups of solutions.

First, continue to improve the legal framework and policies for developing the stock market, focusing on completing guiding documents for the implementation of the amended Securities Law, once approved by the National Assembly, to protect the legitimate rights and interests of investors and create a driving force for the sustainable development of the Vietnamese stock market. Continue to implement solutions to meet the criteria and achieve the goal of market upgrade.

Second, continue to implement synchronous solutions for market arrangement and expansion, restructuring commodities, restructuring securities businesses in the market, restructuring the investor base, and restructuring the market organization to further expand opportunities for businesses to raise capital.

Third, regarding the investor base, the focus will be on developing institutional investors through expanding the scale and diversifying fund types in the stock market. In addition, continue to synchronously implement solutions to strive for an early upgrade of the stock market from a frontier to an emerging market to attract better attention and investment participation from foreign organizations.

Fourth, strengthen the capacity for management, supervision, inspection, and handling of violations in the securities and stock market. Tighten market discipline, strictly handle violations to ensure a transparent and sustainable stock market development. Continue to invest in and upgrade modern information technology systems to ensure information technology system security and safety and the database serving management and market supervision, ensuring the safe operation of the market and protecting the legitimate rights and interests of investors.

Fifth, actively integrate into the global financial and securities market, meeting financial security requirements, enhancing competitiveness and risk management, and applying international standards and practices. Continue to improve corporate governance and risk management of listed companies and public companies according to international practices.

Sixth, promote information dissemination, training, and education to improve financial and securities knowledge for investors, forming a group of investors with a basic knowledge foundation and professional trading skills and increasing the number of institutional investors participating in the market.

Under the leadership and direction of the Party, the Government, and the Ministry of Finance; the efforts, determination, and unity of the leadership and officials, civil servants, and employees of the entire securities sector; and the support and joint efforts of market members, businesses, and domestic and international investors, with the important solutions mentioned above, the Vietnamese stock market will seize opportunities to achieve a breakthrough development in both quality and scale, elevating its position and confidently entering the new era of the nation.

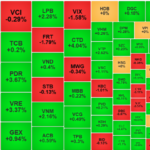

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% compared to their reference prices. Notably, only six of these were from the VN30 basket, with the majority being small- and mid-cap stocks. Among these, several high-liquidity stocks stood out, leading the market’s gains.

The Stock Market: Capital Flows Unbound

The external factor has significantly faded, and the domestic market today witnessed a robust recovery with surging liquidity, despite FPT’s trading decrease. The breadth of stocks, index gains, and liquidity all aligned, indicating a consensus and a positive shift in market sentiment.

Gilimex Expands its Empire: Unveils its Third Industrial Park

Vice Prime Minister Tran Hong Ha signed Decision 201/QD-TTg on the policy for the investment project to construct and operate the infrastructure of Nghia Hung Industrial Zone in the northern province of Bac Giang.