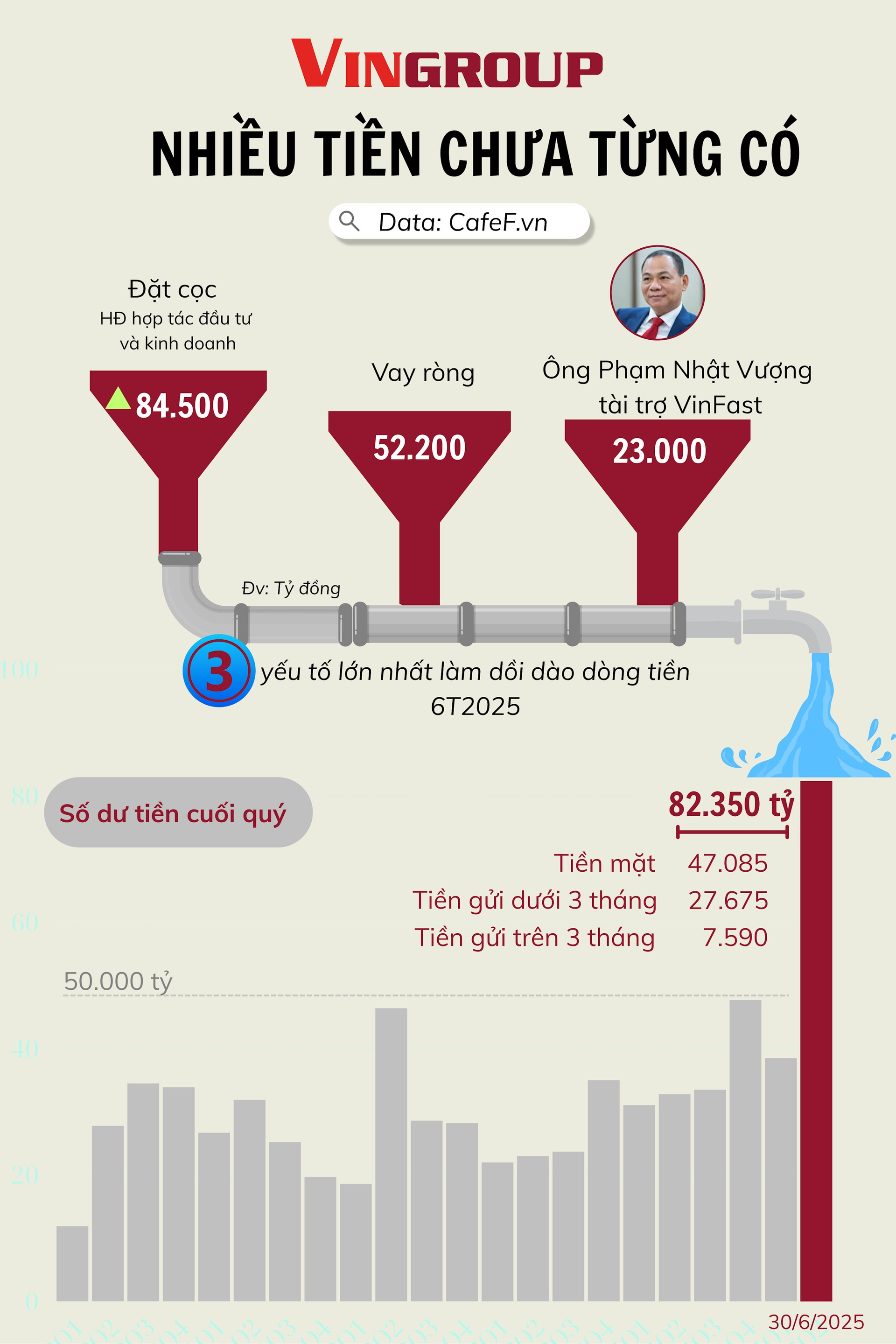

Vingroup’s Financial Report Shows Record-High Cash Balance

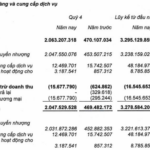

Vingroup’s consolidated financial report for Q2 2025 revealed an all-time high cash balance. Specifically, cash and cash equivalents (short-term deposits under 3 months) amounted to VND 74,760 billion, while long-term deposits (recorded under the category of ‘Held-to- Maturity Investments’) stood at VND 7,590 billion.

Combined, Vingroup held a staggering VND 82,350 billion in liquid assets as of June 30, 2025, marking an increase of nearly VND 34,700 billion compared to the beginning of the year.

This cash balance represents 8.5% of the company’s total assets, slightly lower than the peak of 8.8% recorded in Q2 2022. However, Vingroup’s total assets have significantly grown over the past three years, reaching over VND 964,000 billion at the end of Q2 2025, approaching the VND 1,000,000 billion mark.

Vingroup’s total assets have consistently increased since its listing, and with this momentum, the conglomerate chaired by billionaire Pham Nhat Vuong is poised to become the second non-financial enterprise in Vietnam to surpass the VND 1,000,000 billion asset threshold, following the Vietnam National Oil and Gas Group (Petrovietnam, PVN).

Unraveling Vingroup’s Robust Cash Flow:

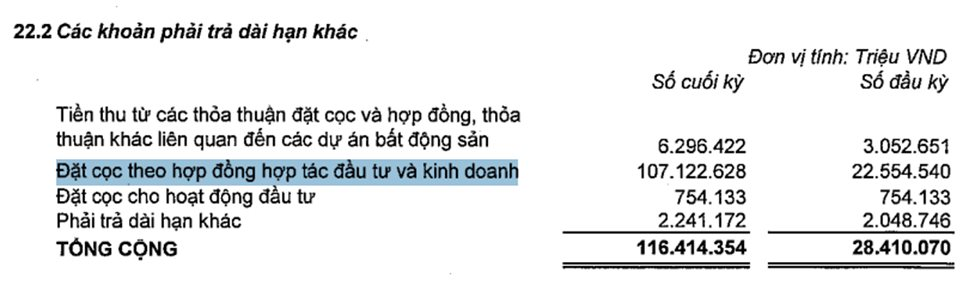

First, long-term payables witnessed a significant surge, primarily driven by an increase in deposits related to Business Cooperation Contracts (BCC) – soaring by VND 84,568 billion from VND 22,554 billion to VND 107,122 billion. BCCs are typically signed between Vingroup and its subsidiaries, Vinhomes and Vincom Retail, to transfer the economic benefits of complex real estate projects with intricate paperwork. The profits from BCC activities are recognized as financial income for both Vinhomes and Vingroup. Similarly, profits from bulk sales are booked as financial income.

Secondly, Vingroup’s net borrowing contributed over VND 52,200 billion to its cash flow (with borrowings totaling more than VND 129,700 billion and principal repayments exceeding VND 77,500 billion).

Thirdly, Mr. Pham Nhat Vuong provided a substantial funding of VND 23,000 billion to VinFast, Vingroup’s subsidiary, including VND 5,000 billion in Q1 2025 and an additional VND 18,000 billion in Q2 2025.

Vingroup’s Strategic Investments:

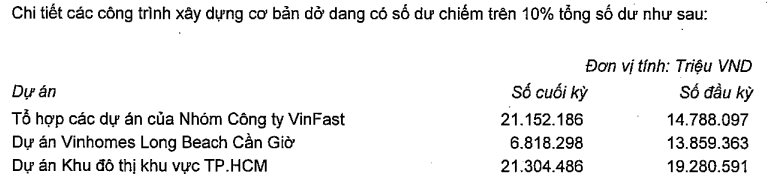

Vingroup’s investment activities accounted for a positive cash flow of over VND 65,800 billion. The largest portion, amounting to nearly VND 42,000 billion, was allocated to the acquisition and construction of fixed assets and long-term investments.

Among Vingroup’s significant investments are the VinFast group of projects, with ongoing construction costs totaling VND 21,152 billion, and the Ho Chi Minh City urban area project, valued at VND 21,304 billion.

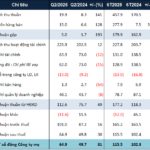

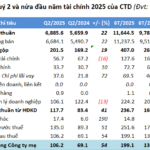

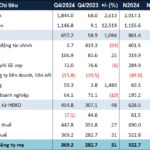

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.