The USD Index (DXY), which measures the greenback’s strength against a basket of six major currencies, surged to 99.97 on July 31, the highest level in two months (since May 29). This was the strongest gain of the week, before DXY turned lower to close the week at 98.69 on August 1, but still over one point higher than the previous week.

The strong US dollar came as the Fed kept its target rate unchanged at 4.25%-4.5%, despite pressure from US President Donald Trump to cut rates. A series of positive economic data also reinforced the Fed’s “higher rates for longer” view.

National employment data from ADP showed that the US private sector added more jobs than expected in July. Additionally, US Q2 2025 GDP grew by 3%, far exceeding the 2.4% forecast in a Reuters poll. These factors boosted confidence that the US economy is strong enough to withstand higher interest rates, supporting the USD.

However, the dollar’s rally paused towards the week’s end as the US Labor Department released data indicating a clear slowdown in the job market: only 73,000 new jobs were added in July, much lower than expected, although higher than June’s 14,000 (revised). This data sparked speculation that the Fed may need to reconsider its stance, especially amid additional tariff-related uncertainties, leading investors to seek other safe-haven assets like gold instead of the USD.

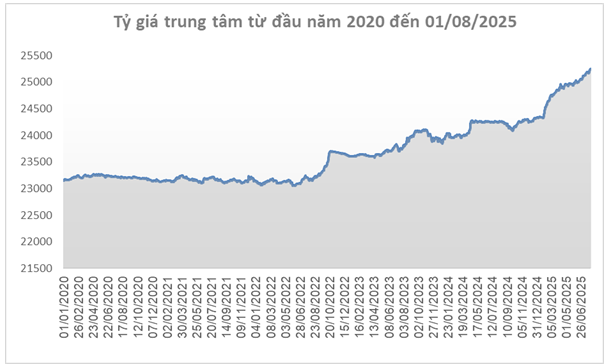

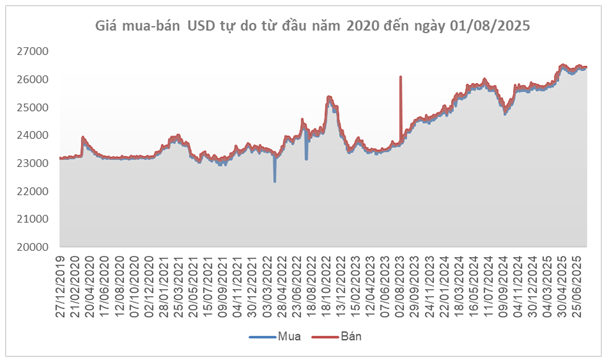

Source: SBV

|

In the domestic market, the central exchange rate set by the State Bank of Vietnam on August 1 was VND 25,249 per USD, up VND 85 from the previous week. With a 5% fluctuation band, USD rates at commercial banks are allowed to trade within a range of VND 23,987 – VND 26,511 per USD.

The USD/VND reference exchange rates at the State Bank of Vietnam’s Foreign Exchange Management Department also increased to VND 24,037 – VND 26,461 (buying – selling), up VND 81 and VND 89, respectively, from the previous week.

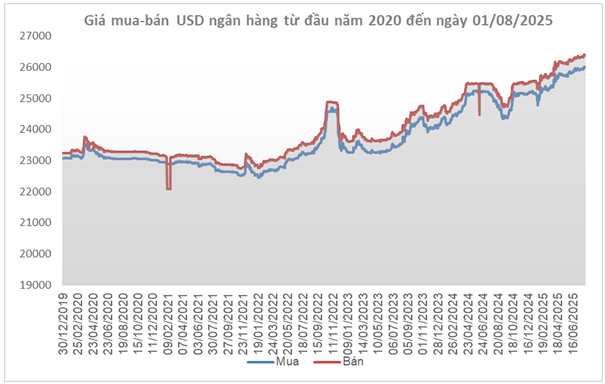

Source: VCB

|

At Vietcombank, the listed exchange rate on August 1 was VND 26,000 – VND 26,390 per USD (buying – selling), up VND 70 in both directions.

Source: VietstockFinance

|

In the free market, the USD rose VND 60 on the buying side but fell VND 10 on the selling side, trading around VND 26,440 – VND 26,450 per USD (buying – selling).

– 5:26 PM, August 3, 2025

Gold Slides After Powell Says No Rush to Cut Rates

The Fed’s meeting spurred a rise in Treasury yields and the dollar, exerting downward pressure on precious metals.

The First Month of 2025: VN-Index Slips, Liquidity Hits 3-Year Low, Foreigners Keep Selling

The first month of the year witnessed a significant 23.4% decline in average trading values, bringing the figure to a meager 11.406 trillion VND. This places the monthly liquidity at a three-year low, a concerning development for the market.