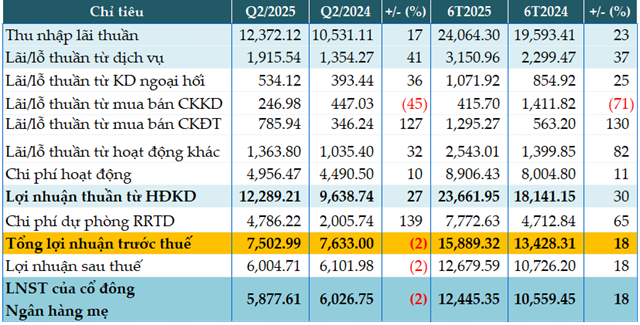

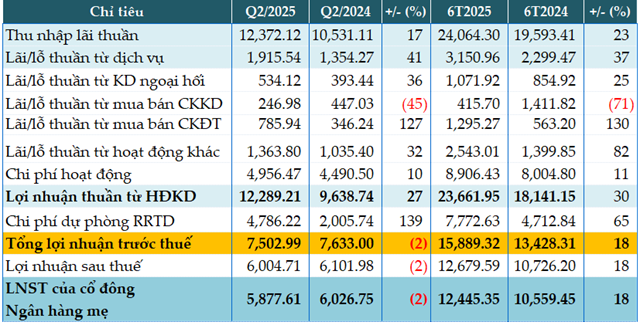

For the first half of 2025, MB’s net interest income reached over VND 24,064 billion, a 23% increase compared to the same period last year.

Service income reached nearly VND 3,151 billion, a significant 37% increase, mainly due to income from trading and insurance services amounting to VND 4,579 billion.

Other non-interest income streams also showed strong growth, including foreign exchange trading income (+25%) and income from trading securities (+130%).

Notably, other income stood at VND 2,543 billion, an impressive 82% increase compared to the previous year, thanks to income from handled debts totaling more than VND 2,018 billion.

Operating expenses increased by 11% to VND 8,906 billion. The cost-to-income ratio (CIR) was at 27.3%, while the consolidated net interest margin (NIM) reached 4.1%.

As a result, the bank’s profit from business operations reached VND 23,661 billion, a 30% increase. During this period, MB set aside VND 7,773 billion for credit risk provisions, a 65% increase, leading to a 18% rise in pre-tax profit to over VND 15,889 billion.

In the second quarter alone, MB recorded a pre-tax profit of VND 7,503 billion, a slight 2% decrease from the previous year, due to a significant 139% increase in credit risk provisions, amounting to VND 4,786 billion.

Compared to the full-year target of VND 31,712 billion in pre-tax profit, MB has achieved 50% of its goal in the first half.

|

MBB’s business results for the second quarter and the first six months of 2025. Unit: Billion VND

Source: VietstockFinance

|

As of the end of the second quarter, the bank’s total assets increased by 14% from the beginning of the year to nearly VND 1.29 quadrillion. Cash increased by 57% (VND 5,262 billion), while deposits at the State Bank decreased by 49% (VND 15,251 billion). Interbank lending and borrowing increased by 25% (VND 96,081 billion), and lending to customers increased by 13% (VND 879,881 billion).

On the funding side, government and SBV debts doubled to VND 20,894 billion. Customer deposits increased by 10% from the beginning of the year to VND 783,291 billion. Notably, current accounts (CASA) continued to be a bright spot, reaching nearly VND 297,000 billion, accounting for 37.9% of total customer deposits.

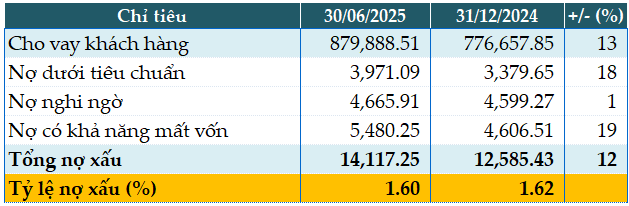

As of June 30, 2025, MB’s total non-performing loans (NPLs) amounted to VND 14,117 billion, a 12% increase from the beginning of the year. The NPL ratio slightly decreased from 1.625% to 1.6%. The NPL ratio stood at 1.6%, and the loan loss provision coverage ratio was 88.9%.

|

MBB’s loan quality as of June 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

– 20:08 29/07/2025

The Captivating Craft of Words:

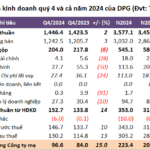

“Dat Phuong’s Profitable Prowess: A Stellar Fourth Quarter with nearly 100 Billion VND in Profit.”

The Joint Stock Commercial Bank for Foreign Trade of Vietnam, or Vietcombank, has announced its fourth-quarter 2024 financial statements, reporting a net profit of VND 97 billion, the highest in the past seven quarters. This figure represents a 15% increase compared to the same period last year, yet Vietcombank has only achieved 88% of its annual profit plan.