During the regular Government meeting on July 3, 2025, Prime Minister Pham Minh Chinh emphasized the requirement for the State Bank to consider and move towards abolishing the “credit room” mechanism. This presents an unprecedented opportunity for the banking system. Banks can take advantage of this leverage to boost loan growth rapidly, with a potential expansion of double digits every year. However, recent deposit growth has slowed, creating a widening gap between credit demand and mobilization capacity, continuously increasing the LDR ratio over the years, and putting liquidity pressure on the system. This requires Vietnamese banks to seek more flexible capital solutions.

To address the capital challenge, lessons from China offer valuable practical insights. As a nation accelerating towards superpower status, China’s banking system has robustly supported its economy. Notably, Chinese banks have successfully diversified their capital sources, flexibly mobilizing funds from payment technology networks like Alipay and WeChat, as well as ramping up bond issuance. Consequently, Chinese banks could establish a robust capital foundation without heavily relying on interbank capital or facing annual equity pressure.

The shift in Chinese banks’ capital structure

With an average economic growth rate of 9.5% annually until 2018, China left its mark as one of the world’s most dynamic economies. During this economic development, the Chinese banking system emerged as the primary conduit, ensuring a continuous flow of capital into the economy. Looking back over the past decade, China’s banking system has demonstrated significant shifts in capital management, aiming not only for financial stability but also long-term development.

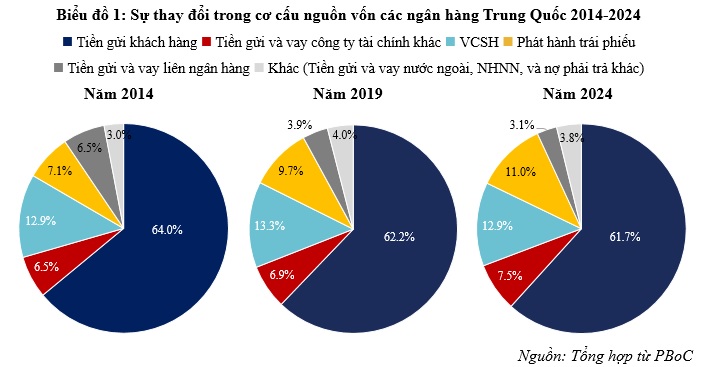

Based on the capital structure data of China’s banking system, customer deposits remain the primary pillar, constituting the largest proportion and maintaining stability (slightly decreasing from 64.01% in 2014 to 62% in 2024). This affirms the dominance of traditional capital sources. Notably, deposits from other financial companies have increased, accounting for a significant proportion of total capital, reaching 7.52% in 2024. If combined, the total deposit ratio is estimated at nearly 70%. The boom in cashless payments and the rise of fintech companies like Alipay and WeChat Pay have contributed to attracting substantial deposits for banks. For instance, Alipay stores customers’ money in special accounts at major commercial banks such as the Industrial and Commercial Bank of China (ICBC). Additionally, banks collaborate with these platforms to offer term deposit services directly to users. This arrangement enhances banks’ deposit mobilization efficiency, reduces pressure on deposit interest rates, and provides room to maintain low lending rates over the long term.

Apart from customer deposits, a notable highlight in Chinese banks’ capital restructuring strategy is the emphasis on bond issuance. The proportion of bonds issued has continuously grown from 7.15% in 2014 to 11% by the end of 2024. In value terms, the volume of issuance increased by more than 320,000 billion NDT in just one decade, equivalent to an average annual growth rate of 15%. This reflects banks’ proactive approach to utilizing debt instruments in the capital market. Bond issuance also provides a more stable medium to long-term capital source, improving liquidity risk management.

Furthermore, Chinese banks’ equity capital has remained stable, accounting for approximately 12%-13%. This stability is due to diversifying capital sources, reducing the pressure to increase equity. Conversely, the proportion of interbank loans has decreased from 6.45% in 2014 to around 3% by the end of 2024. This trend indicates a strategic move by banks to minimize their reliance on short-term capital, susceptible to macroeconomic fluctuations, and instead, move towards a more sustainable capital structure.

Capital structure of Vietnamese banks and lessons learned

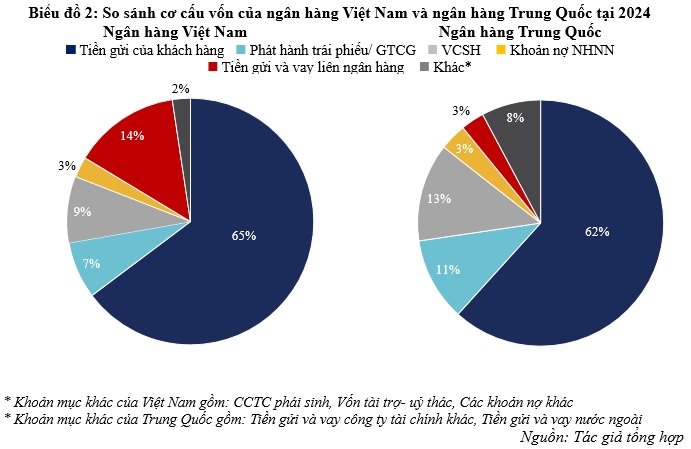

In Vietnam, the banking system is transitioning towards Basel II and approaching Basel III to enhance financial capacity and resilience to risks. The capital structure during 2014-2024 indicates that customer deposits remain the primary source of funding, accounting for 65%-70%, mostly in the form of short-term deposits (estimated at about 90% with terms of less than 12 months). While this proportion has slightly decreased recently, it still poses a high liquidity risk and vulnerability to interest rate fluctuations or depositors’ sentiments. It also creates pressure on efficient capital allocation to meet the increasing demand for medium to long-term credit. Apart from deposits, equity capital is another crucial component. The equity capital ratio of Vietnamese banks increased from 7.60% in 2014 to 8.7% in 2024. However, this figure is still modest, which is an essential reason why the CAR ratio in Vietnam remains low compared to other Southeast Asian countries and more developed nations like China and Singapore. The low CAR ratio hinders Vietnamese banks’ ability to build sufficient capital buffers to meet the future Basel III standards.

A distinct difference in the capital structure of Vietnamese banks is that while the proportion of issued securities has increased from 1.71% (2014) to 7.47% (end of 2024), it is still relatively small compared to the bond issuance of Chinese banks. This indicates that capital mobilization through the capital market, such as bonds and certificates of deposit, has not been maximized to supplement the system’s capital. Conversely, interbank loans still account for a significant proportion, approximately 14%, underscoring the necessity to swiftly shift towards more stable and sustainable capital sources.

From the above analysis, it is evident that Vietnamese banks currently rely on traditional mobilization channels and lack diversification. In contrast, Chinese banks have adeptly increased deposits through intermediary payment platforms like Alipay and aggressively pursued bond issuance. This shift has enabled Chinese banks to supplement their capital needs while mitigating competition for deposit interest rates, reducing equity pressure, and decreasing reliance on volatile interbank capital.

An optimal capital structure is undoubtedly the foundation for any bank’s sustainable development. China’s experience demonstrates that diversifying capital sources through bond issuance and collaborations with financial technology companies have empowered them with more autonomy in capital management. For Vietnamese banks, the key to fortifying their financial foundation and seizing the upcoming growth opportunities lies in their agility in adopting this strategy, supported by macroeconomic policies and internal efforts.

The Future of Banking: A Brighter Outlook with Declining NPA’s and 15% Profit Growth

The banking sector’s financial performance remains robust, indicating a much stronger resilience compared to the previous financial crisis of 2012-2013. The industry’s pre-tax profit forecast for 2025 projects a growth of 14.9% year-over-year, showcasing a healthy and stable outlook.

“Undervalued Banking Stocks: Unlocking the Potential of High-Growth Financial Powerhouses”

We recommend investing in bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. Banks possess robust and sustainable growth drivers and are currently undervalued in the market; these include major players such as ACB, CTG, MBB, TCB, and VPB.