Challenges of Home Ownership

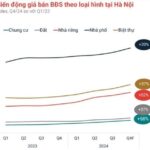

According to market data from Batdongsan.com.vn, there has been a slight stagnation in apartment prices in Hanoi and Ho Chi Minh City post the Tet holiday. Data from Batdongsan.com.vn indicates that the average listing price for apartments in Hanoi and Ho Chi Minh City during the first half of February 2025 was 62 and 57 million VND per square meter, respectively.

The average listing price for apartments in Hanoi and Ho Chi Minh City during the first half of February 2025 was 62 and 57 million VND per square meter, respectively.

Meanwhile, the average price for apartments in January 2025 was 63 million VND per square meter in Hanoi and 60 million VND per square meter in Ho Chi Minh City. This indicates a slight downward adjustment in apartment prices in these two cities.

“However, this is just a short-term fluctuation, and more time is needed to determine the price trend,” said Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn.

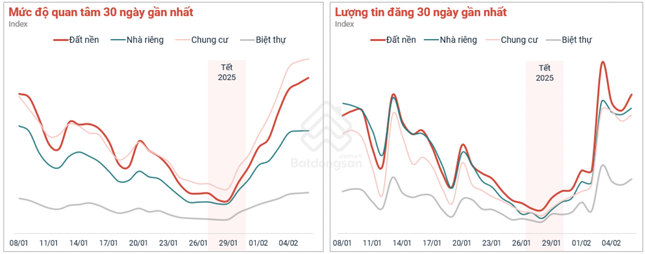

Although the real estate market is showing positive signs post-Tet, with increased searches for properties, and an increase in listings for sale and rent, more incentives are needed to improve liquidity.

Specifically, homebuyers who are primarily interested in apartments and houses are waiting to see if the supply will become more abundant, hoping for a price adjustment to a more reasonable level. Investors, on the other hand, are also considering different channels and areas for investment.

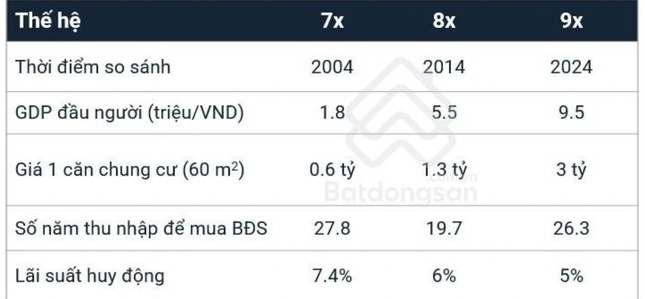

Discussing the challenge of homeownership for young people, Batdongsan.com.vn compared the salary and house prices of the past and present, revealing that not just Gen Z, but young Vietnamese across generations have faced difficulties in purchasing their own homes.

In 2004, an individual from the 7x generation would have needed about 31.3 years of income to buy a 60-square-meter apartment worth 0.6 billion VND, assuming a deposit interest rate of 7.4%. Ten years later, in 2014, an individual from the 8x generation would have needed 22.7 years of income to buy the same apartment, which had increased in price to 1.5 billion VND, while the deposit interest rate had decreased to 6%.

By 2024, a 9x individual would have needed 25.8 years of income to purchase the same apartment (now worth 3 billion VND) with a deposit interest rate of 4.5%. Although the number of years of income and interest rates have gradually decreased over time, young people from different generations still need to work hard for a long time to be able to afford their own home.

Table estimating the factors and ability of young Vietnamese to buy houses across different periods.

Mr. Nguyen Quoc Anh suggested that for those buying property for their own residence, any time is a good time, as long as the buyer has carefully calculated their financial plan and considered factors that ensure a convenient life.

“Even though many developers and banks offer loans of up to 80-85% of the property value, buyers should have at least 30-40% in cash and be confident that their income will be stable for the next 3-5 years to maintain their lifestyle before considering buying a house. If they don’t have enough financial resources, they should consider renting first,” said Mr. Quoc Anh.

Increasing Supply

According to market data from Batdongsan.com.vn, there has been a positive recovery in the number of listings and the level of interest in real estate after the Tet holiday. In Hanoi and Ho Chi Minh City, the level of interest in real estate on the 9th day of the Lunar New Year increased by four to six times compared to before Tet. The number of listings for sale and rent on Batdongsan.com.vn in the week after Tet was also about four times higher than the week before Tet.

Among the different types of real estate for sale, land and apartments have shown the strongest recovery in terms of both interest and listings. In the rental segment, apartments remain the most sought-after type of property, followed by private houses and rooms for rent. This indicates that the demand for rental properties in major cities remains stable, especially from students, workers, and foreign experts.

After Tet, the land and apartment segments showed the strongest recovery in terms of both interest and listings.

In January 2025, there was also a positive development in the activities of real estate enterprises. The number of newly registered enterprises reached 273, an increase of 65% compared to the same period in 2024, while the number of reactivated enterprises was 974, an increase of 51%. These signals from both real estate customers and enterprises reflect a positive and proactive mindset among market participants.

Batdongsan.com.vn’s data also reflects the prominent trends in different localities. In Hanoi, during January 2025, buyers’ searches were focused on apartments in the western area of the city, in districts such as Nam Tu Liem and Ha Dong; land in the outskirts (Long Bien, Hoai Duc, Ha Dong, etc.); and private houses in populous districts like Dong Da, Hoang Mai, and Long Bien.

In the rental market, Cau Giay and Nam Tu Liem districts attracted the most interest in apartment rentals, while the demand for private house and room rentals was concentrated in Cau Giay, Dong Da, and Ha Dong districts.

In the Ho Chi Minh City real estate market, there was some differentiation in January 2025, especially in the land segment. Most of the interest in land was focused on District 9. Meanwhile, those looking to buy apartments were mainly searching in District 2 and District 7.

For private houses, Binh Thanh and Go Vap districts attracted the most interest. In the rental market, Saigon residents sought apartment rentals mostly in District 2 and District 7, and room rentals mainly in Binh Thanh.

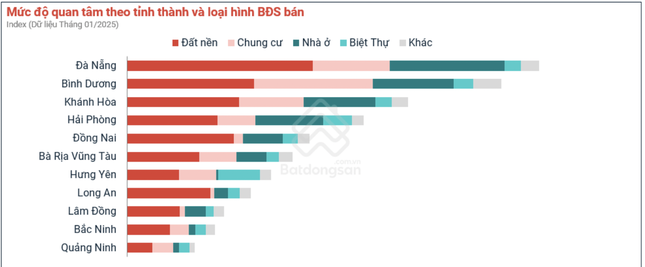

The majority of interest in provincial real estate came from land inquiries.

In the northern region, Hai Phong and Hung Yen received the most attention, with a significant increase in search volume in January 2025. In the southern region, real estate in Binh Duong, Dong Nai, and Ba Ria-Vung Tau continued to attract a large volume of interest.

Notably, in the central region, Da Nang led the country in terms of land interest during January 2025. Da Nang maintains its position as one of the most attractive real estate markets due to its developed tourism industry and modern transportation infrastructure. In many other provincial markets, land was also the most sought-after type of property at the beginning of this year.

However, in response to the question of whether there will be a surge in land prices as large cities tighten their subdivision regulations and the impact of the land price framework, Mr. Dinh Minh Tuan, Southern Regional Director of Batdongsan.com.vn, opined that there may be short-term, localized price increases in some areas, but it is highly unlikely to see a comprehensive land price fever like that of 2022.

The Buzzing Land Auction Preparations in Ninh Binh, Nam Dinh, and Hung Yen: Over 1,100 Land Lots Up for Grabs, with Starting Bids as Low as VND 2.5 Million per sq. meter.

As 2024 draws to a close, provinces surrounding Hanoi are gearing up to auction off a staggering number of land plots. Over a thousand lots will be up for grabs, offering a plethora of opportunities for prospective investors and homeowners alike. This upcoming event is set to be a landmark occasion, with the potential to shape the real estate landscape of the region.

The Rising Dragon: Vietnam’s Property Prices Soar Above the Rest

“Over a 5-year period, Vietnam’s property price growth reached an impressive 59%, outperforming many other countries such as the US (54%), Australia (49%), Japan (41%), and Singapore (37%). The high rate of price increase has led to a rental yield of just 4% for Vietnamese properties, while many other countries, including the Philippines, Malaysia, Thailand, Indonesia, the UK, Australia, and the US, enjoy rental yields ranging from 5% to 7%.”

The Ultimate Guide to the Disappearance of Affordable Housing in Southern Vietnam: Unveiling the Mystery of the $43,000 – $86,000 Apartments

In just a 6-year span (from 2018 to 2024), the Ho Chi Minh City market witnessed the official “extinction” of apartments priced at 1-2 billion VND. Soon, apartments priced at 3 billion VND will also be a thing of the past. In the next few years, the neighboring apartment markets of Binh Duong and Dong Nai are expected to follow a similar trajectory as Ho Chi Minh City’s current situation.