Techcom Securities (TCBS) is planning to offer 231.15 million shares, attracting significant attention from the stock market. If successful, TCBS will increase its circulating shares from over 2.08 million to over 2.31 million. The offering is expected to take place from Q3 2025 to Q1 2026.

With an offering price of VND 46,800 per share, TCBS is valued at over VND 108,169 billion, equivalent to approximately $4.1 billion at the current exchange rate.

Assuming a successful sale of 231.15 million shares, TCBS expects to raise nearly VND 10,818 billion. The company plans to invest over VND 7,572 billion (70%) in proprietary trading (stocks and bonds) and over VND 3,245 billion (30%) in brokerage, margin trading, and pre-paid securities sales. The investment will be disbursed from Q3 2025 to the end of 2026.

For this offering, TCBS will distribute through its own company and designated agents, including SSI Securities Corporation and Ho Chi Minh City Securities Corporation (HSC).

TCBS’s IPO is expected to create a frenzy in the stock market, ending the long-standing IPO drought. From 2025 to 2027, several IPOs and listings are anticipated, totaling $47.5 billion in value, excluding state-owned enterprises.

At the 2025 Annual General Meeting of Techcombank (TCB) – TCBS’s parent bank, Mr. Ho Hung Anh, Chairman of TCB’s Board of Directors, shared insights about this IPO. TCBS is in discussions with one or two large investors who may participate in the pre-IPO stage, with initially positive evaluations. The IPO is expected to take place this year, depending on financial market conditions, international counterparts, and the upgrade of Vietnam’s stock market.

Mr. Hung Anh emphasized the importance of efficiently utilizing the capital raised to maintain a high return on equity (ROE).

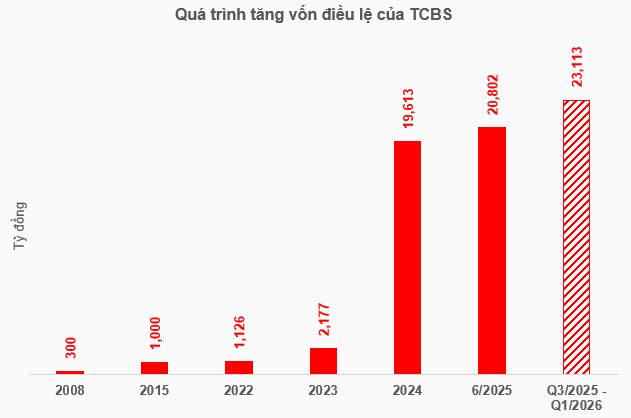

On June 10, TCBS concluded a private placement of over 118.8 million shares, raising over VND 1,188 billion and increasing its charter capital from over VND 19,613 billion to nearly VND 20,802 billion, the highest in the securities industry.

In this issuance, Mr. Nguyen Xuan Minh, Chairman of TCBS’s Board of Directors, purchased over 106.1 million shares, accounting for more than 89% of the offered shares. Several other TCBS leaders also participated in this private placement.

Source: VietstockFinance

|

– 13:40 08/05/2025

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

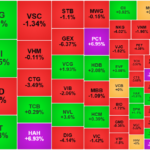

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.

“Foreigners net-sell nearly VND 2.5 trillion in the last session of the week, offloading SSI and CTG stocks.”

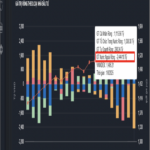

Today’s trading liquidity remained robust at 46.1 trillion, indicating strong investor confidence despite net foreign selling of 2,488.5 billion. Specifically, in terms of matched orders, they net sold 2,444.1 billion.