|

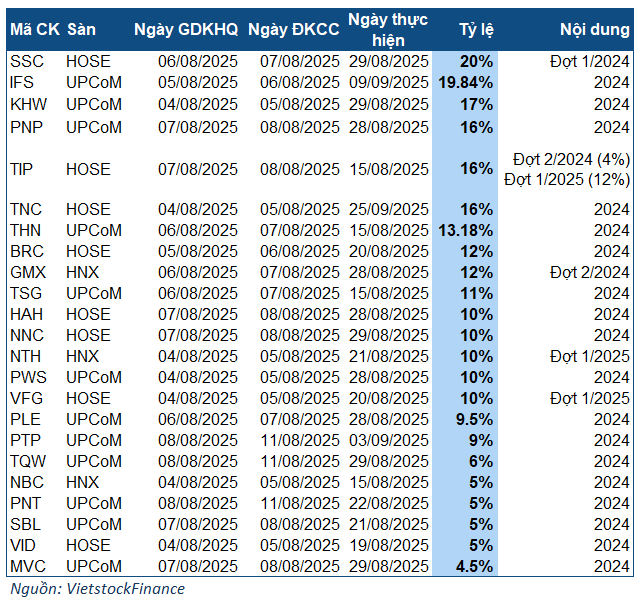

Companies finalising dividend payments for the week of 04-08/08

|

The company with the highest dividend payout this week is SSC (20%), which is the first dividend for 2024. With approximately 13.3 million shares in circulation, the company is estimated to disburse 26.5 billion VND. The ex-dividend date is 06/08, and the expected payment date is 29/08/2025.

Following closely is IFS with a dividend rate of 19.84%, equivalent to 1,984 VND per share. Although ranked second, IFS stands out with its substantial payout, having over 84 million shares in circulation, totaling nearly 173 billion VND. However, the majority of this amount will go to its parent company, Kirin Holdings Singapore, which holds 95.66% of the charter capital. The ex-dividend date is 05/08, and shareholders will receive their dividends on 09/09.

Another notable company is KHW, which finalises its dividend with a rate of 17% (1,700 VND per share). With nearly 28.6 million shares in circulation, the company is expected to disburse approximately 48.6 billion VND. The ex-dividend date is 04/08, and the payment date is anticipated to be 29/08. A significant portion of this amount will go to its two largest shareholders: People’s Committee of Khanh Hoa Province (51%) and Clean Water Company REE (43.88%) – a subsidiary of REE.

This week, eight companies will finalise dividend payments in shares. The highest ratio belongs to ACV at 64.58% (for every 100 shares held, shareholders will receive 64.58 new shares), with an ex-dividend date of 07/08. Following closely are MIC with a ratio of 55% (100 shares for 55 new shares) and HAH with a ratio of 30% (100 shares for 30 new shares). The respective ex-dividend dates are 04/08 and 07/08.

– 13:58 03/08/2025

The Billionaire’s Stock Surprise: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Shares Surge to Historic Highs at Year-End

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.

State-Owned Refinery to Join $2 Billion Capital Team, Joining Ranks with Hoa Phat Dung Quat, MB, and Vietinbank

Introducing the top 19 power players with a capital of over $2 billion. This elite group comprises a diverse range of businesses, including 9 state-owned enterprises, 4 foreign-invested companies, and 6 private sector giants. Each of these organizations boasts a substantial financial backing, reflecting their significant role and influence in the economy.

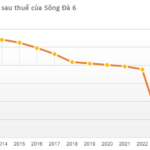

The Reluctant Dividend: A State-Owned Enterprise’s Eight-Year Itch and Delisting Woes

Thus, even after more than 8 years, SD6 is yet to pay dividends from 2016. A lingering issue that raises questions about the company’s financial health and stability.