The plan is expected to be implemented in the last two quarters of 2025. Currently, Ha An’s chartered capital is nearly VND 11,478 billion. After DXG contributes additional capital, the chartered capital of this subsidiary will increase to nearly VND 13,217 billion, with DXG maintaining its ownership ratio at 99.99%.

To fund the above capital contribution plan, on August 4, the DXG Board of Directors also announced a plan to privately place 93.5 million shares to professional securities investors at a price of VND 18,600/share. The total maximum issuance value is over VND 1,739 billion, which is equal to the amount needed to contribute additional capital to Ha An.

The shares issued will be restricted from transfer for one year. The implementation time is also expected in the second half of 2025, after the State Securities Commission announces the receipt of the private placement registration dossier.

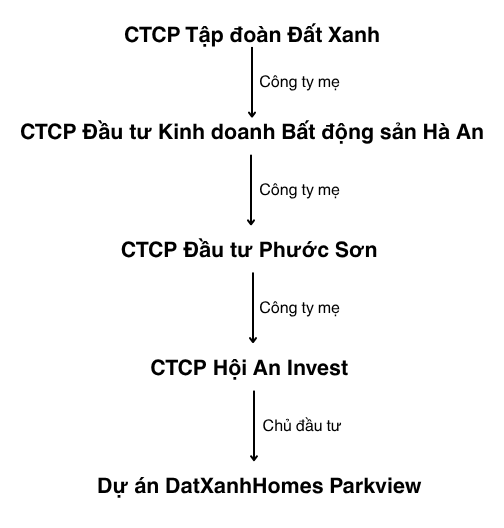

In the issuance plan, DXG stated that Ha An will use this capital to contribute to Phuc Son Investment Joint Stock Company – a subsidiary of Ha An. Subsequently, Phuc Son will use all of this money to contribute capital to Hoi An Invest Joint Stock Company – a subsidiary of Phuc Son, to implement the investment project of the high-rise apartment and commercial service area with the name DatXanhHomes Parkview (DatXanhHomes Parkview).

|

The relationship between DXG and the DatXanhHomes Parkview project

Compiled by

|

DatXanhHomes Parkview is the second project under the DXG‘s DatXanhHomes brand, after Datxanhhomes Riverside (also known as The Prive), located in Thuan An City, Binh Duong Province.

On June 11, 2025, the People’s Committee of Binh Duong Province issued a decision allowing Hoi An Invest to implement the DatXanhHomes Parkview project on an area of 42,205 square meters. Of this, 33,769 square meters will be converted for use as urban residential land, and 7,266 square meters for educational and training facilities.

Back to Ha An, this is DXG‘s most favored subsidiary, having received capital injections multiple times over the past few years. The most recent injection was in the first two months of this year, when DXG offered over 150.1 million shares at VND 12,000/share, raising over VND 1,800 billion, of which VND 1,500 billion was contributed to Ha An.

Ha An is currently the developer of several key DXG projects, including Opal Skyline, Opal Boulevard, Opal Luxury, and Datxanhhomes Riverside (formerly known as Gem Riverside)…

Regarding the private placement of 93.5 million shares to professional securities investors, this plan was approved at the 2024 Annual General Meeting of Shareholders of DXG but was not implemented last year due to the prolonged timeline for offering to existing shareholders into 2025. Therefore, the 2025 General Meeting of Shareholders re-approved the plan with generally similar content to the 2024 plan.

– 11:20 08/05/2025

The Market Beat on December 24th: Strong Inflows in the Afternoon Session See VN-Index Recover to Near Reference.

Despite a negative mid-session turn, the market recovered to close near reference levels today. The VN-Index ended at 1,260 points, a minor loss of 2.4 points, while the HNX-Index dipped 0.15 points to 228.36 points.

Market Beat: Real Estate and Finance Sectors Lead the Recovery, VN-Index Surges Over 11 Points

The market closed with strong gains, as the VN-Index rose by 11.39 points (0.95%) to reach 1,216.54, while the HNX-Index climbed 1.61 points (0.73%) to 221.29. The market breadth tilted heavily in favor of bulls, with 471 advancing stocks against 247 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, with 24 gainers, 2 losers, and 4 stocks closing flat.

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.