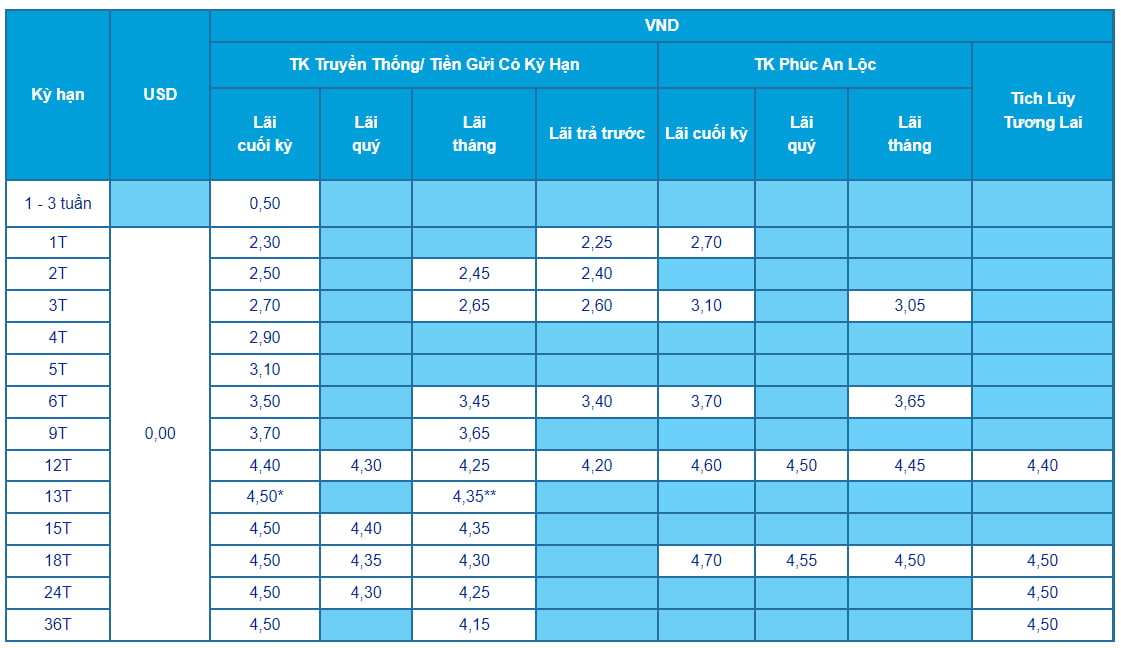

ACB’s Deposit Interest Rates for Over-the-Counter Deposits in August 2025

As of early August, Asia Commercial Joint Stock Bank (ACB) continues to apply deposit interest rates for customers making deposits at the counter, with interest payable at the end of the term ranging from 0.5% to 4.5% per annum.

Specifically, ACB offers an interest rate of 0.5% per annum for tenors of 1-3 weeks; 1-month tenor at 2.3% per annum; 2-month tenor at 2.5% per annum; 3-month tenor at 2.7% per annum; 4-month tenor at 2.9% per annum; 5-month tenor at 3.1% per annum; 6-month tenor at 3.5% per annum; 9-month tenor at 3.7% per annum; and 12-month tenor at 4.4% per annum.

ACB offers a deposit interest rate of 4.5% per annum for tenors of 13-36 months. For the 13-month tenor, customers depositing 200 billion VND or more will receive a preferential interest rate of 6.0% per annum.

ACB’s Deposit Interest Rates for Over-the-Counter Deposits in August 2025

Source: ACB

In addition to interest payable at the end of the term, ACB also offers flexible interest payment options: Quarterly interest: Interest rates range from 4.30% to 4.4% per annum; Monthly interest: Interest rates range from 2.45% to 4.35% per annum (For the 13-month tenor, a minimum deposit of 200 billion VND earns an interest rate of 5.9% per annum); Interest payable in advance: Interest rates range from 2.25% to 4.2% per annum.

ACB also offers the Phúc An Lộc and Tích Lũy Tương Lai savings packages for customers to choose from, with interest rates of up to 4.7% per annum.

ACB’s Online Deposit Interest Rates for August 2025

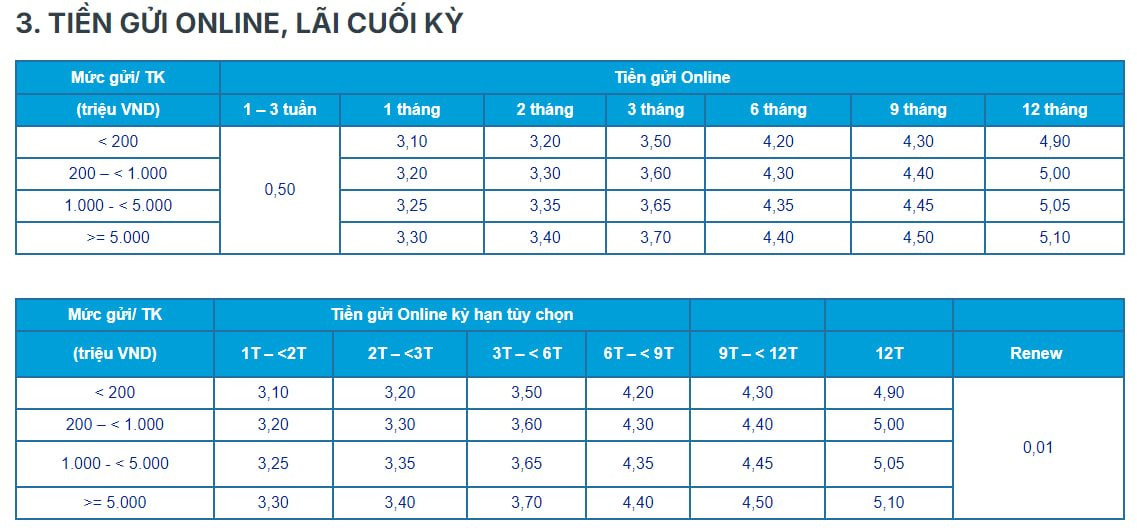

For online deposits via the banking app, ACB’s deposit interest rates range from 0.5% to 5.1% per annum for interest payable at the end of the term.

Specifically, ACB applies an interest rate of 0.5% per annum for tenors of 1-3 weeks. For other tenors, ACB offers different interest rates depending on the deposit amount. Details are as follows:

Deposit amount below 200 million VND: The interest rate for a 1-month tenor is 3.1% per annum; 2-month tenor at 3.2% per annum; 3-month tenor at 3.5% per annum; 6-month tenor at 4.2% per annum; 9-month tenor at 4.3% per annum; and 12-month tenor at 4.9% per annum.

Deposit amount from 200 million VND to below 1 billion VND: The interest rate for a 1-month tenor is 3.2% per annum; 2-month tenor at 3.3% per annum; 3-month tenor at 3.6% per annum; 6-month tenor at 4.3% per annum; 9-month tenor at 4.4% per annum; and 12-month tenor at 5.0% per annum.

Deposit amount from 1 billion VND to below 5 billion VND: The interest rate for a 1-month tenor is 3.25% per annum; 2-month tenor at 3.35% per annum; 3-month tenor at 3.65% per annum; 6-month tenor at 4.35% per annum; 9-month tenor at 4.45% per annum; and 12-month tenor at 5.05% per annum.

Deposit amount of 5 billion VND or more: The interest rate for a 1-month tenor is 3.3% per annum; 2-month tenor at 3.4% per annum; 3-month tenor at 3.7% per annum; 6-month tenor at 4.4% per annum; 9-month tenor at 4.5% per annum; and 12-month tenor at 5.1% per annum.

Thus, the highest online deposit interest rate offered by ACB for a 12-month tenor ranges from 4.9% to 5.1% per annum, depending on the deposit amount.

ACB’s Online Deposit Interest Rates for August 2025

Source: ACB

The Bank’s Endeavor to Lower Interest Rates

The Central Bank, in a bid to heed the Government and Prime Minister’s directive on enhancing measures to reduce interest rates, convened a meeting with the credit institution system on August 4, 2025. The primary focus of this gathering was to discuss strategies for stabilizing deposit rates and reducing lending rates.

Over 15.3 Million Billion Dong Flows into the Banking System

As of the end of May, resident and business deposits in credit institutions reached a record high of over 15.34 million billion VND. This remarkable achievement underscores the robust financial landscape in Vietnam, showcasing the confidence and trust that individuals and enterprises have in the country’s banking system.

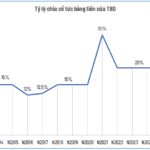

The Rising Interest Rates on Deposits: A Year-End Phenomenon

In early December, commercial banks continued to raise deposit interest rates to meet the surge in capital demand during the year-end period.