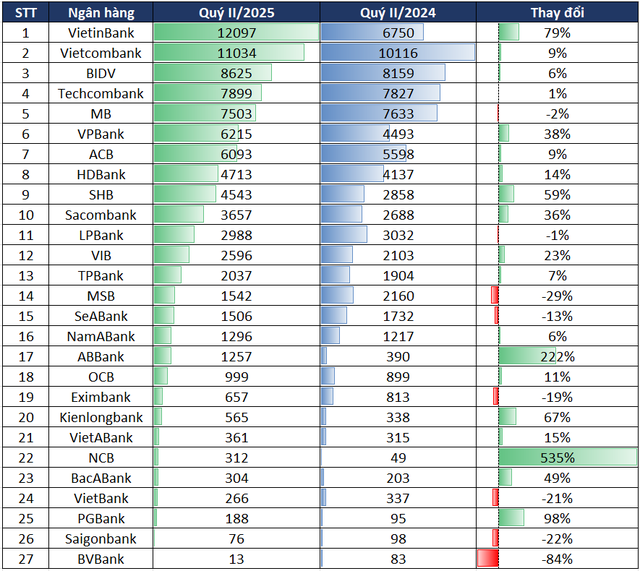

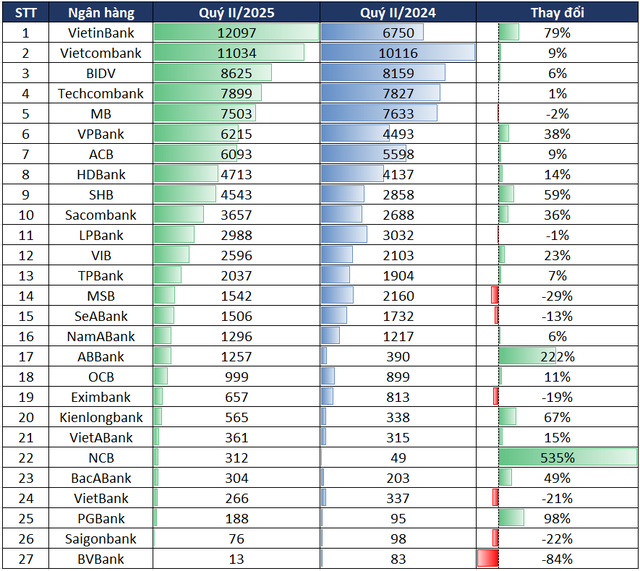

VietinBank witnessed an impressive surge in the second quarter, with a 79% increase in pre-tax profit, amounting to 12,097 billion VND. This remarkable performance propelled VietinBank ahead of Vietcombank, making it the highest-profit bank in the second quarter of 2025.

Vietcombank, despite a positive 9% growth in profit, reaching 11,034 billion VND, was surpassed by VietinBank in the previous quarter. However, Vietcombank maintained its leading position in terms of six-month profit, outpacing VietinBank by over 3,000 billion VND.

The third-highest profit in the second quarter of 2025 was achieved by another state-owned bank, BIDV, with a pre-tax profit of 8,625 billion VND, reflecting a 6% increase compared to the same period in 2024.

Combined, these three state-owned banks garnered nearly 31,800 billion VND in pre-tax profit during the second quarter of 2025, marking a 27% rise year-over-year. Their collective performance accounted for over one-third of the total profit generated by the 27 banks listed on the stock exchange.

Following the state-owned banks, the top 10 profit-generating banks in the second quarter of 2025 included prominent names such as Techcombank (7,899 billion VND), MB (7,503 billion VND), and VPBank (6,215 billion VND). While MB and Techcombank’s quarterly profits remained relatively stagnant or experienced a slight dip, VPBank stood out with a remarkable 38% growth.

The remaining spots in the top 10 were occupied by familiar institutions: ACB (6,093 billion VND), HDBank (4,713 billion VND), SHB (4,543 billion VND), and Sacombank (3,657 billion VND). Together, these 10 banks accumulated nearly 72,378 billion VND in total profit, signifying a 20% increase compared to the same period in 2024, and accounting for over 81% of the total profit of the listed banks.

During the second quarter of 2025, 19 out of 27 banks reported positive profit growth, with 13 of them achieving increases of more than 10%. NCB led the pack with a remarkable six-fold surge in profit, while ABBank impressed with a three-fold increase in pre-tax profit compared to the second quarter of 2024.

Additionally, several banks witnessed profit growth rates exceeding 50% in the second quarter of 2025, including PGBank (+98%), VietinBank (+79%), Kienlongbank (+67%), and SHB (+59%).

On the other hand, eight banks experienced a decline in profit compared to the previous year’s second quarter. BVBank led the decrease with an 84% drop, followed by MSB (-29%), Saigonbank (-22%), VietBank (-21%), Eximbank (-19%), SeABank (-13%), MB (-2%), and LPBank (-1%).

BVBank attributed its significant profit decline to three main reasons: firstly, the bank proactively reduced lending rates and offered preferential credit packages to support individual and corporate customers in line with the government and SBV’s initiatives; secondly, BVBank increased provisions to bolster its safety buffer and maintain asset quality; and lastly, operating expenses rose by 17% as the bank invested in network expansion and technology upgrades to support its long-term digitization strategy and optimize operational processes.

The Big Eight: Banking Giants’ First-Half Success Story

In Q2 2025, the combined profits of 27 banks reached VND 89,341 billion, an impressive 18% increase compared to the same period in 2024.

Vietcombank Reports 9% Rise in Q2 Pre-Tax Profit, Attributed to Reduced Provisions

The recently released consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Foreign Trade of Vietnam, commonly known as Vietcombank (HOSE: VCB). The bank reported a remarkable pre-tax profit of over VND 11,034 billion, reflecting a 9% increase compared to the same period last year. This outstanding performance is attributed to a significant reduction in risk provisions.

Captivated by the Bank’s Notification on ‘Expiring Reward Points’

Cybercriminals are employing a new tactic to deceive unsuspecting individuals. They are sending SMS messages, pretending to be from a bank, informing recipients about reward points expiration and providing instructions on how to redeem gifts. However, the link included in the message redirects victims to a fake website mimicking the bank’s official site.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”