OPES is honored to be recognized in the “Top 10 Reputable Non-life Insurance Companies” ranking by Vietnam Report. As the youngest non-life insurer on the list (based on the year of establishment), OPES has demonstrated exceptional competitive ability and rapid growth in the challenging insurance market.

With this achievement, OPES has cemented its position by securing a series of prestigious titles from Vietnam Report, including Top 10 Reputable Non-life Insurance Companies, FAST500, VNR500, and PROFIT500. These accolades have enhanced OPES’s reputation among customers, partners, and investors, providing further motivation for the company’s journey to becoming Vietnam’s leading digital insurer.

The “Top 10 Reputable Non-life Insurance Companies” ranking is based on three main criteria: financial capacity reflected in the latest financial reports, media reputation evaluated through the Media Coding method – coding articles about the business in influential media channels, and surveys of research subjects and stakeholders, updated as of May 2025.

OPES has outperformed many established non-life insurance companies, impressing the evaluation committee with its remarkable business performance, a strong media presence, and high customer trust.

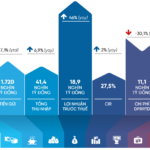

According to the 2024 financial report, OPES recorded a 203% increase in pre-tax profits compared to the previous year – the highest growth rate in the company’s seven years of operation. With a charter capital of VND 1,265 billion, OPES is among the Top 4 companies with the highest charter capital in the industry.

“Our debut in the Top 10 Reputable Non-life Insurance Companies in Vietnam also marks a significant milestone in OPES’s development journey, showcasing our competitive position in the market,” said Mr. Nguyen Huu Tu Tri, Deputy General Director of OPES. “This recognition is a strong testament to our commitment to delivering quality and effective insurance solutions to millions of customers. We will continuously innovate and invest in technology to enhance customer experience, meet market demands, and create sustainable value for our ecosystem, partners, and investors,” he added.

OPES representative at the announcement ceremony of the Top 10 Reputable Non-life Insurance Companies

Alongside business growth, OPES has continuously expanded its brand presence through diverse, multi-channel, and multi-partner communication activities. The company actively engages in social initiatives, creating value for the community and partnering with the VPBank ecosystem. Notable highlights include being the main sponsor of the VPBank International Marathon with over 12,000 participants, participating in the “Cashless City” event, collaborating with the Vietnam Breast Cancer Network (BCNV) to donate wigs to cancer patients, and joining TreeBank in planting tens of thousands of livelihood trees in Lam Dong and water-retaining trees for residents in Tay Ninh.

Moreover, OPES is recognized as a successful model for its comprehensive digital transformation strategy, evidenced by two prestigious awards at the Insurance Asia Awards 2025: “AI Initiative of the Year” and “Digital Insurer of the Year”. The company operates with a lean model, employing 150 full-time staff focused on technology infrastructure, data, and process automation to optimize customer experience.

Given the positive outlook for the non-life insurance market in 2025, with stable growth returning after a period of adjustment, OPES aims to leverage its position within the VPBank financial ecosystem, combined with its intrinsic strengths, to target a pre-tax profit of VND 636 billion, a 34% increase compared to 2024. The company will also continue to develop optimized insurance products to enhance the quality of life and contribute to the comprehensive prosperity of its customers.

Co-opBank: Three Decades of Resilience and Commitment to the Growth of Credit Unions

On August 5, 1995, the Central People’s Credit Fund – the predecessor of the Vietnam Cooperative Bank (Co-opBank) – was established by the State Bank Governor’s Decision No. 162/QD-NH5.

“TPBank: Leading the Way with Efficient Operations and a Pioneer Digital Ecosystem”

With a remarkable profit of over VND 4,100 billion in the first six months of 2025 and total assets reaching VND 428,600 billion, TPBank has not only sustained its robust growth but has also been recognized among the Top 10 most reputable private joint-stock commercial banks in Vietnam for 2025 by Vietnam Report. This testament solidifies TPBank’s standing as a frontrunner in the banking industry.

The Banking Giant Slashes Its Physical Presence: Shuttering 66 Branches in an Unprecedented Move

The recent wave of layoffs in the second quarter of 2025 has been a challenging time for many. With a focus on streamlining and cost-cutting measures, organizations across industries have had to part ways with valuable talent. As we move forward, it’s essential to reflect on the impact of these decisions and the potential consequences they may have on the future landscape of various sectors.

The CRM Machine and the Omnichannel Springboard: Santander to SHB’s Journey

In the quest for comprehensive digitalization, it is imperative to transform and seamlessly connect every service touchpoint. Automated transaction machines, or Cash Recycle Machines (CRMs), are pivotal in this journey. CRMs not only empower customers with self-service capabilities but also serve as a vital link in the construction of an omnichannel experience for the bank of the future.

“Techcombank – Revolving Leadership, Optimizing the Power of the Ecosystem”

As of August 1st, 2025, the Techcombank – One Mount – Masterise Group ecosystem underwent a strategic shift with a leadership transition. This move underscores the ecosystem’s commitment to harnessing the synergy of finance and technology, solidifying its pledge to accompany the nation’s digital transformation journey by leveraging the pillar of talent.