* Newest development in the case of a credit card debt of VND 8.5 million turned into VND 8.8 billion

On March 20th, our source informed us that regarding the case of customer P.H.A in Quang Ninh who had a credit card at Eximbank Quang Ninh branch with a debt of VND 8.5 million, after 11 years, the bank requested payment of over VND 8.8 billion. The State Bank of Vietnam has sent a letter to the Chairman of the Board of Directors and the CEO of Eximbank, requesting a report and resolution on this matter.

Accordingly, the State Bank of Vietnam has requested the leadership of Eximbank to respond to the media and public opinion regarding responsibilities, authorities, and solutions to this matter with a spirit of seeking information, listening, and considering the opinions and suggestions of the people.

“Eximbank is urgently verifying the case to protect the legitimate rights and interests of customers and the bank. The handling results will be reported to the leadership of the State Bank of Vietnam before March 21st,” according to a source from Nguoi Lao Dong newspaper.

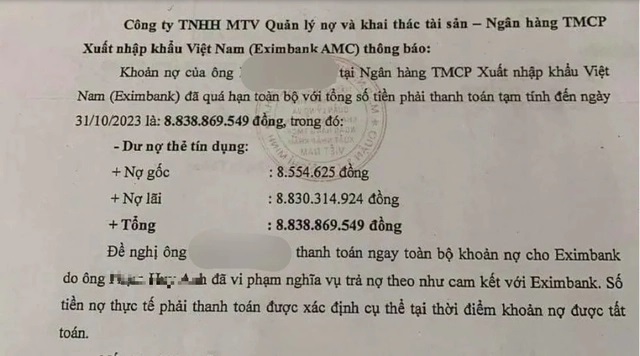

Announcement causing a “stir” in public opinion in recent days

|

Previously, as we have informed, Mr. P.H.A had opened a MasterCard credit card at Eximbank Quang Ninh branch on March 23rd, 2013 with a limit of VND 10 million. This card later had 2 transactions totaling more than VND 8.5 million. However, from September 14th, 2013, the mentioned credit card debt became bad debt.

Recently, Eximbank Asset Management Company (Eximbank AMC) has sent a notice to Mr. P.H.A requesting payment of the principal and estimated interest until October 31st, 2023, amounting to over VND 8.8 billion.

According to Eximbank, this is an overdue debt that has lasted for nearly 11 years. Eximbank has repeatedly notified and worked directly with the customer, but the customer has not come up with a debt handling plan.

Meanwhile, Mr. P.H.A stated that around March 2013, he had asked an employee named Giang working at the Eximbank branch in Quang Ninh to make a credit card, but in reality, he did not receive this credit card. It wasn’t until more than 4 years later (in 2017), when he needed to borrow money, that Mr. P.H.A was surprised to be informed that he had bad debt at Eximbank.

Since then, the customer and the bank have worked together several times, but the case has not been resolved thoroughly until the Eximbank AMC announced a debt paper of over VND 8.8 billion, causing a stir in public opinion.

Thái Phương