Short-term correction is an opportunity to invest

According to VPBankS expert, after 6 consecutive weeks of gains, with many stocks rising from 25% to over 40%, profit-taking pressure is understandable. Last week’s correction (July 28 – August 1) also coincided with the VN-Index approaching the old peak established in the 2021 – 2022 period. Therefore, this is just a technical correction and not a signal of a long-term peak.

The current context shares similarities with the money-pumping phase of 2020 – 2022. Specifically, credit growth as of early July reached approximately 9.9% – the highest level in many years since the COVID-19 pandemic. This was accompanied by macroeconomic support policies such as monetary easing and promotion of public investment. These factors boosted stock market liquidity, with records reaching new highs of up to $3 billion.

In terms of point fluctuations, the current market is very similar to the “wave” of increases from the second bottom after COVID-19, when the VN-Index rose 45 – 50% in three different waves. Between the upward waves were adjustments ranging from 10 – 16%. With a nearly 46% increase in the past, this adjustment wave could fluctuate by 7 – 10%, which is normal. After the adjustment, the VN-Index is fully capable of entering a new uptrend, possibly surpassing the 1,600-point mark and even aiming for 1,800 points. From the technical bottom of around 1,430 – 1,450 points, the index could gain at least 20%.

At this point, there are two investor action scenarios: one is to take profits on a portion (about 15 – 20%) and two is to take advantage of the correction to buy at a reasonable discount, especially when the medium-term “wave” is still long.

With a medium-term vision, this is an opportunity to invest in potential stocks at reasonable discounts. Investors who have taken partial profits should also review their portfolios to identify leading stocks for the next wave of increases.

Looking at the 1,480-point support level, if the VN-Index holds, the market will fluctuate within a wide range of 1,480 – 1,550 points. This scenario is likely as 1,480 indicates a good base price.

In the second scenario, if the 1,480-point region is pierced, there may be an opportunity to buy stocks at a lower support level, around 1,430 – 1,450 points. However, regardless of the scenario, this is an opportunity for new money to enter the market.

Mr. Tran Hoang Son – Director of Market Strategy, VPBank Securities (VPBankS) shared at the Vietnam and the Indices program on August 4, 2025.

|

In the early days of August, the fluctuation range may still be wide. If there is a deeper correction in the second half of the month, it will be a better buying opportunity. By September, in the event that Vietnam is officially upgraded to an Emerging Market by FTSE Russell, it will be a huge boost.

According to Mr. Son, at present, many long-term investors will be cautious and find it difficult to make decisions. However, this could be the phase of a large “wave” as the money flow supporting economic growth is very strong, aiming for a high GDP growth target of 8.3 – 8.5%.

In this context, banks are benefiting significantly from the credit growth cycle. Many banks have had their limits relaxed, with quick and substantial disbursements, leading to impressive profit growth. Investors’ task is to choose stocks with reasonable valuations from among these banks.

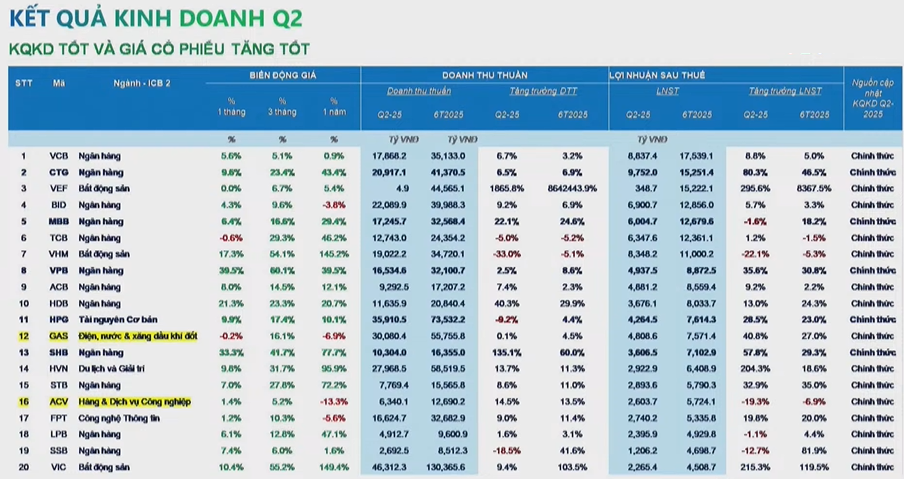

Q2 financial results open up a bright picture for the whole year

Currently, about 970 enterprises have announced their Q2 financial results, with the total market profit increasing by about 33% over the same period last year. This is a very positive figure, opening up bright prospects for the whole year’s profit picture in 2025.

Profit growth comes not only from the financial group but also from the non-financial group. The financial group grew more slowly (about 18% in Q2) but due to its high capitalization and liquidity, it is still noteworthy. From these figures, investors can certainly seek investment opportunities based on positive business results.

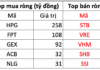

According to statistics, among the top 20 stocks with the strongest profit growth in the first half of the year, most have performed very well in terms of price increases. This shows that profit is the key factor leading stock price trends. However, whether the price increase will last or not depends on the solidity of the enterprise’s internals.

Source: VPBank Securities

|

However, there is a group of stocks whose Q2 and six-month results showed good growth, but whose prices went against the trend and even decreased. Through observations over the years, this phenomenon often occurs in small and medium-cap stocks, stemming from two main reasons: low absolute profits and prices that have reflected expectations.

Mr. Son often uses the PEG (Price/Earnings to Growth) ratio to assess the reasonableness of a stock’s price relative to its growth. If PEG > 1, the growth is not attractive enough compared to the current valuation, and the stock will struggle to attract money. Conversely, PEG < 1 indicates that the stock's valuation is attractive relative to its growth rate, presenting potential investment opportunities.

Note that in any market, when entering a strong uptrend, many “tea” stocks can also double in price. But this is also when greed can be easily triggered, causing investors to overlook risks. Stock prices are just an expression; what matters is the foundation behind the price increase, whether it is based on positive business results and information or simply price manipulation.

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.

The Wealth of Vietnam’s Top 20 Stock Market Billionaires: Vietjet Chair Adds Another $29 Million, VPBank Chair’s Family Sees Largest Increase

As of Wednesday, August 6, 2025, Mr. Pham Nhat Vuong, Chairman of Vingroup, remains the wealthiest individual on the Vietnamese stock market. With a staggering net worth of 233,500 billion VND, Mr. Vuong’s wealth continues to be a testament to his success and influence in the country’s economy.

The Market Beat: Foreigners Turn Net Buyers, VN-Index Recovers Over 14 Points

The trading session concluded with significant gains, as the VN-Index rose by 14.22 points (+0.95%), closing at 1,507.63. Meanwhile, the HNX-Index also witnessed a notable increase of 6.15 points (+2.41%), finishing the day at 261.51. The market breadth tilted in favor of advancers, with 426 tickers in the green and 337 in the red. Similarly, the VN30 basket painted a bullish picture, as 20 stocks advanced, 9 declined, and 1 remained unchanged, ending the day on a positive note.

Market Beat: Foreigners Turn Net Buyers, VN-Index Holds Firm at 1,510 Points

The trading session concluded with the VN-Index climbing 2.77 points (+0.18%), reaching 1,512.31. Meanwhile, the HNX-Index witnessed a rise of 1.48 points (+0.6%), ending the day at 249.33. The market breadth tilted towards the bulls, as evident from the advance-decline ratio of 467:296. A similar trend was observed in the VN30 basket, with 17 gainers outpacing 13 losers.

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.