While non-financial sectors such as real estate, construction, and industries all achieved impressive growth, the banking sector, which is the main driver of market profit growth, faced significant pressure in maintaining business efficiency, despite very favorable credit growth in the first six months.

Unfavorable factors such as unchanged input capital costs and limited scope for expanding lending rates have put pressure on the industry’s net interest margin (NIM). As pure interest income growth faces obstacles and non-interest income sources such as services and investments remain insufficient to compensate, expense management and provision control continue to be the main drivers of bank profitability, a trend that has persisted since late 2024.

Q2 2025 Profit Picture for the Banking Sector

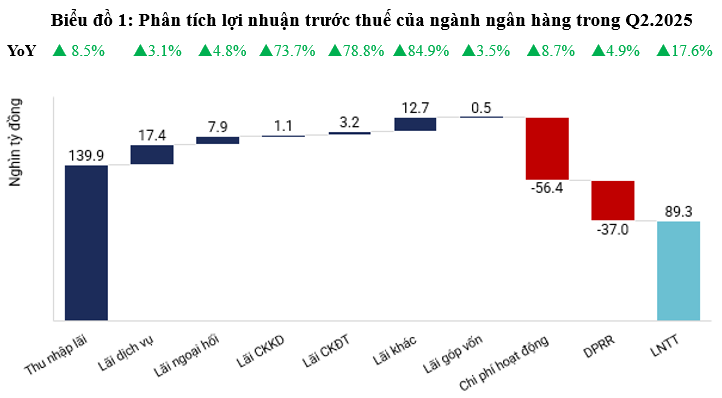

In Q2 2025, the banking sector recorded a pre-tax profit of VND89,341 billion, supported by a 12.0% year-on-year (YoY) increase in total operating income to VND182,741.37 billion, while expenses rose at a much slower pace. However, a deeper analysis reveals a less positive picture. Net interest income, the main pillar, increased by only 8.5% YoY, contributing 76.6% to total income—a significantly lower proportion than in previous years. The industry’s net interest margin (NIM) is under pressure as funding costs (COF) start to rise slightly. With the expected continuation of the loose monetary policy, there is limited room for growth in lending rates, while funding costs face upward pressure as the gap between total credit and mobilization widens. This will continue to put pressure on the industry’s net interest income.

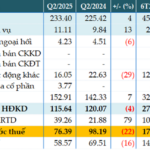

In the context of slowing interest income, non-interest income sources became the highlight of this quarter’s business picture. Although service income increased by only 3.1% YoY, reflecting core business challenges, investment segments showed impressive growth. Specifically, income from securities trading increased by 78.8% YoY, income from securities investments rose by 73.7% YoY, and income from other activities surged by 84.9% YoY. This reflects the industry’s efforts to diversify its income streams. However, with a modest proportion (only 7-9% of total income), these segments are not yet strong enough to fully offset the slowdown in interest income. Therefore, the overall operating income of banks still showed slow growth this quarter.

Source: Consolidated

|

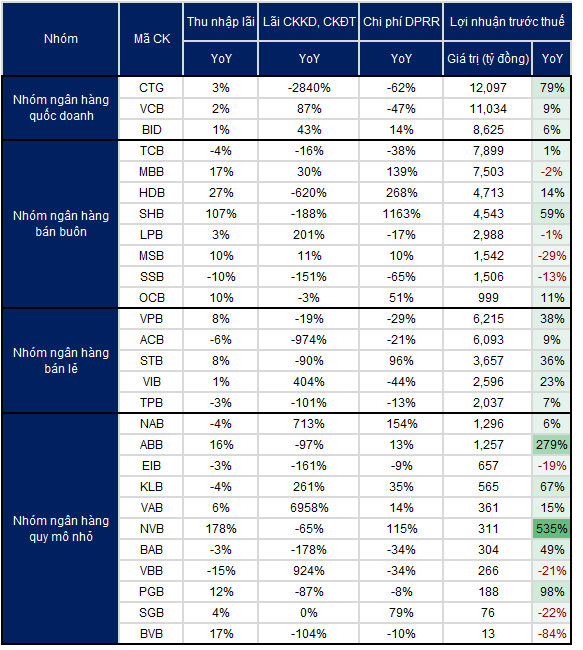

Although the industry’s total expenses increased by 7.1% to VND93,400 billion, with operating expenses of VND56,366 billion (up 8.7% YoY), the bright spot remains in the control of provisioning costs. Credit risk provision expenses (DPRR) increased by only 4.9% YoY to VND37,033 billion. This growth rate is significantly lower than the rate of increase in total income, indicating that provisioning pressure has eased and played an important role in supporting industry profits. Analyzing by bank groups reveals a mixed picture. The group of small-scale banks emerged as the leader in pre-tax profit growth, achieving a 36.4% YoY increase. This breakthrough did not come from net interest income (up only 5.2%) but was mainly due to investment segments. Trading and investing in securities, along with other activities, recorded over 300% growth—contributing nearly 15% to total operating income and becoming a significant driver of profit for this group.

On the other hand, wholesale banks faced multiple challenges. Despite a robust 20% YoY recovery in net interest income, the group’s pre-tax profit increased by only 4.7%. The main reason for this is a nearly 120% increase in provisioning expenses during the period. This indicates that, despite improvements in core operations, provisioning pressure remains a significant burden. Meanwhile, state-owned and retail banks had a relatively favorable quarter. Both groups achieved pre-tax profit growth of over 20%. The main driver was a significant reduction in credit risk provision expenses (down 32.7% and 23.5% YoY, respectively). Additionally, income from trading and investing in securities, as well as other activities, grew positively, by 168.2% and 50.5%, respectively, contributing to the growth momentum of these two groups.

Divergence in Pre-tax Profit Growth Rates among Banks

Q2 2025 financial reports indicate that bank profits are on a recovery path but still face multiple obstacles. Notably, the group of state-owned banks demonstrated superior stability, with most members achieving positive profit growth. CTG stood out with an impressive 79% profit increase, mainly due to a deep 62% cut in provisioning expenses. In contrast, other large banks, such as VCB and BID, also showed positive growth but at a more modest pace, with increases of 9% and 6%, respectively. Regarding income sources, there has been little improvement in net interest income for state-owned banks, as the pressure to narrow NIM remains significant.

The performance of wholesale banks in Q2 2025 revealed a strong divergence. SHB’s profit surged by 59%, mainly due to a remarkable 107% YoY increase in net interest income. Conversely, many other banks in this group experienced profit declines or slow growth. Notably, MBB’s profit decreased by 2% due to a 139% surge in provisioning costs, while MSB’s profit plunged by 29% because it failed to improve net interest income while provisioning expenses continued to rise rapidly, higher than the industry average. SSB was also negatively impacted by declines in both net interest income and investment income from securities. Overall, while net interest income for this group improved more positively than other groups, the management of credit risk provision expenses has not been particularly effective.

Retail banks faced challenges in enhancing net interest income this quarter, with no bank achieving growth higher than the industry average of 8.5%. Within this group, VPB (+38%), STB (+36%), and VIB (+23%) led in pre-tax profit growth. This breakthrough in the group mainly resulted from reduced credit risk provisions, except for STB. However, the picture of net interest income among these banks was mixed. STB and VPB maintained net interest income growth in line with the industry average, while VIB, ACB, and TPB lagged significantly due to a further decline in NIM.

|

Table 2: Pre-tax Profits of Banks in Q2 2025

Source: Consolidated

|

Regarding small-scale banks, some achieved very high pre-tax profit growth: ABB (+279%), NVB (+535%), and PGB (+98%). This performance was accompanied by impressive credit growth ranging from 23% to 35% YoY, the highest in the industry. However, this breakthrough often comes with significant fluctuations. For instance, NVB’s 535% profit surge mainly resulted from net interest income due to successful restructuring and new lending initiatives as per the roadmap. Nevertheless, the bank’s credit risk provisions also soared by 115% YoY, indicating that underlying risks remain.

Q2 2025 results indicate that bank profits continue to grow but at a slow recovery pace and amid multiple challenges. The most significant obstacle lies in the difficulty of improving net interest income. Consequently, banks have turned to other solutions to maintain business efficiency, including diversifying non-interest income sources and tightly controlling the growth rate of provisioning expenses. Notably, small banks showed more room for breakthrough compared to larger peers in this period. Their success stems from robust credit expansion, a slower decline in NIM, and, notably, some banks benefiting from effective restructuring.

– 08:10 06/08/2025

The First Vietnamese Bank to Hit the 3-Million-Billion-Dong Mark: A Monumental Achievement

“This bank currently leads the banking system in all three financial indicators: asset scale, customer loan balance, and bank deposits. With an impressive performance, it has solidified its position as a top financial institution, outperforming its competitors and establishing itself as a powerhouse in the industry.”

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

“Sacombank has been recognized as one of the top 10 most reputable commercial banks in Vietnam for 2025 by Vietnam Report and VietNamNet Newspaper. Not only has the bank climbed to the top 5 most reputable private joint-stock commercial banks, but it has also secured a spot in the top 50 public companies for trust and performance (VIX50). This achievement is a testament to Sacombank’s financial prowess, media reputation, and positive feedback from key stakeholders in the financial and banking markets, as evaluated through independent assessment criteria.”

“Top 10 Banks With the Highest Profit in Q2 2025: A New Leader Emerges as VietinBank, Vietcombank, and BIDV Claim Over One-Third of the Banking Sector’s Profit on the Stock Exchange”

As of the morning of July 31st, all 27 banks listed on the stock exchange had released their financial reports for the second quarter of 2025. Impressively, these banks collectively raked in a total profit of 89,341 billion VND in Q2 2025, marking an 18% increase compared to the same period in 2024.

“Saigonbank Reports a 22% Drop in Pre-Tax Profits: A Significant Rise in Provision Costs”

“Saigonbank’s latest quarterly report reveals a pre-tax profit of over VND 76 billion in Q2 of 2025, marking a 22% dip compared to the previous year’s figures. This decrease is attributed to a significant 79% surge in credit risk provisions, highlighting the bank’s cautious approach amidst economic uncertainties.”