Vietnam’s coal imports: A necessary evil?

According to preliminary statistics from the Customs Department, Vietnam’s coal imports in June reached over 6.4 million tons, valued at more than $645 million, a slight decrease from the previous month.

In the first six months of the year, the country imported over 38 million tons of coal, valued at more than $3.8 billion, up 13.3% in volume but down 8.8% in value compared to the same period in 2024, as the average import price stood at just $101 per ton, a decrease of over 19%.

The decrease in price but increase in volume indicates that domestic consumption demand for coal remains high, especially given the continued reliance on thermal power in the national energy system.

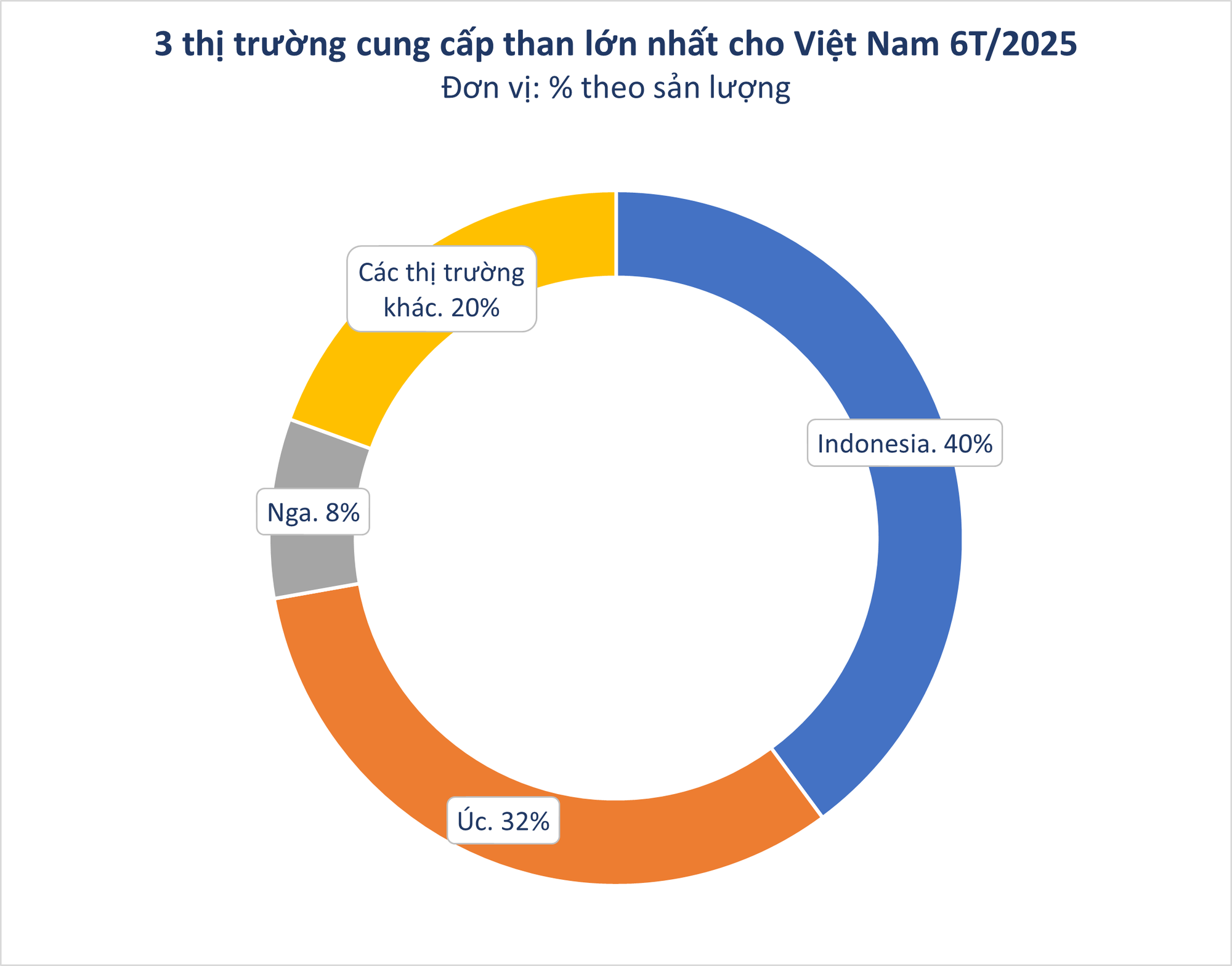

Indonesia maintained its position as Vietnam’s largest coal supplier in the first half of the year, providing over 15 million tons, worth over $1.22 billion, an increase of 6% in volume but a decrease of 9% in value year-on-year. The average price was $81 per ton, lower than the market average.

Australia was the second-largest import market, supplying Vietnam with over 12.4 million tons, valued at over $1.5 billion, a significant increase of 50% in volume and 8% in value compared to the same period last year. The average import price decreased by more than 28%.

Notably, Russia has emerged as the third-largest supplier to Vietnam in the first six months, with over 3.1 million tons, worth over $419 million, an increase of 7.7% in volume but a decrease of 23% in value year-on-year. The decrease in trade value is attributed to a more than 23% drop in the average import price, equivalent to $132 per ton.

Vietnam’s coal imports on the rise since 2021

According to statistics from the Customs sector, Vietnam’s coal imports have been on a strong upward trend since 2021. The surge in coal imports each year can be attributed to the increasing consumption demands from various industries, with thermal power and cement production being the most prominent. Given that coal-fired power generation is expected to remain high during the dry season, coal imports are projected to continue rising.

Vietnam is among the top five coal-consuming economies in Southeast Asia. Despite being a long-standing producer of coal, Vietnam relies on imports due to the inability of domestic supply to meet quality requirements. Most of the locally mined coal is suitable for cement production or small-scale operations. In contrast, modern thermal power plants demand coal with higher calorific value, consistency, and lower impurities.

Additionally, as easily exploitable domestic reserves are gradually depleting, mines are forced to dig deeper, resulting in increased costs and reduced efficiency. Meanwhile, importing cheap coal allows businesses to maintain supply flexibility while reducing production costs.

Currently, imported coal is subject to a standard Most Favored Nation (MFN) tax rate of 3-5%. The specific MFN rate depends on the type of coal and its corresponding tariff code.

This year, Vietnam is expected to produce approximately 37 million tons of clean coal, while consumption is projected to reach 50 million tons, mainly for thermal power plants. As a result, Vietnam will continue to rely on imports, particularly of thermal coal from Indonesia and Australia. Despite a shift towards renewable energy, coal is set to remain a key component of the country’s energy mix until 2030.