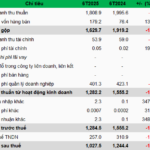

According to the consolidated financial statements, Q2 net revenue remained unchanged at approximately VND 3,190 billion. However, the gross profit margin improved significantly, increasing from 14.45% to 19.51%, resulting in a gross profit of VND 623 billion, the highest since Q3 2022. Financial activities also contributed positively, with revenue increasing by 15% to VND 135 billion, while expenses decreased by half to VND 27 billion.

In the first six months of the year, VHC recorded a net profit of VND 691 billion, an increase of nearly 42% compared to the same period, despite a decrease in revenue to VND 5,840 billion. This is the most positive semi-annual result since 2022, achieving about 53% of the optimistic profit target for the whole year and 70% according to the basic plan.

| VHC had the most favorable first half since 2022 |

Previously, the Company adjusted its plans just before the annual general meeting, reducing its profit target from VND 1,500 billion due to concerns about tax risks from the United States. General Director Nguyen Ngo Vi Tam stated that the change reflected caution as the US announced a countervailing duty rate of up to 46%, although it was later extended for another 90 days. According to Ms. Tam, this tax rate, if applied, could reduce profits by 15-30%.

At the annual meeting, Ms. Tam affirmed that export activities in Q2 remained stable as businesses proactively delivered goods early, avoiding the time when the tax took effect in early July.

Chairwoman of the Board of Directors Truong Thi Le Khanh also expressed confidence, stating that Vietnamese pangasius meets the tastes of American consumers and has almost no substitute. In addition, VHC‘s removal from the anti-dumping tax list further strengthens its position in this market.

The US is currently VHC’s largest export market, accounting for 56% of total sales in 2024. At the beginning of 2025, the Company was the only unit in Vietnam to be exempted by the US from anti-dumping taxes on pangasius and basa.

As of the end of Q2, VHC’s total assets were nearly VND 12,800 billion, slightly higher than at the beginning of the year. Of this, bank deposits exceeded VND 3,000 billion. Short-term receivables increased nearly threefold to VND 122 billion, with advances to employees rising sharply from VND 24 billion to VND 109 billion. This amount is secured by land use rights.

Meanwhile, short-term payable expenses doubled to VND 139 billion, mainly due to inventory in transit. The investment portfolio in NLG, DXS, and KBC stocks reduced provisions thanks to the market recovery.

VHC leadership lowers profit target as the US announces countervailing duties – Photo: FB Vinh Hoan

|

VHC Shareholders’ Meeting: No need to be pessimistic about the pangasius market in the US

Vinh Hoan lowers business plan on the eve of the annual general meeting

Pangasius exports in the first six months increased by 11%

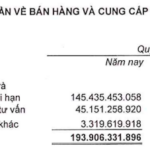

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), pangasius exports from Vietnam in the first six months brought in more than $1 billion, up 11% over the same period.

Frozen fillet products continued to lead with a turnover of $821 million, up 11%, accounting for 98% of the total pangasius export value. Deep-processed products reached $26 million, up 48%, reflecting a shift towards higher value-added items.

In terms of markets, the US recorded impressive growth. In total, in the first six months, this market consumed $175 million worth of Vietnamese pangasius, up 10%; specifically, in June, it increased by 23%. Brazil was also a bright spot, with a 111% increase in June, reaching $16 million. In total, exports to the South American country reached $175 million, up 10%.

Meanwhile, exports to China and Hong Kong reached only $249 million in the first six months, down 4%, but it remains the largest market in terms of scale. The EU bloc increased slightly by 5%, earning $90 million, with the Netherlands being the largest importing country with $26 million, up 11%.

On July 15, the US officially announced that it would impose a 20% countervailing duty on imports from Vietnam, effective August 1. According to VASEP, some businesses have started shifting towards deep-processed products to increase value and limit the risk of price increases after taxes. The Q2 export results mainly reflected FOB or CIF orders signed earlier, so they did not fully reflect the actual impact of the new tax policy.

– 14:12 05/08/2025

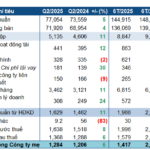

The Vietnam Stock Exchange Plunges 17% in H1 Profits

In the first half of 2025, the Vietnam Stock Exchange (VNX) recorded a remarkable performance with approximately VND 1,809 billion in net revenue and nearly VND 1,028 billion in net profit, reflecting a 9% and 17% decrease, respectively, compared to the same period last year.

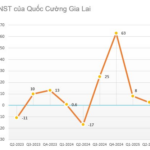

“DXS Profits Soar: First-Half Earnings Quadruple with 46% Increase in Down Payments for Condos and Land”

Recognizing an extraordinary performance in Q2, the net profit of the Real Estate Service Joint Stock Company (HOSE: DXS) for the first half of 2025 tripled that of the same period last year, reaching an impressive VND 258 billion.