|

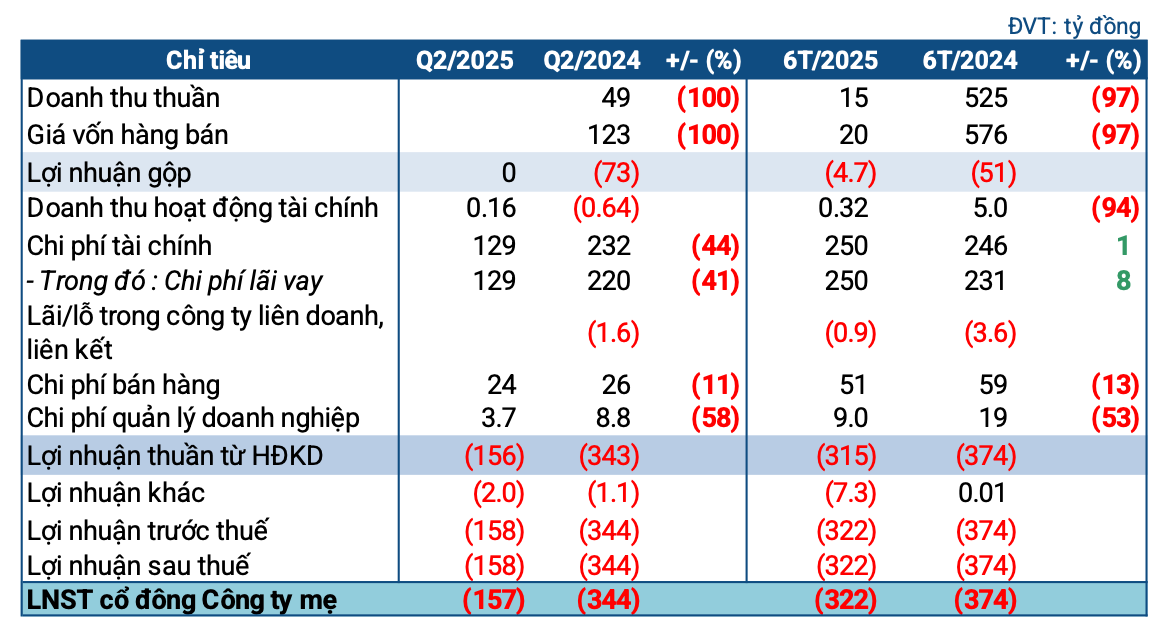

PetroVietnam Southern’s Q2 2025 Business Results

Source: VietstockFinance

|

In Q2 2025, PetroVietnam Southern (PSH) witnessed a lack of revenue and cost of goods sold. The only income during this period was financial revenue, amounting to approximately VND 160 million (compared to a loss of over VND 640 million in the same period last year). After deducting expenses, the company suffered a net loss of VND 157 billion (compared to a loss of VND 344 billion in the same period), marking the seventh consecutive quarter of losses.

| Business Performance of PSH |

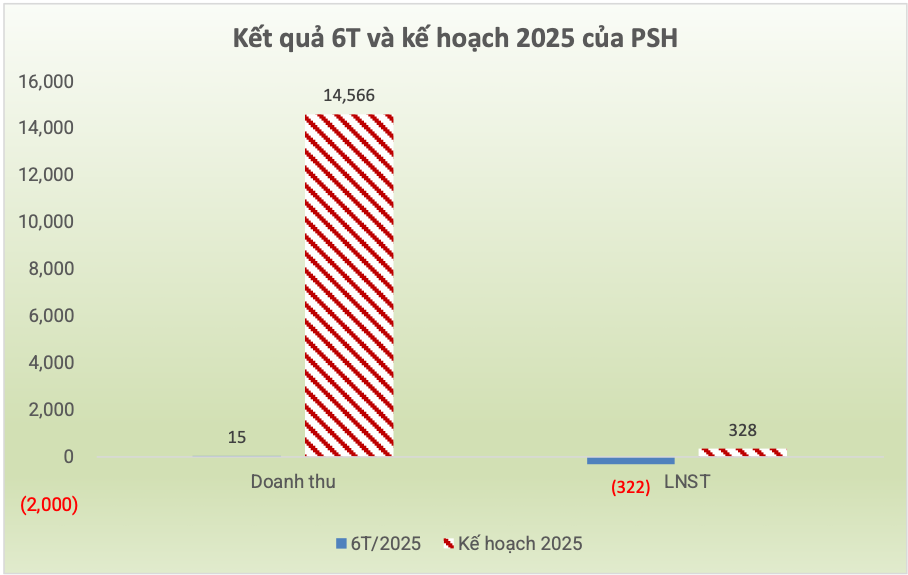

In the first six months of the year, the company generated VND 15 billion in revenue, a 97% decrease compared to the previous year, and continued to incur a net loss of VND 322 billion (compared to a loss of VND 374 billion in the same period). At the 2025 Annual General Meeting of Shareholders, PSH ambitiously set a target of over VND 14.5 trillion in revenue and VND 328 billion in after-tax profit. However, based on the semi-annual results, the chances of achieving these goals are diminishing. The accumulated loss at the end of June reached nearly VND 831 billion.

Source: VietstockFinance

|

PSH has been facing challenges since being fined and having their invoices enforced by the Tax Departments of Hau Giang and Can Tho provinces in late 2023, amounting to over VND 1.2 trillion.

To address these financial obligations, PSH is working with Acuity Funding and BIDV – Branch of Transaction Office 2 to secure loans to repay taxes. Meanwhile, the bondholders of PSHH2224002 and PSHH2224003 have agreed to debt rescheduling and committed to not enforcing their rights over the company’s assets for the next six months, providing the company with time to improve its situation. However, the lack of revenue in Q2 indicates that the tax debt issue remains unresolved, and the company is unable to resume normal business operations.

In reality, PSH had announced the resolution of its Board of Directors regarding loan agreements related to a multi-million-dollar loan arranged and managed by its strategic partner, Acuity Funding, in mid-2024, with the aim of obtaining a $720 million funding package to resolve tax debts. However, the disbursement process encountered obstacles. At the 2024 Annual General Meeting, Chairman Mai Van Huy attributed this issue to a regulation from Circular 08, which prohibits using foreign loans to repay domestic debts. At that time, Mr. Huy revealed a plan to bring cash into the country and deposit it in a bank to create a tripartite contract for PSH to mortgage with the foreign partner.

Additionally, the relationship between PSH and Acuity Funding appears less than harmonious, as evidenced by the case of Mr. Ranjit Prithviraj Thambyrajah (R.P.T.), a member of Acuity Funding, who was appointed as PSH’s CEO at the 2024 Annual General Meeting, but later sent a document to authorities regarding his temporary travel ban.

KPF and PSH stocks started trading on UPCoM from July 09

HOSE decides on compulsory delisting of PSH stocks

PSH provides information on the temporary travel ban of its CEO

PSH “wipes out” for 6 consecutive sessions due to shareholder exodus?

As of the end of June, PSH’s total assets amounted to nearly VND 10.6 trillion, a slight decrease from the beginning of the year, including VND 5.9 trillion in short-term assets, a minor decline. The company held nearly VND 61 billion in cash (compared to just over VND 5.2 billion at the beginning of the year). Accounts receivable from customers totaled over VND 814 billion, a 13% decrease. Inventory remained unchanged, recorded at nearly VND 4,680 billion.

Construction in progress amounted to over VND 1,900 billion, reflecting expenses for projects such as Vam Lang, Phong Dien, Soai Rap, Mai Dam warehouse, and biofuel plant… At the 2025 Annual General Meeting, PSH stated that these projects are underway, and their completion is expected to bring significant revenue to the company.

On the capital side, short-term debt accounted for the majority of the company’s payables, reaching VND 8.2 trillion, a slight increase from the beginning of the year. Borrowings totaled over VND 5.5 trillion, a minor rise, mostly comprising loans from BIDV and Agribank.

– 08:58 06/08/2025

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”

SHS Plans to Offer 5 Million ESOP Shares

SHS is set to offer 5 million ESOP shares at VND 10,000 per share, aiming to raise VND 50 billion to supplement the company’s operating capital.

“Ben Thanh TSC Announces 30% Cash Dividend, to be Paid in Two Installments”

Ben Thanh Trading & Services Joint Stock Company (Ben Thanh TSC) has announced a generous cash dividend payout of VND 40.5 billion for the fiscal year 2024, amounting to a 30% dividend ratio. This payout marks the second-highest dividend in the company’s history and is a testament to its strong financial performance and commitment to returning value to shareholders. As the company embarks on a new phase of growth, with plans to reinvest profits into a long-awaited project in the heart of Ho Chi Minh City, this dividend declaration stands as a highlight in the company’s trajectory.

“Cen Land Reports Significant Growth in Second Quarter After-Tax Profit”

Century Real Estate Joint Stock Company (Cen Land, HOSE: CRE) has unveiled impressive business results for the second quarter and the first half of 2025, showcasing a remarkable surge in post-tax profits.