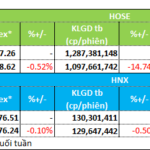

Vietnam’s stock market opened the first trading session of the week with a vibrant green hue. The upward trend expanded towards the end of the session on August 4th, with the consensus of large industry groups. At the close, the VN-Index surged nearly 33 points to 1,528.19. Liquidity on HoSE remained high, with a matching value of 30.9 trillion VND.

Against the backdrop of a vibrant VN-Index, foreign investors unexpectedly net sold heavily VND 10,242 billion in the market, setting an unprecedented net selling record. Specifically:

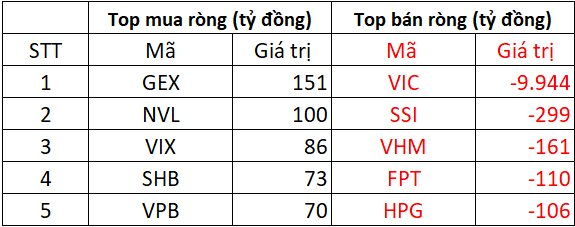

On HoSE, foreign investors net sold nearly VND 10,258 billion

In the buying direction, GEX shares were the most net bought by foreign investors in the market, with a value of about VND 151 billion, and NVL was also net bought VND 100 billion in today’s session. In addition, other codes such as VIX, SHB, and VPB were also net bought from VND 70 billion to VND 86 billion.

In the opposite direction, VIC had a net selling transaction today with a value of VND 9,944 billion, of which foreign investors net sold 90 million VIC shares through matching, with a value of VND 9,819 billion.

Today’s net selling by foreign investors related to SK is part of SK’s global investment portfolio restructuring strategy, which has been previously announced. VIC is just one of SK’s investments that it has been and is in the process of divesting.

With the positive performance of VIC shares since the beginning of the year, SK assesses that this is the optimal time to divest. SK will continue to maintain a strategic partnership with Vingroup and look for opportunities to cooperate and develop. The Group is also currently interested in the field of renewable energy in Vietnam.

In addition, other stocks such as SSI, VHM, FPT, and HPG were also heavily net sold by foreign investors, ranging from over VND 100 billion to nearly VND 300 billion.

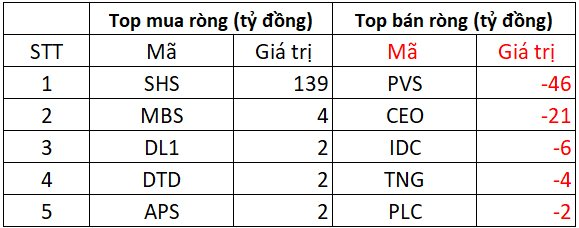

On HNX, foreign investors net bought about VND 71 billion

In the buying direction, SHS shares were the most net bought on HNX with a value of VND 139 billion, followed by MBS, DL1, DTD, and APS, with a net buying value of VND 2-4 billion each.

In contrast, PVS and CEO shares were heavily net sold on HNX, with values ranging from VND 21-46 billion. In addition, IDC, TNG, and PLC were also net sold from VND 2 billion to nearly VND 6 billion each.

On UPCOM, foreign investors net sold approximately VND 56 billion

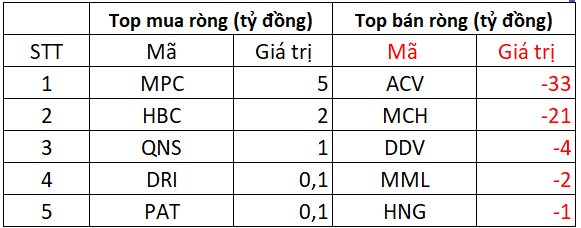

In the buying direction, MPC, HBC, and QNS shares were net bought VND 5 billion, VND 2 billion, and VND 1 billion, respectively. Following were DRI and PAT, which were net bought in the hundred million VND range.

On the opposite side, ACV shares were heavily net sold with a value of VND 33 billion, and MCH was also net sold VND 21 billion, while DDV, MML, and HNG were net sold in the range of a few billion VND.

The Stock Market Frenzy: Investors Rush to Open Accounts as VN-Index Soars to New Heights

The number of new securities accounts opened in July hit an 11-month high, marking a significant surge in investor activity.

The Two Stock Symbols Unexpectedly Sold Off by Proprietary Trading Firms in Monday’s Session

The HoSE witnessed a significant development as proprietary securities firms offloaded stocks en masse, resulting in a staggering net sell value of VND 296 billion.