HDCapital Investment JSC (HDCapital) has acquired 15.3 million shares of Petrosetco, equivalent to a 14.34% stake in the Total Petroleum Services Joint Stock Company (Petrosetco – code PET). With this move, HDCapital has become the second largest shareholder in Petrosetco, only after the Vietnam Oil and Gas Group (now Vietnam Energy and Industrial Group – PVN).

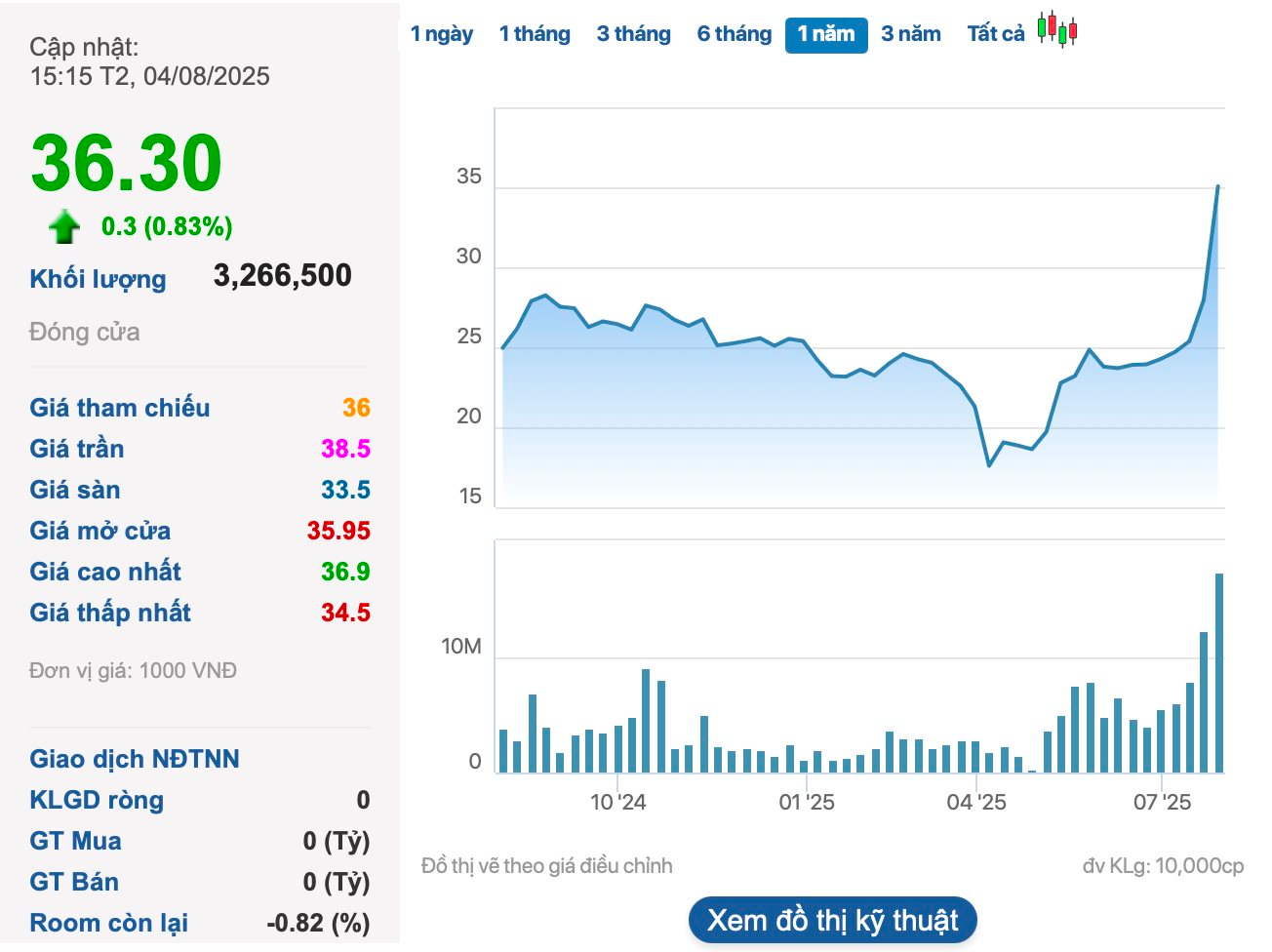

The transaction took place on July 28, as PET shares saw a series of large matching orders totaling nearly 20.3 million units, or 19% of the circulating shares. The matching price was VND 28,000/share, valuing the deal at approximately VND 570 billion. HDCapital was likely one of the buyers in these transactions.

In contrast, several Petrosetco executives have registered to sell all their PET holdings from August 6 to September 4. Specifically, Mr. Ho Minh Viet, a member of the Board of Directors, registered to sell 209,100 shares; Mr. Ho Hoang Nguyen Vu, Vice President, registered to sell 78,020 shares; Mr. Huynh Van Ngan, Vice President, registered to sell 297,000 shares; and Mr. Vu Tien Duong, member of the Board of Directors and General Director, registered to sell 399,250 shares.

Prior to this, during the sessions of July 23-24 when PET saw a series of large matching orders, VietinBank Capital Joint Stock Company (a subsidiary of Vietnam Industrial and Commercial Bank) divested its entire stake. The fund sold 7.8 million PET shares on July 23, reducing its ownership from 9.37% to 2.06% (equivalent to 2.2 million shares) and is no longer a major shareholder in Petrosetco. The fund likely sold its remaining shares in the session on July 24.

According to the documents of the 2025 Annual General Meeting of Shareholders, Petrosetco announced that PVN will divest its entire state capital (more than 24.9 million shares, equivalent to a 23.2% stake) in the company this year, marking an important turning point in its development history. If this plan proceeds as scheduled, Petrosetco’s shareholder structure will undergo significant changes.

On the stock exchange, PET shares have surged nearly 50% in the past month and are currently trading near their 3-year high. At the close of the session on August 4, PET shares stood at VND 36,300/share, with a market capitalization of nearly VND 3,900 billion.

For the 2025 business plan, Petrosetco targets consolidated net revenue of VND 20,500 billion, pre-tax profit of VND 305 billion, and net profit of VND 244 billion, up 8%, 8%, and 11% respectively compared to 2024. In 2025, the company plans to pay dividends at a maximum rate of 10%, with a 6% bonus and welfare fund.

At the 2025 Annual General Meeting of Shareholders, Petrosetco’s shareholders approved a plan to allocate 6% to the bonus and welfare fund, equivalent to nearly VND 3.4 billion, and pay a 5% cash dividend (VND 500/share) for 2024, equivalent to over VND 53 billion.

A Surprise Sell-Out: Bank Stock Soars Ahead of August’s Cash Dividend Payout

The stock market is buzzing with excitement as share prices soar to new heights. Investors are eagerly snapping up stocks, with buy orders piling up at the max price. It’s a thrilling time for those in the know, as the market surges with energy and potential profits.

Insider Trading: PET Leaders’ Strategic Exit as Share Prices Soar, Welcoming HDCapital as a Major Investor.

Recent developments at the Joint Stock Petroleum Services Corporation (Petrosetco, HOSE: PET) have caught the attention of investors. Five key leaders at the company have registered to sell their entire stock holdings, coinciding with the share price returning to a three-year high. On the flip side, HDCapital has emerged as a significant shareholder, acquiring 15.3 million PET shares on July 28.

“Ben Thanh TSC Announces 30% Cash Dividend, to be Paid in Two Installments”

Ben Thanh Trading & Services Joint Stock Company (Ben Thanh TSC) has announced a generous cash dividend payout of VND 40.5 billion for the fiscal year 2024, amounting to a 30% dividend ratio. This payout marks the second-highest dividend in the company’s history and is a testament to its strong financial performance and commitment to returning value to shareholders. As the company embarks on a new phase of growth, with plans to reinvest profits into a long-awaited project in the heart of Ho Chi Minh City, this dividend declaration stands as a highlight in the company’s trajectory.

The Chief Accountant of PVOIL Hanoi is Appointed as the New Deputy Director

The Hanoi PVOIL Chief Accountant, Mr. Le Duc Dan, has been appointed as the new Vice Director of Petroleum Oil and Gas Vung Ang Joint Stock Company (UPCoM: POV), effective August 1st, 2025, for a four-year term.