Dragon Vietnam Securities has recently released an updated report on the stock market outlook, highlighting the positive shifts in the investment environment as global trade policy uncertainties diminish with the new quarter.

The signing of the executive order by U.S. President Donald Trump to impose countervailing duties on goods from multiple countries, including a significant reduction in tariffs on Vietnamese goods from 46% to 20%, sets a new tone for subsequent detailed negotiations.

This new tariff rate is not only considerably lower than previously proposed but also on par with other Southeast Asian countries and more advantageous than direct competitors like China and India. This restores Vietnam’s competitive edge in terms of cost, infrastructure, and geographical location in the race for attracting orders and FDI in the medium to long term.

In the short term, the tariff reduction provides a significant boost to import-export activities, stabilizing capital flows and easing pressure on policies geared towards supporting economic growth.

However, the U.S.’s tightened regulations on “transhipped” goods to curb Chinese products masquerading as originating from third countries pose a short-term challenge for Vietnamese businesses heavily reliant on imported supplies. Nevertheless, this is a regional risk affecting nations closely linked to China’s supply chain.

From a long-term perspective, this also presents an opportunity for Vietnam to attract capital shifting away from China, thus gradually enhancing its domestic manufacturing value chain and ancillary industries.

Externally, the new tariffs, 10% higher than pre-negotiation levels, will cause U.S. importers to adjust their selling prices, directly impacting consumers. Core PCE inflation shows signs of rebounding, potentially delaying the Fed’s rate cut plans.

However, with unemployment rates in the U.S. trending upward, the Fed may need to reconsider its monetary policies to stabilize the labor market and sustain economic recovery. The Fed’s cautious stance, which seems out of sync with market expectations, could create valuation risks for global financial assets.

Regarding business prospects, catalysts such as domestic demand stimulation, stable exports, robust public investment disbursement, and accelerated credit growth will be the primary drivers for listed companies’ profit growth in the coming quarters.

VDSC estimates a roughly 14% year-over-year increase in the overall market’s profit in Q3 2025, mainly driven by the banking sector and non-financial enterprises. The real estate group is not expected to maintain its leading role due to the dissipation of abnormally high profits from the previous year.

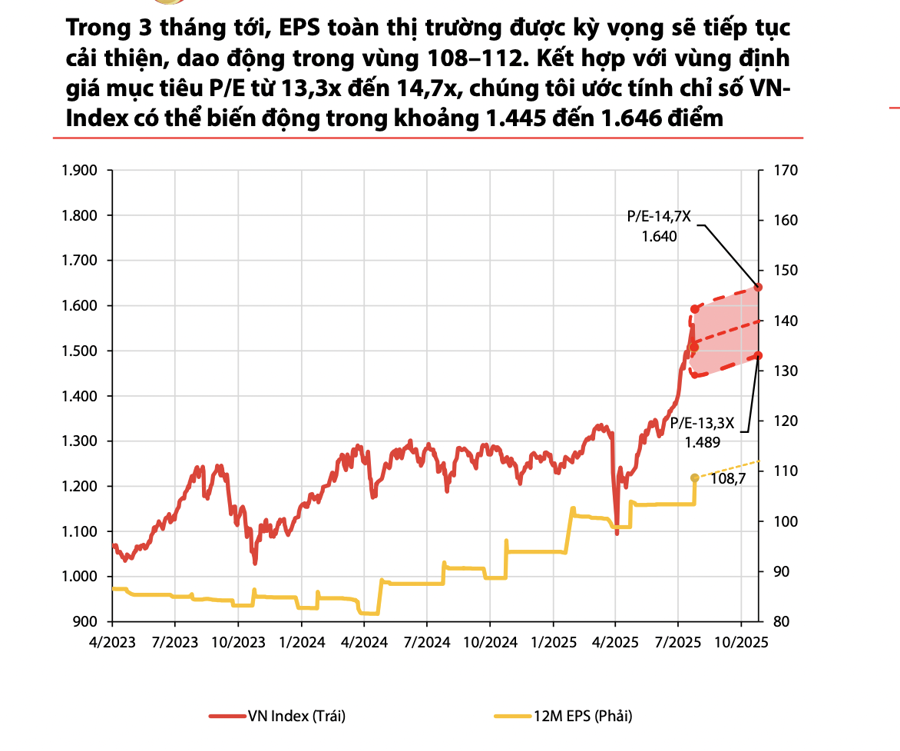

As of the end of Q2 2025, the VN-Index’s cumulative EPS for the last four quarters stood at approximately VND 108.7 per share and is projected to improve to VND 112. The market’s P/E valuation has thus decreased to 13.8 times (as of July 31, 2025), reflecting relative attractiveness amid continued liquidity support from monetary policies and market upgrade expectations.

Considering these factors, VDSC maintains its target P/E valuation range of 13.3x to 14.7x, corresponding to a VN-Index trading range of 1,445–1,646 points over the next three months.

VDSC remains steadfast in advocating a high allocation to listed equity assets, particularly focusing on businesses capable of expanding their operations and resilient to inflation. With liquidity being the central factor supporting market performance, capital tends to vigorously rotate into stocks with growth potential.

In light of the latest developments in trade policies, VDSC believes this is an opportune time to adjust portfolios by incorporating sectors expected to witness marked improvements but are not yet fully reflected in their valuations.

Industrial parks and seafood are two prominent sectors anticipated to reap clear benefits. Specifically, the outlook for seafood exports to the U.S. market is likely unaffected due to the nature of low-priced products, short supply chains, and minimal external dependence.

The industrial park sector will benefit from the new tariff landscape, bolstering Vietnam’s inherent competitive advantages in terms of cost, infrastructure, and strategic geographical location. Three stocks highly regarded this quarter are SIP, ANV, and FMC.

The Shocking Rise and Fall: VN-Index Sets New Turnover Records, But For How Long?

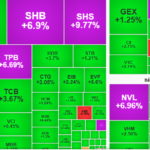

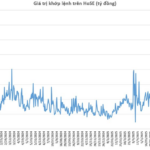

The market took an unexpected turn this afternoon, catching investors off-guard. As the VN-Index soared to a 3.72% gain, a sudden wave of selling hit, sending the index plunging. In just under 30 minutes, the index dropped 0.6%, resulting in a staggering 4.34% swing. Today’s trading volume on the HoSE exchange surged to a new record high of 72,841 billion VND, surpassing the previous record set on July 29.

New Record: Nearly VND 70,000 Billion in Matching Orders on HoSE

The VN-Index’s consecutive record-breaking performance has ignited a speculative frenzy, resulting in a vibrant trading landscape unseen in recent times.

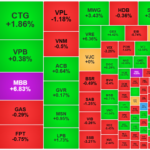

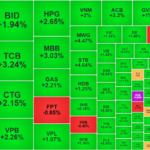

The Stock Market Surge: Banking Sector Leads VN-Index to New Heights

The market slowed down and turned volatile in the afternoon session, but ultimately finished on a positive note. The VN-Index rose 1.72% to 1573.71, closing at a new all-time high. This achievement was largely driven by TCB, VCB, and the banking sector as a whole, which propelled the index beyond its previous peak.