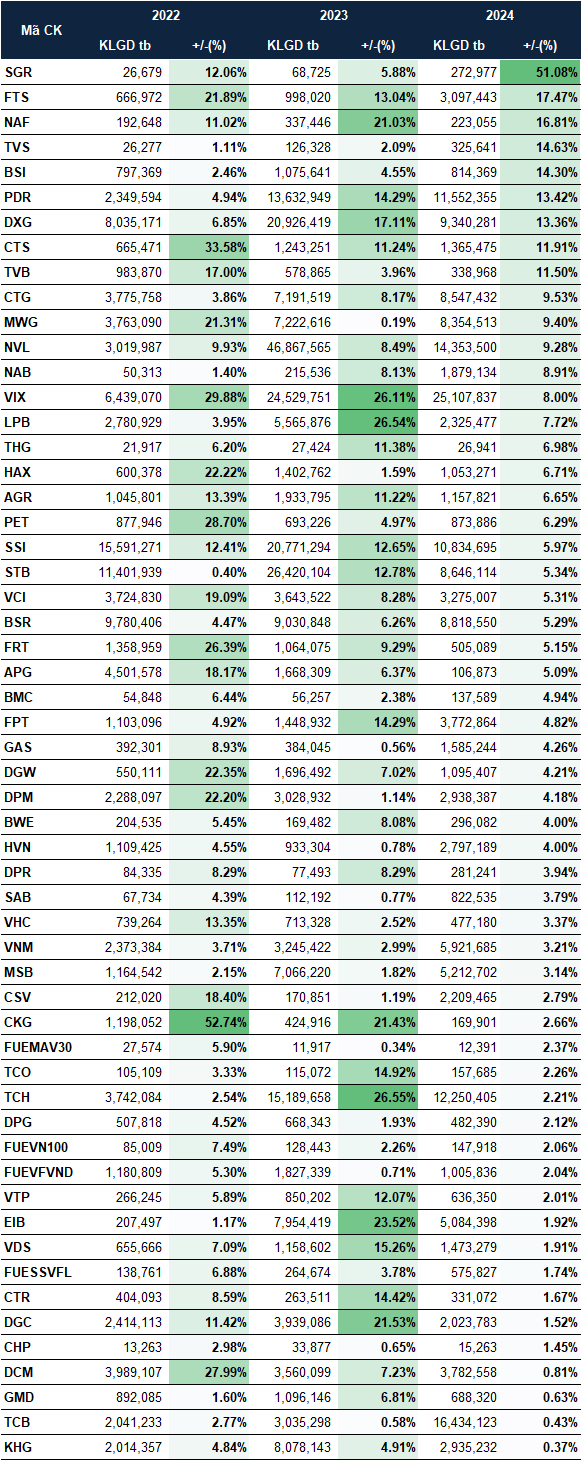

According to VietstockFinance, there were 56 stocks/fund certificates on the HOSE that consistently increased in August over the last three years (2022-2024). Notably, several large enterprises across various sectors exhibited this trend, including NVL, DXG, and PDR from the real estate industry; SSI and VCI from securities; DCM, DGC, and DPM from chemicals and fertilizers; SAB and VNM from beverages; and DGW and FRT from retail.

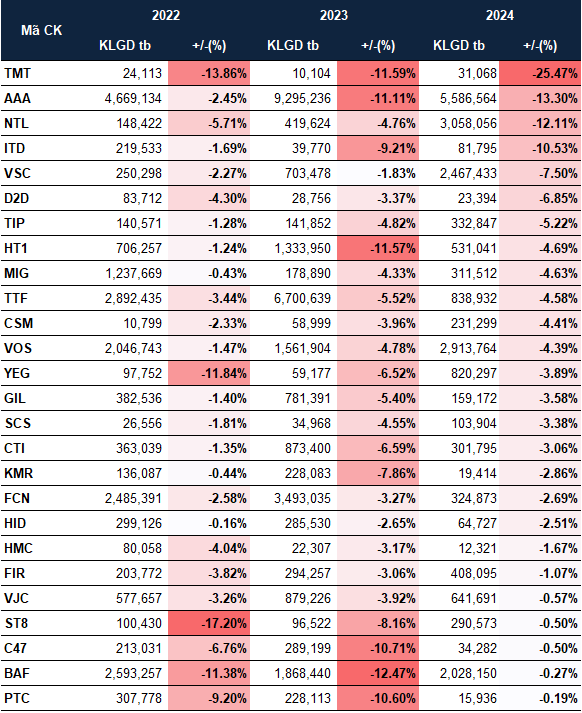

On the contrary, 26 stocks experienced consistent declines during this period, with notable mentions such as NTL, TIP, MIG, FCN, and BAF, among others.

|

Stocks on the HOSE that increased in August from 2022-2024

Source: VietstockFinance

|

|

Stocks on the HOSE that decreased in July from 2022-2024

Source: VietstockFinance

|

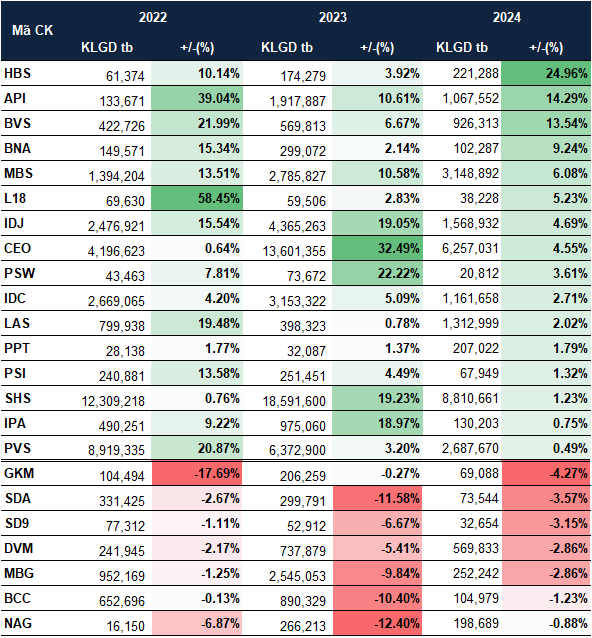

On the HNX exchange, 16 stocks predominantly increased in August, featuring prominent names like IDC, CEO, API, and MBS. Conversely, seven stocks declined, including GKM, SDA, SD9, DVM, MBG, BCC, and NAG.

|

Stocks on the HNX that increased/decreased in August from 2022-2024

Source: VietstockFinance

|

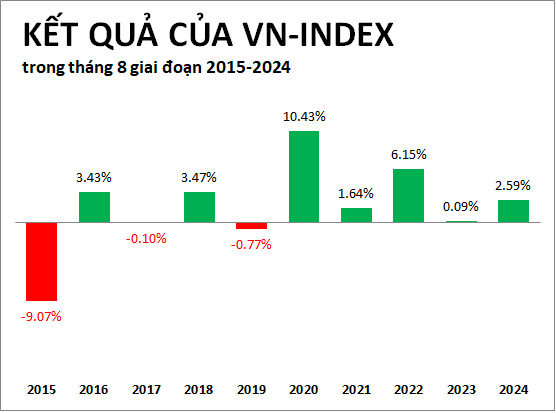

August not only showcased a disparity between the number of rising and falling stocks but also presented a historically favorable period for the VN-Index over the last decade (2015-2024). Specifically, the index only declined in 2015, 2017, and 2019 during this timeframe.

Source: VietstockFinance

|

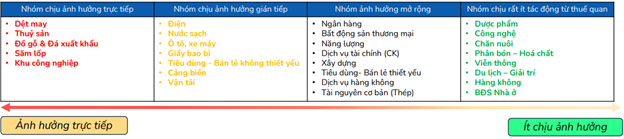

According to the mid-2025 industry report by BSC Securities Company, investors can prioritize recovery to restructure their portfolios with stocks that are less directly impacted and possess solid fundamentals, attractive valuations, and strong domestic leadership.

Regarding the 20% tax on exports to the US and the 40% tax on “transshipped” goods, BSC highlights several key considerations:

– Determining the ratio of guaranteed origin, the ability to diversify markets, and forecasting the recovery timing for directly impacted groups;

– The defined tax rates reduce market and business uncertainty, aiding in strategic planning and investment;

– The 20% tax rate and vague “transshipment” definition may influence the short-term prospects of directly impacted sectors until further tax agreement details emerge, shifting market focus to domestically driven narratives and private economic development;

– Market valuations remain attractive, with expectations for a PE deficit at the end of 2025 to remain below -1 standard deviation (PE trailing at 13.6 times, lower than the 5-year average of 14.3 times).

|

Portfolio of sectors affected by US tariffs

Source: BSC

|

– 10:00 08/05/2025

Is Q3 the Comeback Quarter for Industrial Real Estate Stocks?

The industrial sector is set to benefit from the new tariff landscape, which reinforces Vietnam’s inherent competitive advantage in terms of cost, infrastructure, and strategic geographic location. This quarter’s standout stocks are SIP, ANV, and FMC, poised to capitalize on these favorable conditions and offer promising opportunities for investors.

The Shocking Rise and Fall: VN-Index Sets New Turnover Records, But For How Long?

The market took an unexpected turn this afternoon, catching investors off-guard. As the VN-Index soared to a 3.72% gain, a sudden wave of selling hit, sending the index plunging. In just under 30 minutes, the index dropped 0.6%, resulting in a staggering 4.34% swing. Today’s trading volume on the HoSE exchange surged to a new record high of 72,841 billion VND, surpassing the previous record set on July 29.

Tomorrow’s Stock Market Outlook: Anticipating VN-Index’s Uptrend to Persist, Driven by Large-Cap Stock Resilience

With a stellar performance by leading stocks such as VIC, VHM, and SHB on August 4th, investors are optimistic about the continued rise of the VN-Index.