|

Vietnam is eagerly anticipating its potential upgrade to an emerging market in the upcoming September review, presenting an opportunity to attract substantial foreign investment. (Source: Vietnam+)

|

Vietnam is eagerly anticipating its potential upgrade to an emerging market in the upcoming September review, conducted by FTSE Russell, a renowned global index provider. This upgrade will open doors to attract substantial foreign investment, particularly from international financial institutions and foreign investment funds.

To delve deeper into the strategies for attracting new capital inflows upon the market upgrade, a correspondent from Vietnam News Agency interviewed Mr. Nguyen Son, Chairman of the Members’ Council of Vietnam Securities Depository (VSDC).

Correspondent: Alongside the ongoing efforts to完善 the legal framework in preparation for the market upgrade evaluation in September, could you elaborate on Vietnam’s plans to attract foreign investors in the upcoming period?

Chairman Nguyen Son: In the past year, the regulatory authorities, market operators, and market members have collectively implemented a range of solutions aimed at upgrading the Vietnamese stock market from a frontier market to an emerging market. According to VSDC’s expectations, in the upcoming September review, the Vietnamese stock market will be upgraded to an emerging market, specifically to the second tier, as per the classification of the international ranking organization FTSE Russell.

With the anticipated market upgrade in September, Vietnam will be able to attract foreign investment funds and international financial institutions. Typically, foreign investors have specific allocation quotas based on their investment criteria. Their investment levels vary depending on the market classification: lower investment in frontier markets, higher investment in emerging markets, and much higher investment in developed markets, indicating a differentiation in risk assessment for investment capital.

To facilitate the market upgrade process, the Ministry of Finance, the State Securities Commission, and market members, under the guidance of the Government, have collaboratively implemented a range of solutions. Specifically:

- Circular No. 68/2024/TT-BTC dated September 18, 2024, of the Minister of Finance, which took effect on November 2, 2024, allows foreign investors to place buy orders for stocks without requiring sufficient funds (margin trading).

- Vietnam has also implemented a mechanism for checking balances between foreign custodian banks and domestic securities companies when placing orders for foreign investors.

- We have addressed bottlenecks, especially in the mechanism for issuing transaction codes for foreign investors through an online code issuance system. We have also coordinated with the State Bank to facilitate the opening of indirect cash accounts, similar to the process for opening securities trading accounts.

- On May 5, 2025, the new trading system for the Vietnamese stock market (KRX) officially commenced operations, enabling the gradual implementation of new technology platforms. This includes the introduction of a central counterparty clearing company, a subsidiary of VSDC. The implementation of this central counterparty mechanism will allow investors to place trading orders without the need for margin or with only a small portion of margin requirements.

- In addition to this technological foundation, when conditions are met, Vietnam can deploy functional applications such as intraday trading, stock buyback, or even allow short-selling mechanisms in the long term. These are part of the roadmap for deploying new technology platforms based on the readiness of the regulatory authorities, stock exchanges, and VSDC.

These are the initiatives that the regulatory authorities and market operators are planning to implement in the upcoming period, contributing to attracting foreign investors to the domestic market.

Correspondent: Apart from technological advancements, what other measures is the regulatory body implementing to attract new foreign capital inflows?

Chairman Nguyen Son: Currently, the Government, the Ministry of Finance, and the State Securities Commission have been actively promoting and introducing the potential of Vietnam’s stock market and investment environment to international markets. Over the past three years, the Ministry of Finance has organized roadshows in the US, UK, Australia, and Singapore, sharing information about economic policies, reforms, and macro-economic bottlenecks. They have also highlighted commitments to consistent policy improvements, innovations in state-owned enterprises, and the development of the private sector in line with Resolution No. 68-NQ/TW dated May 4, 2025, of the Politburo.

These actions affirm to the international investment community Vietnam’s commitment to an open mechanism that values the private sector and implements policies to facilitate foreign investment in the country. Additionally, Vietnam has mechanisms in place to address obstacles in both direct and indirect investment.

A notable example is Vietnam’s progress towards establishing international and regional financial centers through specific policies to develop this foundation. In my opinion, these are the factors that will provide international investors with a clearer understanding and encourage them to channel capital into Vietnam.

|

Customers conducting transactions at Bao Viet Securities Joint Stock Company’s Head Office. (Photo: Tran Viet/VNA)

|

Correspondent: The Ministry of Finance is proposing that individuals transferring securities will be subject to a tax rate of 20% on taxable income, determined by subtracting the purchase price and reasonable expenses from the selling price. If the purchase price and expenses cannot be determined, the tax amount will be equal to 0.1% multiplied by the selling price of securities for each transaction, in accordance with the current regulations. Could this proposal potentially hinder capital inflows into the market?

Chairman Nguyen Son: Each country has different tax policy objectives, resulting in varied adjustment mechanisms. Currently, in the field of taxation in securities, Vietnam is implementing a mechanism that levies taxes on both selling transactions and cash dividend payments, or a policy of taxing stock dividend payments. In reality, many countries also apply this mechanism. Alternatively, some countries impose taxes on net income or capital gains. At present, Vietnam is considering adjusting the mechanism to tax net income for investors.

In my opinion, each taxation mechanism has its advantages and disadvantages. The current mechanism taxes 0.1% on sales revenue, which is straightforward and easy to implement for investors who sell securities. Vietnam also had a period where it applied a dual model, taxing both sales revenue and year-end net income, allowing investors to choose. Now, the Ministry of Finance is proposing a third option, which is to tax net income.

Each proposal has its merits, and the tax authority is discussing this matter. However, whichever option is chosen, we need to consider supporting investors and facilitating foreign organizations entering Vietnam.

– Thank you for your insights, Mr. Chairman./.

Anh Nguyen

– 08:48 05/08/2025

The Shocking Rise and Fall: VN-Index Sets New Turnover Records, But For How Long?

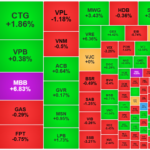

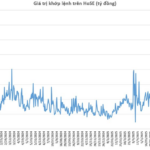

The market took an unexpected turn this afternoon, catching investors off-guard. As the VN-Index soared to a 3.72% gain, a sudden wave of selling hit, sending the index plunging. In just under 30 minutes, the index dropped 0.6%, resulting in a staggering 4.34% swing. Today’s trading volume on the HoSE exchange surged to a new record high of 72,841 billion VND, surpassing the previous record set on July 29.

New Record: Nearly VND 70,000 Billion in Matching Orders on HoSE

The VN-Index’s consecutive record-breaking performance has ignited a speculative frenzy, resulting in a vibrant trading landscape unseen in recent times.

“Phát Đạt Repositions Its Investment Portfolio, Focusing on the Southern Market to Embrace the New Growth Cycle.”

As the real estate market enters a more selective and substantive recovery phase, businesses must reshape their strategies to adapt. Phat Dat Real Estate Development Corporation (HOSE: PDR) is demonstrating a clear and aggressive shift to capture the significant movements in planning, policies, capital flows, and consumer trends.

Corporate Bonds Rebound, Redemption Pressure Mounts

The Vietnamese corporate bond market is witnessing a notable recovery in both issuance and buyback activities, indicating a resurgence of investor and business confidence. However, alongside these positive signals, there is a mounting maturity pressure, particularly from the real estate sector, which faces significant challenges regarding cash flow and repayment capabilities.

“France-sourced Pigs Power BAF’s Ambitious 10 Million Pig Plan for 2030”

Amid the challenging ASF situation, BAF Vietnam Agriculture Joint Stock Company (HOSE: BAF) has imported a significant number of great-grandparent pigs from France for the Central Highlands region. This move aligns with the company’s ambitious goal of reaching 10 million commercial pigs by 2030. The Central Highlands is a key area in BAF’s strategy to expand its pig population, thanks to its favorable climate and vast land area, which are ideal for large-scale, closed-system farm models.