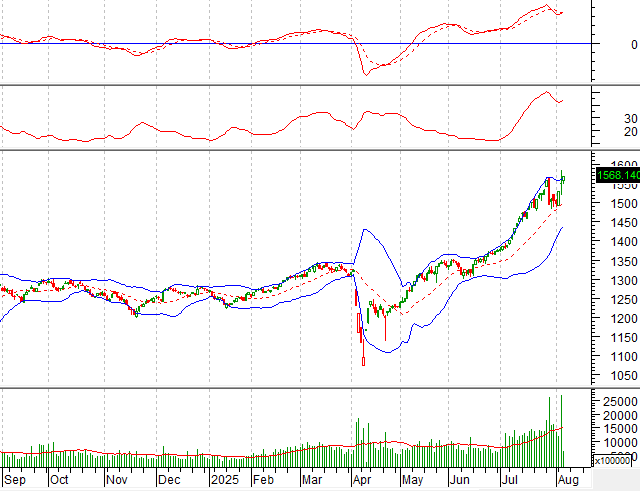

Technical Signals for VN-Index

In the trading session on the morning of August 6, 2025, the VN-Index opened higher and formed a small body candle pattern, while trading volume declined sharply in the morning session, indicating investors’ hesitation.

Currently, the index is closely following the upper band of the Bollinger Bands, while the ADX indicator remains in the strong trend region (ADX>25), suggesting that the short-term uptrend is still intact.

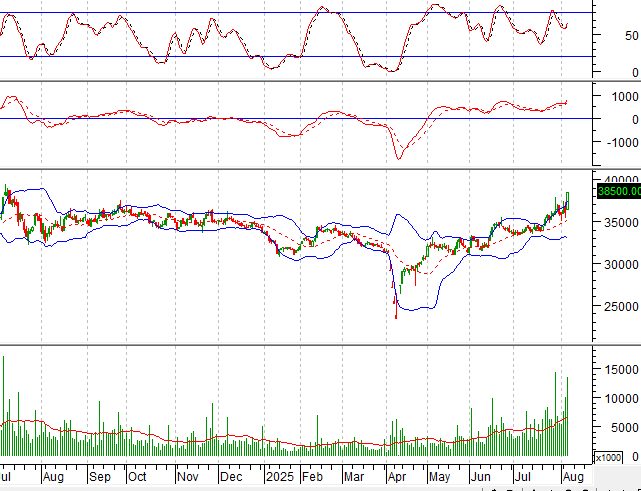

Technical Signals for HNX-Index

In the trading session on the morning of August 6, 2025, the HNX-Index opened slightly higher, accompanied by a significant decline in liquidity, indicating investors’ caution.

In addition, the MACD line is narrowing the gap with the signal line after giving a buy signal. If the indicator turns to a sell signal in the following sessions, the risk of a correction will increase.

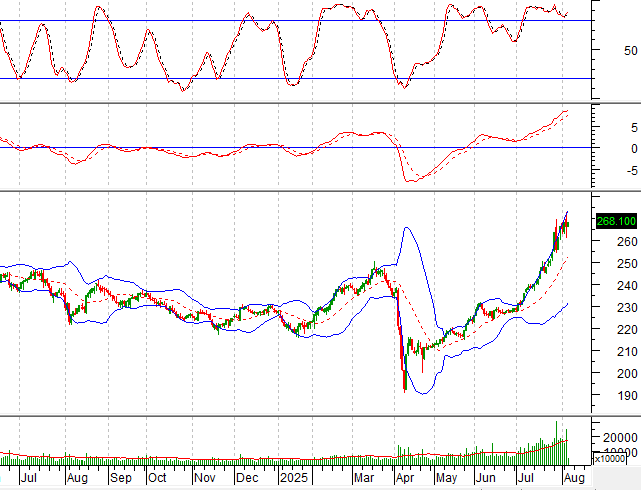

DCM – Ca Mau Petroleum Fertilizer Joint Stock Company

In the morning session of August 6, 2025, DCM stock opened with a strong gain and formed a White Marubozu candle pattern, with trading volume exceeding the 20-session average, indicating active trading by investors.

Additionally, the price broke above the upper band of the Bollinger Bands, while the Stochastic Oscillator gave a buy signal again, suggesting a short-term upward potential.

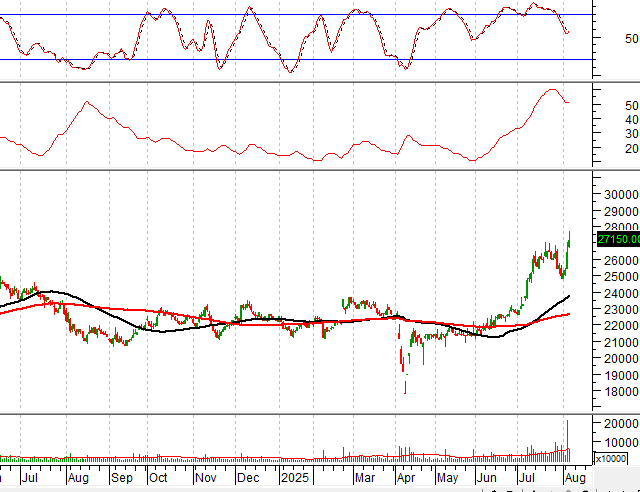

HPG – Hoa Phat Group Joint Stock Company

In the trading session on the morning of August 6, 2025, HPG stock opened higher and formed a Three White Soldiers candle pattern, with trading volume expected to exceed the average by the end of the session, reflecting investors’ optimism.

Furthermore, the ADX indicator remains in the very strong trend region (ADX>25), while the MACD line continues to narrow the gap with the signal line. If a buy signal is triggered in the future, the uptrend will become more sustainable.

Technical Analysis Team, Vietstock Consulting Department

– 12:24 06/08/2025

Is Q3 the Comeback Quarter for Industrial Real Estate Stocks?

The industrial sector is set to benefit from the new tariff landscape, which reinforces Vietnam’s inherent competitive advantage in terms of cost, infrastructure, and strategic geographic location. This quarter’s standout stocks are SIP, ANV, and FMC, poised to capitalize on these favorable conditions and offer promising opportunities for investors.

The Shocking Rise and Fall: VN-Index Sets New Turnover Records, But For How Long?

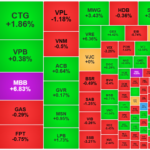

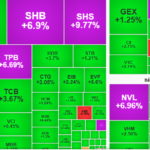

The market took an unexpected turn this afternoon, catching investors off-guard. As the VN-Index soared to a 3.72% gain, a sudden wave of selling hit, sending the index plunging. In just under 30 minutes, the index dropped 0.6%, resulting in a staggering 4.34% swing. Today’s trading volume on the HoSE exchange surged to a new record high of 72,841 billion VND, surpassing the previous record set on July 29.

Is the Market Valuation Still Cheap?

The Q2 2025 earnings season has reflected positively on the market, with EPS witnessing an impressive 8% uptick from the prior quarter. This improvement pulled the P/E ratio of the VN-Index down to a compelling 13.8x as of the market close on July 31, 2025.