MB Bank’s Savings Interest Rates for Individual Customers

A survey conducted in early August revealed that Military Commercial Joint Stock Bank (MB) offers competitive interest rates on savings accounts for individual customers, ranging from 0.5% to 5.8% per annum.

Specifically, for short-term deposits with tenors of 1, 2, and 3 weeks, a uniform interest rate of 0.5% per annum is applicable, regardless of the deposit amount.

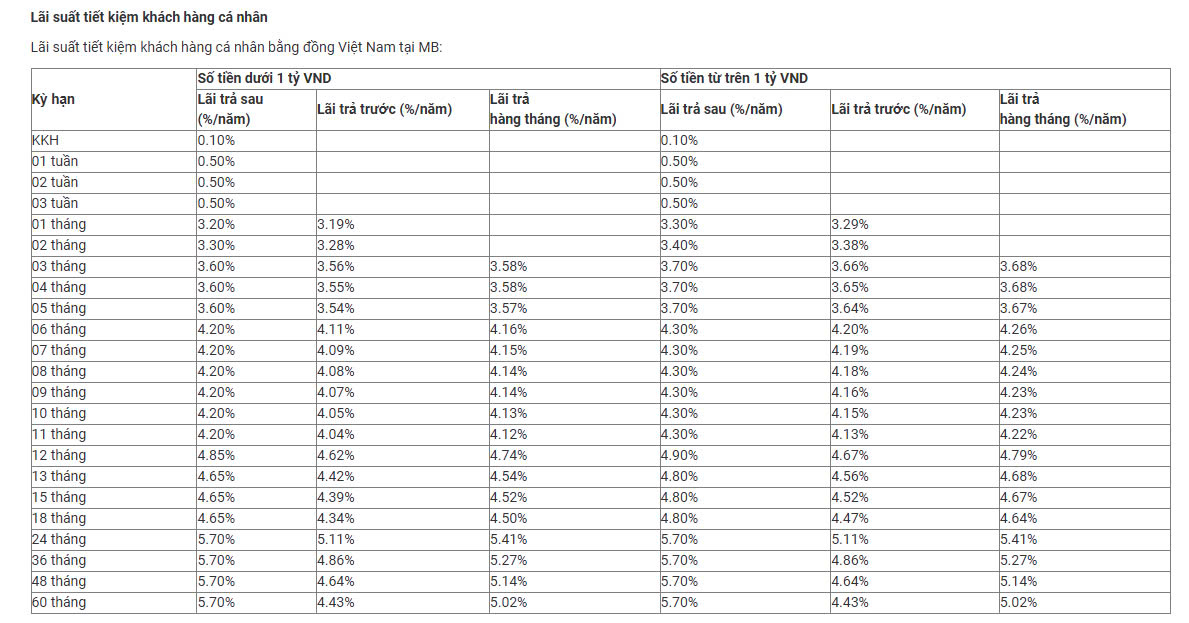

For longer-term deposits, MB differentiates interest rates based on two tiers of deposit amounts: below VND 1 billion and VND 1 billion or above.

For deposits below VND 1 billion, the interest rates are as follows: 1-month tenor earns 3.2% per annum; 2-month tenor, 3.3%; 3-5 months, 3.6%; 6-11 months, 4.2%; 12 months, 4.85%; 13-18 months, 4.65%; and the highest rate of 5.7% per annum for tenors of 24-36 months.

For deposits of VND 1 billion and above, the interest rates are slightly higher: 1-month tenor earns 3.3% per annum; 2-month tenor, 3.4%; 3-5 months, 3.7%; 6-11 months, 4.3%; 12 months and above, 4.9%; 13-18 months, 4.8%; and the highest rate of 5.7% per annum for tenors of 24-36 months, on par with the rate for smaller deposits.

MB’s Savings Interest Rate Table for Individual Customers – August 2025

Additionally, individual customers who deposit at branches in the Central and Southern regions will enjoy slightly higher interest rates compared to other regions, with a difference of approximately 0.1% per annum (excluding tenors shorter than 1 month). The interest rate range for these regions is 0.5% to 5.8% per annum for end-of-term interest payment options. The highest rate of 5.8% per annum is offered for deposits with a tenor of 24 to 60 months.

MB Bank’s Savings Interest Rates for Business Customers

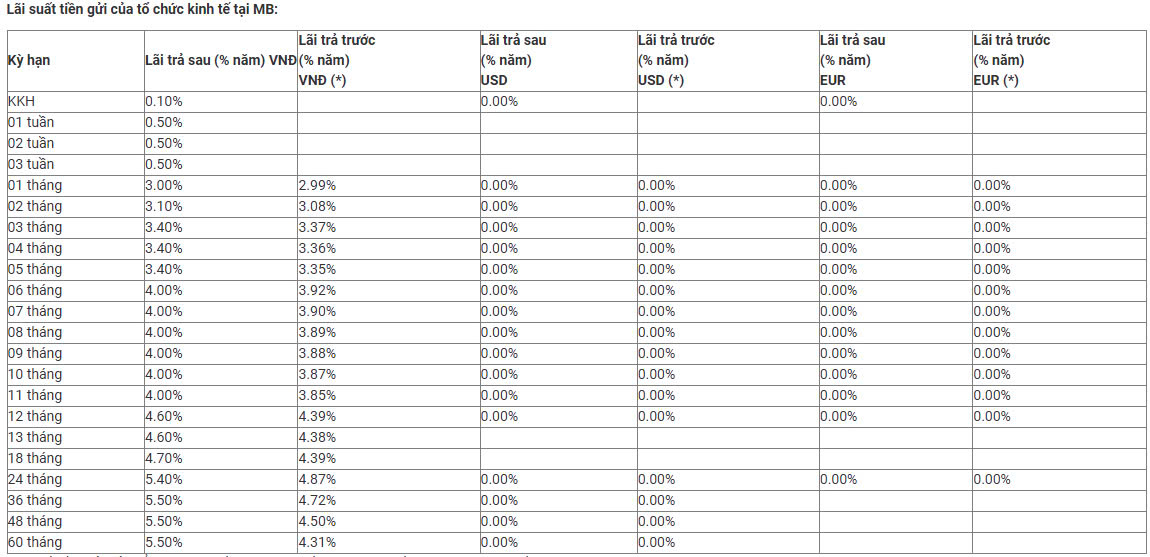

During August, business customers at MB can expect interest rates on term deposits to range from 0.5% to 5.5% per annum for end-of-term interest payment options.

For short-term deposits with tenors of 1, 2, and 3 weeks, the interest rate is set at 0.5% per annum.

The interest rates for longer tenors are as follows: 1-month tenor earns 3.0% per annum; 2-month tenor, 3.1%; 3-5 months, 3.4%; 6-11 months, 4.0%; 12-13 months, 4.6%; 18 months, 4.7%; and 24 months, 5.4%.

The highest interest rate of 5.5% per annum is offered for long-term deposits with tenors ranging from 36 to 60 months.

MB’s Savings Interest Rate Table for Business Customers – August 2025

MB also offers a separate interest rate framework for business customers in the Central and Southern regions (excluding Ho Chi Minh City), with rates 0.1% per annum higher than standard rates for tenors of 6 months and above. The highest interest rate of 5.6% per annum is applicable for business customers depositing for 36 to 60 months.

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.